A Framework for Expanding Investor Relations Metrics

How IROs Can Harness New Data to Achieve Their Goals

Investor Relations tend to prioritize a limited set of traditional metrics that drive to share price. But with the rise of digital behaviors among investors and modern measurement tools, it's time for IR teams to expand their performance-tracking efforts.

Digital media is disrupting traditional IR methods, much like it has in marketing the past decade. Just as marketers now track multiple data points to drive sales, IROs need to measure beyond the basics to understand stock interest and stability. Historically, limited data sufficed for IR teams. But today’s diverse, online investor base requires more comprehensive metrics to capture the wide-ranging sources of influence.

What happens to companies when the influence of institutional and retail investors becomes more balanced? It’s much harder to measure the efficacy of IR efforts when the audience is so fragmented, but there are ways to expand metrics to include the rising influence of retail investors.

Introducing the IR Funnel

Investor relations is obviously different from marketing, but marketing frameworks can help IROs think about how they engage investors and, ultimately, turn them into shareholders. Moreover, as assets go to passive strategies (e.g. indexing using ETFs), tracking the journey of active, fundamental investors become more and more important to IROs.

For example, marketing activities are generally plotted within the marketing funnel. Top-of-funnel activities are designed to generate awareness. As you move down the funnel, other tactics are used to push qualified audiences closer and closer to purchase, from awareness to consideration to conversion, and finally, the holy grail: loyalty. Marketers measure activities at each stage to optimize each stage to drive the most impact to their end goal.

IROs are also in the business of moving audiences down a funnel and closer to an end goal, albeit in different ways. Here’s how an IR funnel might look within a similar framework.

In the same way marketers assign specific metrics to progress down the funnel, IROs can also think of their own activities as aim to attract and retain investors, supporting share price.

Investor Relations Funnel Framework

To effectively track and improve investor relations metrics, companies need a structured approach. The investor relations funnel framework helps in understanding and optimizing the journey from attracting potential investors to maintaining long-term relationships.

Let’s start at the top of the funnel, where the aim is attracting potential investors. At this stage IROs are building Awareness through activities that increase knowledge that your stock is publicly traded and available for investment, and where it sits in the market.

→ IR websites, marketing, PR, and shorter-form content (e.g. social media posts) are all top of funnel activities designed to support awareness.

The middle of the funnel is all about educating and engaging interested investors. In the Fundamental Analysis stage, IR activities are designed to educate investors on the investment thesis and key differentiating factors, like leadership, product innovation, and financial performance.

→ Investor outreach, long-form content (like podcasts and investor decks), and analyst briefings can all support middle of funnel objectives to educate interested investors.

At the bottom of the funnel is where interested investors are converted to shareholders, and retained over time. Shareholder Conversion is the point at which interested investors transition to stockholders, cementing their belief in the company by putting actual skin in the game. Beyond conversion, IROs want to ensure Stability, or shareholder loyalty. These activities keep investors engaged and holding on (if not adding to) their positions.

→ Earnings calls and reports, shareholder meetings, and ongoing shareholder communications such as monthly or quarterly investor newsletters all support lower funnel IR objectives.

Revamped metrics for IROs

Each layer in the IR funnel comes with its own set of metrics that can provide helpful signals for IROs seeking to track in their efforts to attract, engage, and retain shareholders. Tracking the right metrics at each stage of the funnel helps in measuring effectiveness and identifying areas for improvement.

You’ll note that the list below includes both tried-and-true metrics—financial media hits, analyst briefings, to name a few—as well as new metrics that teams can track thanks to the digitization of investor engagement.

Top of Funnel: Awareness Metrics

IR Website Analytics

Number of visitors to IR website

Percent change of visitors over time

Percent of organic visitors over time (as share of total visitors)

Website referral sources that can be used to optimize PR efforts (e.g. identifying a niche financial creator blog mention that led to a significant increase in visits)

Media Monitoring

Number of press mentions on financial performance

Change in press mentions over time

Percentage of press mentions reaching specific shareholder audiences (e.g. institutional sources vs. sources that skew toward retail, like Morning Brew)

Analyst Engagement

Analyst briefings set

Analyst briefing quality (e.g. percent tier 1 vs. tier 2)

Analyst coverage secured

Analyst sentiment

Social Media Analytics

Mentions of your company in context of stock across social platforms where people are actively discussing investments (X, Reddit, Stocktwits, TikTok, Meta, etc.)

Social media sentiment - changes over time and changes as a result of key events like earnings and leadership changes

Category benchmarking - social media mentions and sentiment as compared to your category or specific peers

Most influential mentions - identify which sources had the most impact (positive or negative)

Trend-spotting - monitoring shifts in conversations over time to see shifts in language used or catching misinformation before it’s able to spread

Middle of Funnel: Fundamental Analysis Metrics

IR Website Engagement

Time spent on site, changes over time

Specific pages or pieces of content with most pageviews

Exit points: Areas of your site where visitors are most likely to bounce

Total website events volume (clicks, video views, etc.)

Virtual event registrations

Number of shareholder communications opt-ins

Content shares (e.g. tapped button to share on X)

Earnings Call and Virtual Event Participation

Virtual event attendees

Virtual event attendee engagement (time spent listening to call or watching on Zoom)

Number and tone of questions asked (increasingly possible for both institutional and retail)

Virtual event participation the context of other engagement metrics (i.e. email engagement rates), made possible through an owned and operated IR CRM

Email Analytics

Shareholder communication open rates

Shareholder alert opens and engagements (e.g. clicks or shares)

Shareholder communications conversion rates (e.g. signed up to virtual event)

Unsubscribe/opt-out requests

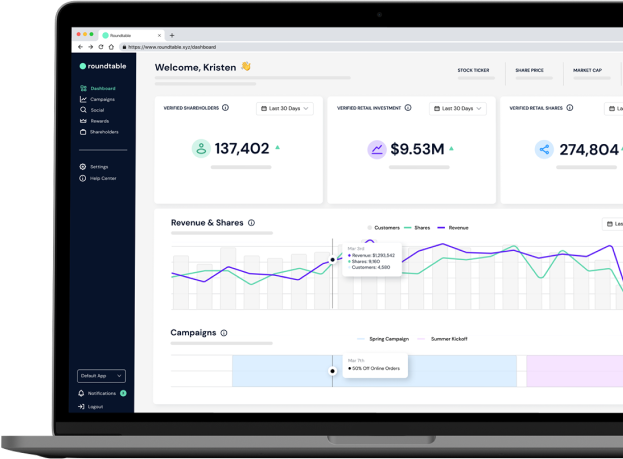

Bottom of Funnel: Conversion & Retention Metrics

Trading metrics

Trading volume and liquidity

Share price performance - isolated and benchmarked

Average position size for retail shareholders

Change in average position size over time

Shareholder metrics

Shareholder composition (% institutional vs. retail)

Changes to shareholder composition over time

Number of authenticated retail shareholders

Top institutional investors

Institutional ownership composition (e.g. ETFs, hedge funds, etc.)

Top individual shareholders (e.g. top 10% by position, or above a certain dollar threshold)

Shareholder loyalty program members

Shareholder demography: e.g. age, region, psychographic profile

Average tenure of shareholders

Verified shareholder engagement metrics (questions submitted during earnings call, return visits to site, email open rate)

Tips for getting started

Investor relations teams are famously lean, so while the abundance of new data available brings value to IROs, it can also feel daunting. Fortunately, there are tools and partners that are able to help you expand and automate your measurement efforts.

Access and monitor your website analytics

Whether you host and manage your own IR website or partner with an IR website provider, find out how and where to access the data you need to track progress down the IR funnel. Stakeholder Labs recently rolled out a new no-code IR website builder that allows teams to easily update content, add rich media, and access deeper analytics that provide actionable insights to strengthen your strategy over time.

Create a social listening dashboard

The rise of retail investors has brought stock conversations out of Bloomberg Terminal and into all corners of the Internet. Social media listening and analytics tools can help companies identify where conversations are happening, track sentiment over time, identify potential news sources and creators worth engaging, and stop misinformation before it spreads. Stakeholder Labs offers social listening tools specifically designed for the nuances of tracking ticker conversations versus general brand conversations, so companies can filter out the signal from the noise and focus exclusively on conversations related to the company stock.

Audit your digital communications plan

Keeping shareholders informed is key to supporting retention over time. If you’ve been using the same playbook of automated alerts and outreach only once a quarter, consider a more ongoing approach to meet the expectations of modern investors. Companies like Snap and Bark, for example, send regular shareholder newsletters that provide updates more frequently. Following Bark CEO’s appearance on the After Earnings Show, the company sent out a summary of the key takeaways to investors, along with a link to watch the full interview.

Bottom line: The growth of retail investors has prompted IR teams to rethink their metrics and communication strategies. New technologies are expanding the way IROs engage, measure, and align with their investors.

Stakeholder Labs builds tools for modern organizations that want to up level their shareholder analytics and engagement to support long-term growth. Contact us to learn more.