C-Suite Branding: The Key to Connecting with Next-Gen Investors

How Modern Executives Are Flipping the Script to Win Over Shareholders

A tech CEO who oversees one of the top 15 most downloaded apps in the United States recently sat down to an interview with a giant 7 Eleven cup in-hand, audibly slurping as he proclaimed it as his favorite coffee. “It’s cheaper, it’s bigger, and it’s better,” he said.

Image via After Earnings with Life360 ($LIF) CEO Chris Hulls

Not quite what you’d expect of a C-suite executive with an annual comp that’s in the millions. But then again, this is becoming a new normal for companies that understand the impact of building their C-suite brands—demonstrating candor, humility, and access to the more than 100 million retail investors (and growing) in the United States alone.

In fact, a survey of 2,000+ retail investors reveals that trust in leadership is among the top 3 highest-ranked factors that next-gen investors look to when picking a stock. Moreover, market volatility in 2022 ushered in new behaviors. From 2022 to 2023, 69.4% of investors surveyed by Public.com say trust and credibility are more important to them today.

The rise of the celebrity CEO

Since the first meme stock wave in 2021, there have been plenty of conversations about the role of the “celebrity CEO,” meaning, C-suite leaders acting as influencers outside of their day-to-day duties. Elon Musk is the most commonly cited reference, but there have been other figureheads, like AMC’s Adam Aron, Gamestop’s Ryan Cohen, NVIDIA’s Jensen Huang, who have amassed cult followings online.

NVIDIA CEO Jensen Huang flashes his ink, via Business Insider

As we all know, influence isn’t just about capturing attention and creating buzz. Real influence is created when an individual can display both high likability and high competence, which is the crux of charisma.

IR and Comms teams accustomed to prepping C-level executives for speaking to institutional shareholders and analysts aren’t running the same old playbook when it comes to instilling confidence from retail investors. Three minutes with Joe Kernan is a lot different than 30 minutes with a financial creator.

Most organizations get that these are exciting opportunities and are eager to embrace new ways of connecting with new audiences, but as is the case with any innovation, the devil is in the implementation.

So, how should companies go about this in an authentic and brand safe way that instills substantive trust in the business for the long-term?

A framework for modern C-suite branding

If modern investors are looking for strong executives when making decisions about their portfolio, it makes sense to start by looking into the traits that instill trust and confidence.

The University of Pennsylvania’s Wharton School says there are a few key traits that make an effective C-suite executive. While not every organization and executive will want to flex the same traits in the same way, they form a great starting point for backing into how these traits can be communicated in channels where next-gen investors are the primary audience.

1. Effective leadership skills (aka, results)

Shareholders aren’t privy to internal meetings, so they determine the efficacy of leaders based on do-to-say ratio. What are the stated goals in their public statements and earnings? And how did they execute around those goals? In other words, the scoreboard matters.

Stakeholder Labs and Morning Brew’s After Earnings show gives executives an additional level of storytelling, beyond the press release and heavily-scripted earnings calls. For example, Japanese HR tech CEO Swimmy Minami used the long-form interview to describe the cultural factors that are accelerating Visional’s (4194:TYO) growth. He cited that Japan has traditionally had an extremely loyal employee market, with employees staying at their jobs for long tenures. But change is afoot, and job hopping trends are on the rise. Minami walked listeners through just how Visional plans to capitalize on the trend.

And while e.l.f. Beauty’s ($ELF) CEO Tarang Amin doesn’t have a million followers on X, the company has posted 21 consecutive quarters of growth and the stock is up more than 1,000% in the past 5 years.

View e.l.f. Beauty’s Investor Relations page.

2. Communication skills and emotional intelligence

Soft skills are often valued in the C-suite, and they are only becoming more important. Harvard Business Review looked at job descriptions for C-level roles and noted that there has been a clear uptick in language around soft skills, and a decline in language speaking to operational skills.

Chart via Harvard Business Review, “The C-Suite Skills That Matter Most”

C-suite executives are learning that opening up, perhaps a bit more than they are comfortable with, is one of the best ways to build trust and authenticity with shareholders. On After Earnings, Life360’s ($LIF) CEO shared a personal anecdote about how an aging relative uses the app. The founder of psychedelic biotech atai Life Sciences ($ATAI) said the idea for the business was born during a mushroom trip. Monday.com’s ($MNDY) CFO opened up about being skeptical about the brand’s Super Bowl ad, and shared openly that he wouldn’t do it again. Better.com’s ($BETR) CEO talked about how it felt to get canceled on the Internet.

3. Change management & strategic foresight

Retail investors have experienced market volatility and actively assess how macro trends impact their portfolio. They not only want to see competency; they want to see competency in context. Sharing how a business navigates a tough interest rate environment, supply chain issues brought on by a global pandemic, or increased competition helps shareholders see how leadership’s knowledge is applied to position the company to be sustainable in the long-term. (h/t Dynex ($DEX) President and Chief Investment Officer Smriti Popenoe, highlights the need for companies to show resilience amid the natural ups and downs of the economy.)

4. Subject matter expertise

CEOs aren’t expected to know every detail of the business, but the best ones are able to distill complex themes into plain terms that are understandable by those outside of their industry. This is especially true for organizations that find themselves in buzzy pockets of the market, like EV, psychedelics, and big tech. For example, on a recent episode of After Earnings, Sprout Social ($SPT) President Ryan Barretto broke down how investors should view their platform in the context of consumer-facing social platforms, and how they use data to help modern businesses make better decisions.

5. Employee development & delegation

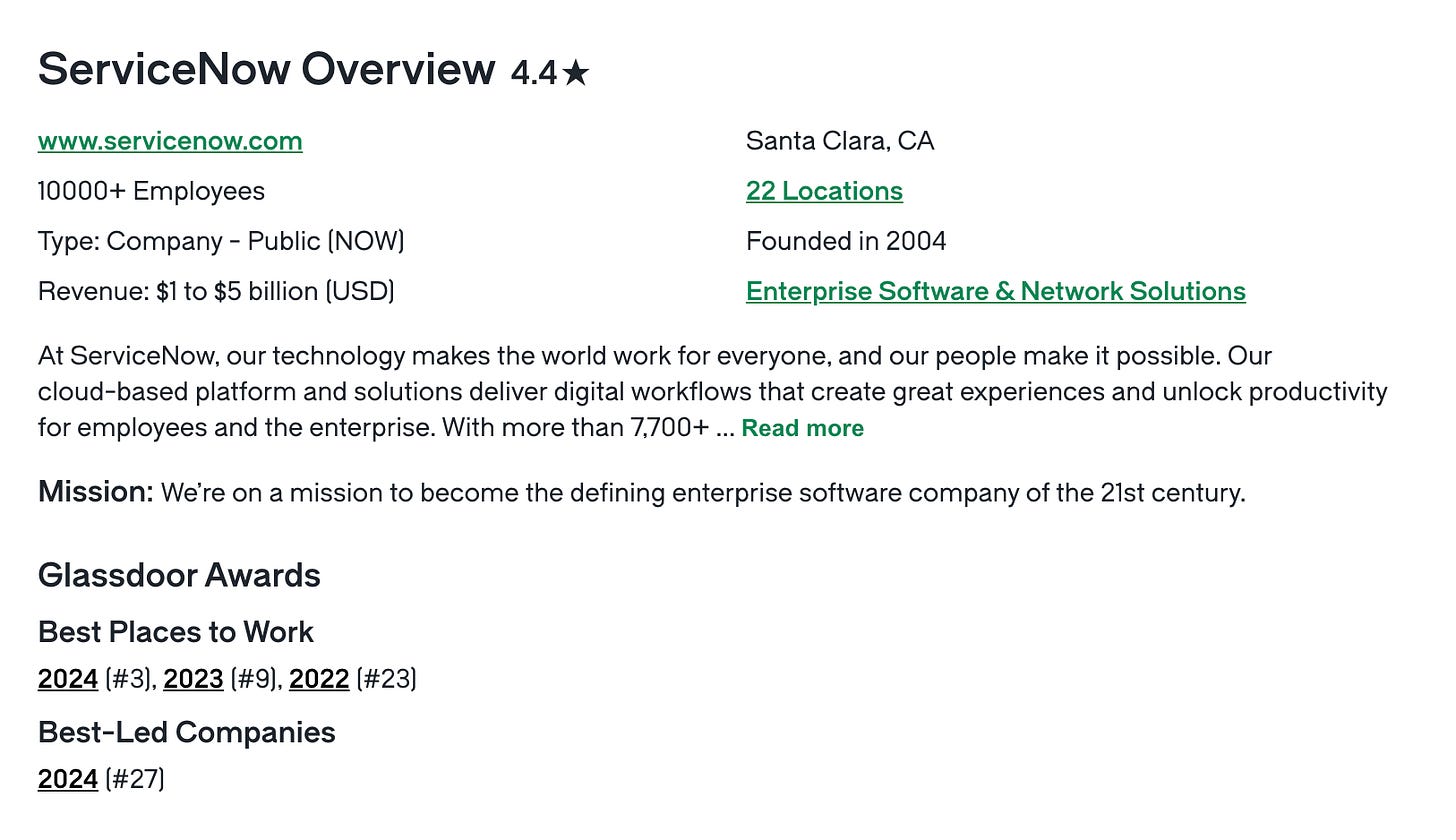

Finally, modern shareholders are looking for insights into how a company operates. What are the cultural values that make up the organization? How good (or bad) are the Glassdoor reviews? On After Earnings, ServiceNow ($NOW) CFO Gina Mastantuono reinforced the importance of people behind their powerful enterprise tech. She cited culture as a competitive advantage, sharing that over a million people applied for jobs at ServiceNow last year. Cava ($CAVA) CEO and founder Brett Schulman talked about the company’s immigrant roots, and how those values reverberate across their business today. REE Automotive ($REE) CEO Daniel Barel boasted that the team powering their commercial EV ambitions are “the best in the world.”

ServiceNow has been named a Top Place to Work by Glassdoor for three years running.

Putting it into action

Here are some next steps for organizations looking to build their C-suite brands in the eyes of modern shareholders.

Explore new channels and platforms. The average age of a CNBC viewer is 57 years old. Outlets like Morning Brew and Robinhood-affiliated Sherwood News offer scaled audiences of millennials and Gen Z who are turning to different publishers when doing due diligence.

Communicate the story behind your stock. Articulating vision, strategy, and results will always be core to shareholder communications, but there are likely narratives within your leadership team that are interesting and differentiated. Talk to leaders at your team to mine these stories and find opportunities to work them into your C-suite branding.

Know what motivates your investors. You may have a general sense of who comprises your shareholder base, but shareholder analytics will help you optimize messaging based on how your investors are motivated. NOBO list analysis is possible; but even better are shareholder authentication tools that allow you to own your own data and directly communicate with your investors.

Build trusted leaders, not celebrities. Leaders that show both competence and humility, and do so consistently, will be better positioned to gain the trust of shareholders. It’s not always about simply making a headline.

Stakeholder Labs builds tools for modern organizations that want to up level their shareholder analytics and engagement to support long-term growth. Contact us to learn more.