Bridging Investor Relations and the Experience Economy

Introducing our new IR Site Builder product - helping companies close the 'experience gap' between their investor relations properties and corporate/consumer experiences

As Stakeholder Labs prepares for this year’s National Investor Relations Institute’s (NIRI) annual conference in San Francisco, it's a great opportunity to reflect on our achievements and lessons from the past twelve months and to anticipate the industry trends of the year. With 40% of the S&P 500 mentioning A.I. in their latest earnings calls, there is no doubt that we’re entering a new economic paradigm in which many of the world’s knowledge and service-based tasks are becoming rapidly commoditized. Experience will increasingly become a key differentiator for companies that have historically enjoyed sustainable profits selling commodities, goods, and services in more human capital-intensive ways.

According to Gartner, 89% of businesses compete mainly on customer experience (CX). This is up from 36% in 2010. CX is considered a primary competitive differentiator by 44.5% of organizations globally.

This week’s Roundtable Roundup examines the concept of the ‘experience economy’ first introduced in 1998 by Harvard’s B. Joseph Pine II and James H. Gilmore and extends this framework for investor relations professionals to guide their approach towards shareholder engagement in a digital-first, experience driven world. We conclude by previewing Stakeholder Labs’ IR Site Builder and the opportunity to close ‘experience gaps’ between IR and corporate/consumer channels.

Welcome to the Experience Economy (B. Joseph Pine II and James H. Gilmore - Harvard Business Review, 1998)

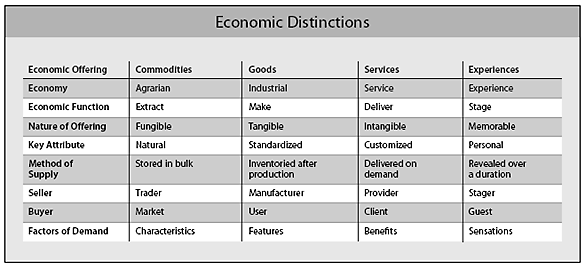

Economic Evolution: Pine and Gilmore describe the progression of economic value from commodities to goods, services, and now experiences. This evolution demonstrates how each stage adds more value. For example, the transformation of a birthday cake from homemade to store-bought, and now to an outsourced party at a venue like Chuck E. Cheese’s, illustrates the increasing economic value as we move towards the experience economy.

Four Realms of the Experience Economy: The authors introduce the concept of the four realms of an experience, which help businesses design engaging experiences:

Entertainment: Passive absorption where customers enjoy experiences such as watching a movie or attending a concert.

Educational: Active absorption where customers engage in learning experiences, like attending a class or a workshop.

Escapist: Active immersion where customers participate in immersive activities, such as playing video games or theme park attractions.

Esthetic (or Environment): Passive immersion where customers appreciate the environment, like visiting an art gallery or enjoying a scenic view. These realms provide a framework for creating diverse and rich experiences that cater to different levels of participation and engagement.

Differentiation through Experiences: As services become commoditized, companies can differentiate themselves by staging memorable experiences. Experiences are distinct economic offerings that engage customers on a personal level, creating lasting memories and adding significant value beyond the basic service provided. This differentiation is crucial for companies looking to stay competitive in today's market.

Charging for Experiences: Pine and Gilmore emphasize the importance of charging explicitly for experiences to capture their full economic value. Businesses need to think about how they would stage and improve their experiences if they were to charge admission. Examples include theme restaurants like the Hard Rock Cafe and retail stores like Niketown, which could enhance their offerings by introducing admission fees for more immersive experiences.

Design Principles for Memorable Experiences: The authors outline five key design principles for creating engaging experiences:

Theme the Experience: Establish a clear and compelling theme that ties all elements of the experience together.

Harmonize Impressions with Positive Cues: Use sensory cues to reinforce the theme and create a cohesive experience.

Eliminate Negative Cues: Remove elements that detract from the experience.

Mix in Memorabilia: Offer tangible items that help customers remember the experience.

Engage All Five Senses: Utilize all senses to enhance the experience and make it more immersive and memorable.

Experience-led growth: A new way to create value (Mckinsey, 2023)

Significant Financial Impact: Companies that excel in customer experience (CX) outperform their peers significantly. For instance, companies with leading CX achieved more than double the revenue growth compared to "CX laggards" between 2016 and 2021. Additionally, CX leaders saw their revenues rebound more quickly from the COVID-19 pandemic compared to other companies.

Higher Total Shareholder Returns (TSR): Experience-led growth strategies have been shown to deliver 30% higher total return to shareholders (TRS) and nearly double the shareholder value compared to industry peers. This strong correlation between CX ratings and financial performance underscores the importance of investing in customer experience.

Enhanced Customer Retention and Satisfaction: Successful CX initiatives can lead to substantial improvements in customer retention and satisfaction. For example, CX leaders in the insurance industry outperformed their peers by 20 to 65 percentage points in TSR over a five-year period, demonstrating the tangible financial benefits of prioritizing customer experience.

Increased Share of Wallet and Cross-Sell Rates: Companies implementing effective experience-led growth strategies can see cross-sell rates increase by 15-25% and share of wallet by 5-10%. Improved customer satisfaction and engagement also lead to better financial outcomes, including higher repeat purchases and net revenue retention.

Making the Shift: Experience Economy to Transformation Economy with B. Joseph Pine II (2023)

Shift from Experience Economy to Transformation Economy: Pine emphasizes the shift from the experience economy, where businesses create memorable experiences, to the transformation economy. In the transformation economy, the focus is on guiding people to achieve their aspirations and personal growth, leading to transformative experiences that go beyond mere entertainment or engagement.

Economic Progression and Value Creation: Pine outlines the progression of economic value from commodities to goods, services, experiences, and finally, transformations. Each step represents an increase in economic value, with transformations providing the highest value by helping individuals achieve their goals and improve their lives. This shift requires businesses and cities to innovate and offer personalized, transformative experiences.

Examples of Successful Transformative Practices: Pine provides several examples of companies successfully implementing transformative practices:

Starbucks: Transformed the coffee experience by creating a social atmosphere around coffee consumption.

Nespresso: Innovated with home coffee machines and Nespresso boutiques to create personalized coffee experiences.

Mosaic Life Care: Transitioned from healthcare to life care, focusing on helping patients and community members achieve better lives through a holistic approach to health and well-being.

Time as a Key Factor: Pine highlights the importance of time in the transformation economy. He distinguishes between time well saved (services), time well spent (experiences), and time well invested (transformations). Businesses need to focus on creating value through time well invested, where the time customers spend with them leads to long-term benefits and personal growth.

Experience is everything. Get it right. (PwC, 2018)

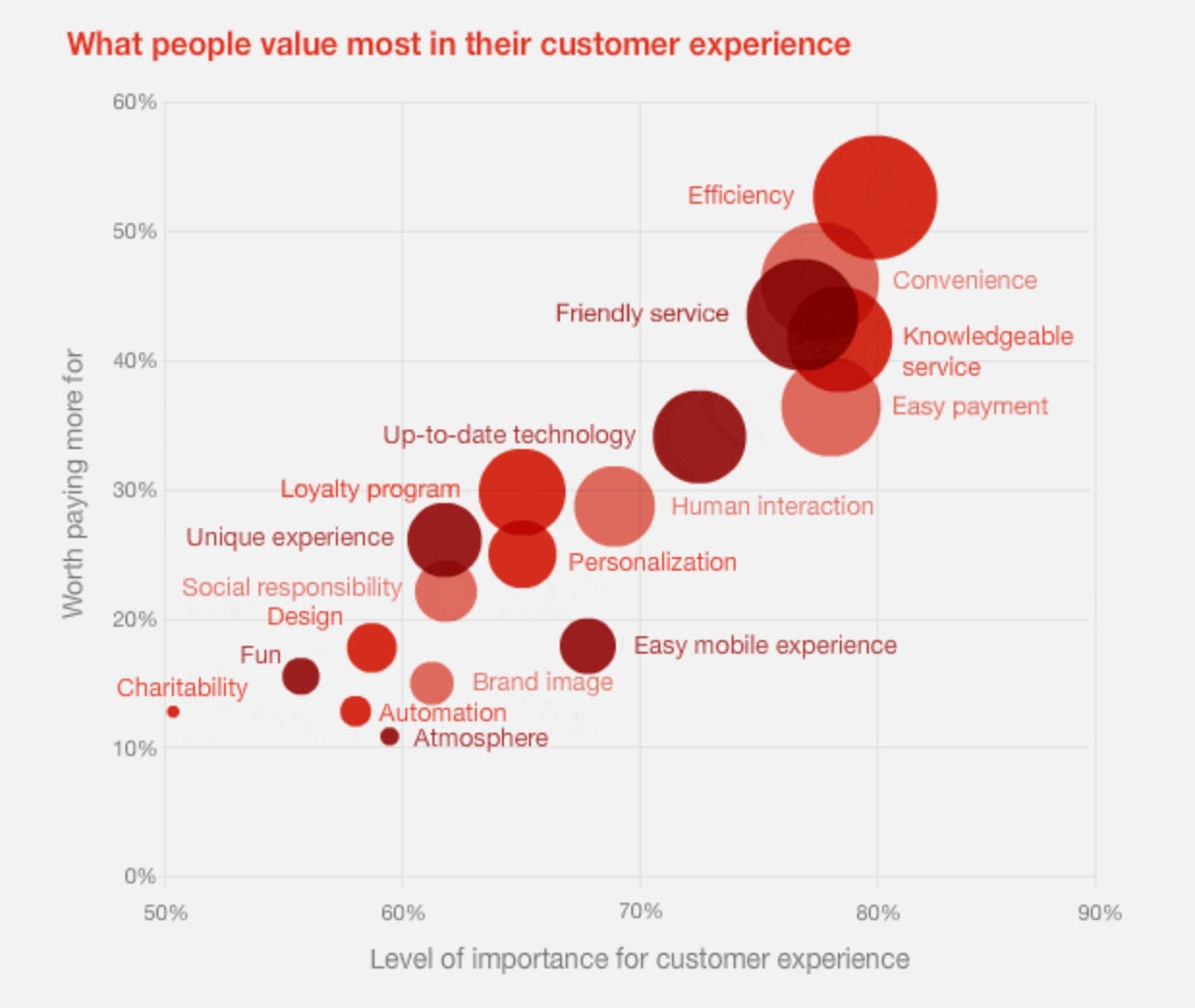

Economic Value of Good Experiences: Excellent customer experiences can lead to up to a 16% price premium on products and services, particularly benefiting luxury and indulgence purchases. For instance, 63% of customers would share personal data for a valued product or service.

Impact of Bad Experiences: A single bad experience can lead 32% of customers to abandon a beloved brand. In Latin America, 49% of consumers would walk away after one negative experience.

Key Drivers of Positive Experiences: Speed, convenience, knowledgeable help, and friendly service are crucial. About 80% of American consumers prioritize these elements over advanced technology or flashy design.

Employee Experience Matters: Superior customer experiences start with engaged and empowered employees. 59% of consumers feel companies have lost the human element in customer interactions, highlighting the need for better employee support and training.

Introducing the experience economy to investor relations

By applying the principles and learnings of the experience economy to the investor relations function, IROs can prioritize their engagement programs and technology providers through a lens that has proven to drive significant shareholder returns over time. The four E’s of experience outlined by Pine II and Gilmore —Entertainment, Educational, Escapist, and Environmental —provide a compelling framework for creating memorable and valuable experiences for shareholders.

Entertainment: Passive absorption via earnings calls on YouTube, brand-forward investor newsletters, a c-suite appearance on After Earnings and other forms of multimedia storytelling allow shareholders to stay informed and connected to the company without requiring active participation. These methods and mediums are crucial for keeping shareholders updated on financial performance and strategic initiatives, ensuring transparency and trust.

Education: Active absorption where shareholders engage in learning experiences through interactive webinars with leadership, polls, surveys, and informative digital callouts during proxy season. These activities foster a deeper understanding of the company's operations and market trends, empowering shareholders to make more informed decisions and feel more involved in the company's journey.

Escapist: Active immersion providing shareholders with hands-on, engaging experiences. Examples include immersive annual meetings (such as Berkshire Hathaway’s), product launch events, investor trips to company facilities, and exclusive experiential marketing events with VIP shareholder access. These activities not only entertain but also build a stronger emotional connection to the brand, making shareholders feel like an integral part of the company's success.

Environment: Passive immersion where shareholders can appreciate the company's environment and culture. Virtual reality tours of company facilities, interactive investor portals, personalized communications, themed merchandise & collectibles, and interactive financial reports provide immersive experiences that allow shareholders to explore and appreciate the company in a more engaging and memorable way.

Equity may always be treated as a commodity by certain traders, but for the many analysts and millions of retail investors who are investing in companies they know and love, IR professionals have a responsibility to offer more then timely information and shareholder returns. When companies ‘stage’ a unique IR experience and treat one share as the price of admission, they cultivate stronger relationships and foster loyalty, setting themselves apart by providing a truly memorable economic exchange. Embracing this approach is not radical for many of the world’s largest and most successful companies, it’s being used by their customer success teams every day, so the challenge for IR teams is finding the tools and platforms that will help them close ‘the experience gap’ between their corporate/customer channels and IR channels.

Closing a critical experience gap with Stakeholder Labs’ IR Site Builder

The most important company asset within a shareholder experience is an IR website.

Numerous research studies show that both institutional and retail investors assess a company’s IR website for buying or selling signals. Brunswick Group’s 2023 Digital Investor Survey emphasizes, “Investors seeking digital interactive content reflects broader online content trends, and companies should consider the production value of their IR websites with the same regard as for their consumer and employee-facing websites.” While it seems logical for a billion-dollar company to maintain brand consistency across all digital properties, budget constraints and team structures often leave IR websites lacking compared to consumer or corporate sites.

At this year’s NIRI National Conference, Stakeholder Labs is thrilled to introduce IR Site Builder. Our team conducted dozens interviews with IR teams to identify the root causes of experience gaps on IR websites and our goal with this platform is to empower IR teams to offer an interactive, brand-forward digital shareholder experience that is as easy to manage and update as composing a tweet.

Moreover, we’ve integrated Roundtable digital shareholder verification and analytics directly into the platform, bridging the data gap between the information companies have on their customers and their shareholders.

By closing this critical experience gap, we're bringing the principles of the experience economy to investor relations, ensuring that shareholder engagement is as dynamic as any other customer interaction. Research in this week’s roundup shows that companies that have invested in the experience economy are driving greater economic value and shareholder returns and it is critical that IR channels are congruent with the experience-focused operations they are highlighting. As capital markets continue to evolve and digitize at breakneck speed, now is the time for IR teams to elevate beyond a commoditized website and invest in memorable digital experiences.