July 2025: Capital Markets in Motion

AI, Retail Investors, Tokenization, and IPOs

July felt like it crammed a year’s worth of capital markets innovation into four short weeks. Retail investors proved their staying power, lighting up options desks and pushing narrative-driven names such as GoPro and Krispy Kreme well beyond fundamental models. On X, builders showcased chat-based investor-relations portals that drive the cost of discovery toward zero, while founders teased tokenized equity drops that may never touch a traditional transfer agent. Corporations kept iterating too: one mid-cap treasury now holds more ethereum than the Ethereum Foundation, underscoring how quickly balance-sheet strategy is changing. All of this unfolded as the primary market stirred back to life: global IPO proceeds rose 35 % in the first half.

TL;DR (skim‑in‑60‑seconds)

IPOs are back – H1 2025 deal count +35 % YoY and oversubscribed tech debuts (Figma, Circle) are handing retail investors real first‑day pops.

Retail Renaissance 3.0 – Meme‑stock energy (GoPro, Krispy Kreme) proves communities still move tape; options UIs increasingly look like bet‑slips.

Everything is Going On‑Chain – From tokenized private shares to 24/7 fractional real‑estate, blockchain rails are colliding with disclosure rules.

Crypto as Treasury Strategy – SharpLink just flipped the Ethereum Foundation with a 280 k ETH war‑chest; expect others to copy‑paste.

AI eats IR – ChatGPT‑run portfolios beat benchmarks, synthetic narratives multiply; IROs turn into real‑time threat‑intel desks.

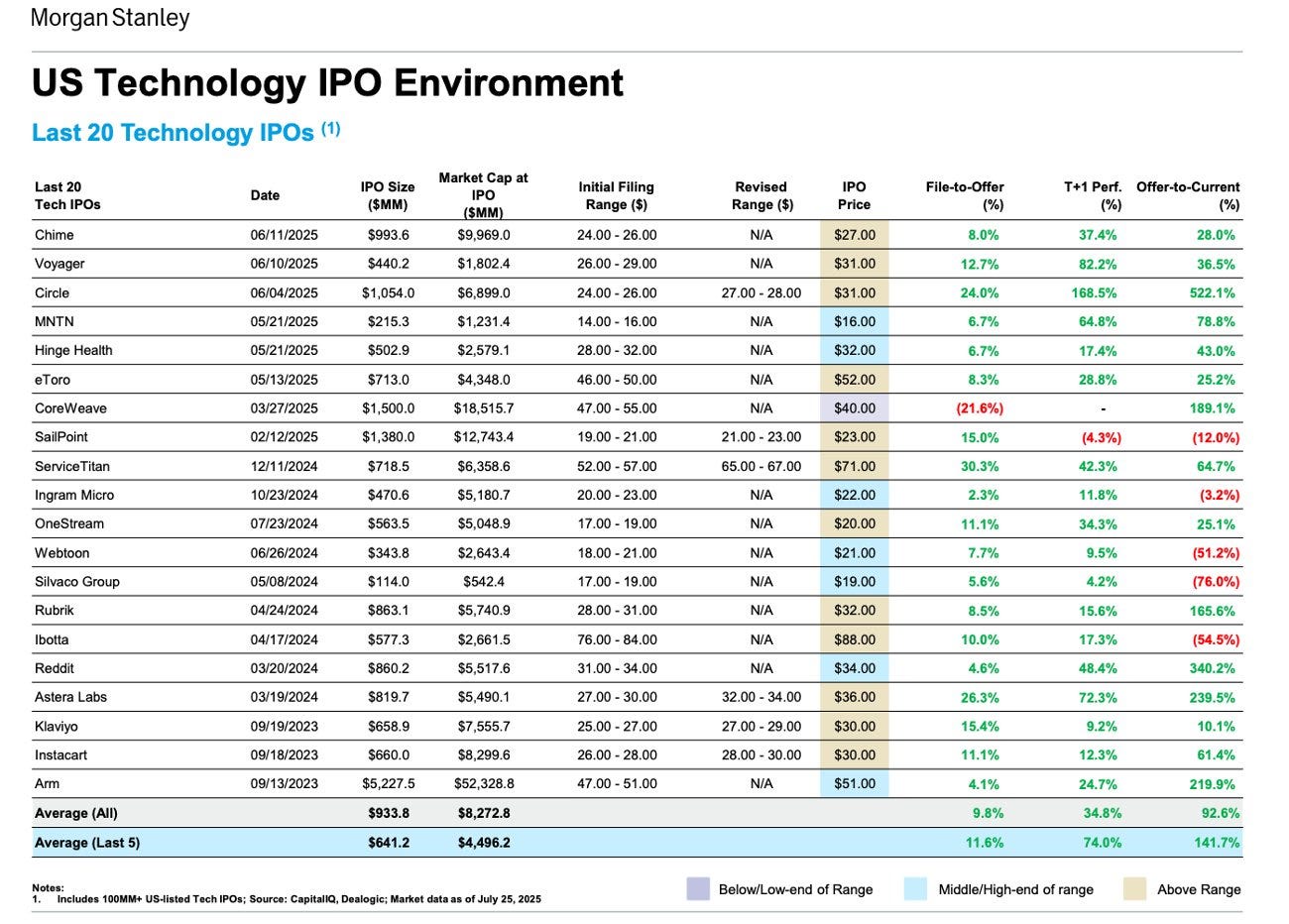

The IPO Window Swings Open—For Those Ready

EY’s latest Global IPO Trends report shows 109 U.S. IPOs in H1 2025 (+35 % YoY) despite tariff turbulence and rates jitters. 📈

Figma priced at $31 (above the raised $30–32 range) and opened at $85 on July 31—a +174 % first‑day surge. [Insert chart: Figma day‑one pop]

Circle shattered expectations in June with a 5× run‑up, proving the Revolving Door between crypto and public markets swings both ways.

Why it matters: Retail‑forward platforms like Robinhood IPO Access continue to blur roadshow velvet ropes; retail investors are getting a seat at the table in the IPO process.

Retail Renaissance 3.0: Meme Mania Reloaded

CNBC and Bloomberg both rang the bell: “Meme Stocks Are Back.” July saw:

GoPro (GPRO): intraday +73 %, closing +12 % on 34 × volume.

Krispy Kreme (DNUT): halted twice, peaked +39 %.

Kohl’s, Beyond Meat, Opendoor followed on WSB momentum.

Why it matters: Retail conviction forces IROs and Comms teams to monitor sentiment in real time.

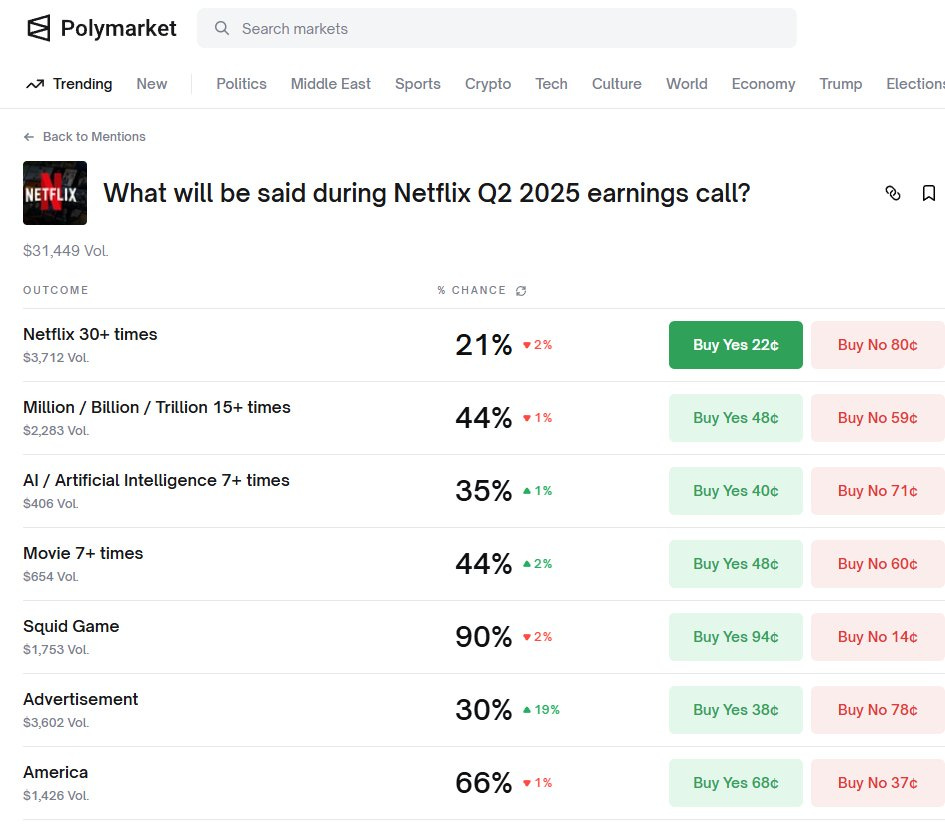

Bet‑Fi: When Neobrokerages Become Sportsbooks

Matt Levine’s Money Stuff (“Do Your Betting With Your Broker” – Jul 10) nails it: the Robinhood options ticket now mirrors DraftKings’ parlay builder. Add prediction‑markets like Polymarket (Netflix‑earnings side‑bets) to earnings and you inject a meta layer to the “degenerate economy” (h/t Howard Lindzon).

Why it matters: IR and Comms must confront a new class of speculative player in the markets: part gambler, part investor. Even betting on the narrative components of an earnings call - the frequency of their words.

Tokenization & Private Markets Become Public

“The Stocks Will Be Tokenized” (Money Stuff, Jul 2) charts the migration of listed, unlisted equity onto blockchain rails.

Robinhood EU launched 200+ stock tokens (OpenAI, SpaceX). OpenAI’s rebuttal, “these tokens are not equity,” spotlights the disclosure gray zone.

Bernstein now calls 2025–27 an “equity tokenization super‑cycle.”

Why it matters: Like everything else in this new world, the token movements will affect the price and sentiment of related stocks. And there might be a lot more IR and Corp Comms jobs opening up as private companies have to operate like public companies.

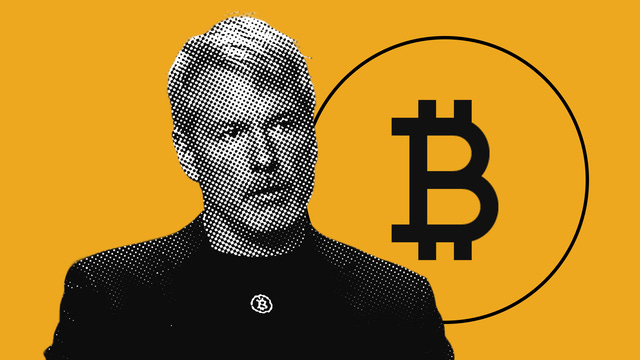

Crypto Treasuries: The ETH Arms Race

SharpLink Gaming (SBET) bought its way to 280,706 ETH (~$860 M), overtaking the Ethereum Foundation (Jul 15). Staking rewards already add 415 ETH/month.

Why it matters: Expect mid‑caps with tepid core growth to “bootstrap” valuations via hard‑asset treasuries. Disclosure dashboards and concentration risk metrics will become table‑stakes.

AI Agents Invade the Capital Stack

A high‑schooler’s $100 ChatGPT portfolio beat the Russell 2000 by +23.8 % in four weeks (Jul 31, Decrypt).

Grok vs. GPT‑4o day‑trading contests trend on Reddit; viral posts claim 100 % returns in 10 days.

https://x.com/gregisenberg/status/1950544309515637126

someone on reddit let ChatGPT manage a $100 stock portfolio for four weeks and beat the market by 23%.

here are 14 things it means for you, markets and the future of finance:

1. there will be a massive market crash caused by too many AIs making the same trades. when millions of ChatGPT instances start following similar logic, you get dangerous herding behavior. the reddit user asked to buy microcaps and it ONLY bought biotech. imagine this at scale.

2. companies will start optimizing press releases for AI readers, not humans. the businesses that write in "AI-parseable" language will get disproportionate algorithmic attention and investment.

3. we'll see the rise of "AI investment clubs" where people pool money and let collective AI strategies compete. it'll be like fantasy football but with real money and ChatGPT as your quarterback.

4. financial advisors will become "AI prompt engineers." instead of picking stocks, they'll craft the perfect instructions for AI systems and charge clients for their prompting expertise.

5. day trading will be completely dominated by AI within 18 months. humans won't be able to compete with AI that can process earnings calls, news, and social sentiment in real-time.

6. every retail investor will have an AI trading assistant by 2027. not managing their money directly, but whispering suggestions in their ear based on news they'd never read themselves.

7. investment newsletters will pivot to selling "winning prompts" instead of stock picks. why give you fish when they can sell you the AI fishing rod?

8. someone will build a "social network for AI trading strategies." think github for investment prompts where successful strategies get forked and improved by the community. a16z prob funds it

9. the SEC will create new regulations around "algorithmic investment advice." they'll scramble to figure out who's liable when your ChatGPT loses your retirement savings.

10. google searches for basic financial terms will plummet by 50%. why google "what is a P/E ratio" when you can ask your AI assistant to explain it while analyzing your portfolio?

11. the phrase "my AI beat your AI" will become the new "my dad can beat up your dad." AI performance bragging becomes a social status symbol.

12. your bank will offer "AI portfolio management" as a free checking account feature. basic AI investing becomes as common as mobile deposits.

13. AI will create the first "algorithmic insider trading" scandal. when AI can predict earnings better than executives, the definition of insider information gets blurry.

14. the stock market will have its first "AI flash crash" caused by recursive feedback loops. millions of AI systems reacting to each other's trades in milliseconds.

the reddit post went viral because it feels like a glimpse into a world where everyone has access to institutional-level analysis. but really, it's showing us how quickly we're willing to hand over decision-making to systems we don't understand.

maybe that's not entirely bad though. most people are terrible at investing anyway, they buy high, sell low, and let emotions drive every decision. if AI can remove the emotional component and stick to data-driven strategies, maybe we'll all end up better off. And plus financial advisors charging ~1% AUM has been unchallenged for too long.

Why it matters: IR roles shift from crafting messages to curating data pipelines for AI readers—while policing deep‑fake earnings calls.

Capital markets are now a mash‑up of TikTok virality, crypto programmability, and AI velocity. Retail traders now set intraday narrative arcs; token engineers compress settlement cycles; AI copilots parse filings before humans can blink. The convergence empowers investors in many ways, while raising the stakes for corporates trying to navigate today’s markets.

For IROs and comms teams the mandate is clear: master the feedback loops. Treat online community sentiment as seriously as analyst feedback, explore the next-gen tech implications for your business, pre‑build crisis rebuttals that travel at the speed of X. Pair every flashy mechanic (fractional tokens, AI chatbots, prediction markets) with plain‑English disclosure and a human tone. The upside is valuable: deeper loyalty, cheaper capital, faster signal extraction.

Stakeholder Labs will continue to explore this new world: testing playbooks, publishing field notes, and spotlighting the experiments. Please reach out if you are interested in partnering.