Digitally Native Retail Shareholders

Meet the new generation transforming the stock market

This week’s Roundtable Roundup is focused on the new generation of retail shareholders that have entered or increased their stock market participation since 2020. These digitally native investors have either been raised or have spent their entire adult lives on social media, have preconceived notions of how a company should communicate with its stakeholders, and progressive values on the environment, sustainability and social justice. While the news cycle has been focused on the overall market declines since the ‘meme stock’ craze in 2021, retail investor net flows have continued to pour into the market despite the Fed tightening monetary policy.

This ‘new normal’ was accelerated by pandemic related economic stimulus but was caused by increased digital access to the stock market via mobile-first like Robinhood and WeBull and amplified on community platforms like Reddit. Blackrock, the world’s largest asset manager, recently reported that retail trading volumes in ETFs grew over 50% YoY since 2019 and attributes “commission-free trading, improved digital experiences, and investor empowerment stemming from greater access to financial education through social media and other forums” as the source of the growth. The companies that understand this demographic and lean into their cultural norms will be at a major strategic advantage over the next decade as earning and spending power continues to be transferred.

Interested in learning more? Stakeholder Labs team is researching and publishing a in-depth analysis of the new generation of retail investors in partnership with the

National Investor Relations Institute (NIRI) & IR Magazine in the next few weeks.

The Gen Z Report: What Business Needs to Know About The Generation Changing Everything (Oliver Wyman Forum)

Global consulting firm Oliver Wyman recently published a Gen Z report that involved studying 10,000 participants in the 18-25 cohort over a two year period to ‘crack the code on what makes Gen Z tick’.

Born between 1997 and 2012, Gen Z represents 25% of the world’s population and $7 trillion or more in purchasing influence, and will comprise 27% of the workforce by 2025. Gen Zers are empathetic, pragmatic, cynical, resourceful, self-protective, and wise beyond their years.

Gen Z investors are…

1.8 times more likely than older generations to cite social media as the impetus for investing

45% more likely to start investing by age 21 compared with millennials

seeking to have fun while making friends and, potentially, money. They are also more likely to point to nonfinancial factors such as boredom, novelty, and community as motivators than to financial factors such as job loss or the need for supplementary income.

Gen Z’s participation in investing also marks a demographic shift toward greater gender and racial diversity.

Two decades ago, 36% of white households reported owning stock, compared with less than 10% of Black and Hispanic households, according to a 2000 study by the Social Security Administration.

Today, the investing cohort of Gen Z investors in the United States and the United Kingdom has 60% more Black and Asian representation.

This broader participation extends to alternative investments. In the United States, Black and Hispanic Gen Zers are 1.7 and 1.4 times more likely, respectively, to invest in cryptocurrency than their older counterparts.

Gen Z: What to Know About the Next Generation of Investors (Nasdaq)

According to a Morgan Stanley poll, 60% of Gen Z used a smartphone before the age of 14 and an estimated 3 out of 4 Gen Zers use money-transfer apps such as Venmo or Zelle at least once a month.

91% of Gen Z report having used social media for investing research, more than any other source of information, with 61% reporting Reddit as a trustworthy source.

71% of Gen Z report using YouTube videos for financial information over the past month, 42% reported using Reddit, 36% TikTok videos, 28% Facebook, 32% Twitter and 27% Instagram.

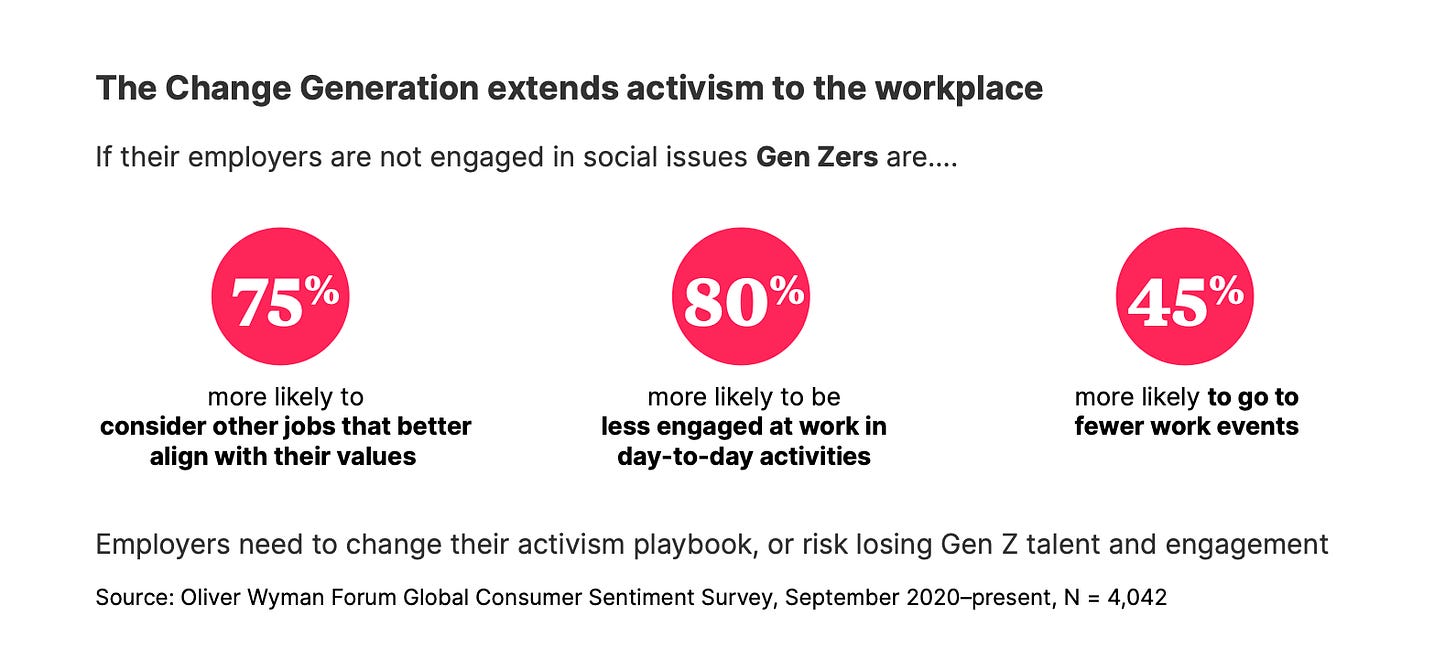

Takeaway: Investment firms will need to adapt to the changing needs and preferences of younger investors, while businesses will need to prioritize social responsibility and sustainability to attract this growing demographic. Failure to do so could lead to missed opportunities and a failure to appeal to the next generation of investors.