The Evolution of Experiential Shareholder Engagement and Events

Tesla, Chevron and Goldman Sachs host investor days to broaden their reach

As our global financial system becomes more accessible via digital technology and the demand for information and engagement continues to grow, experiential shareholder events are becoming an important brand moment for companies and their management teams to communicate with their stakeholders and ensure transparency in their operations. Tesla, Chevron and Goldman Sachs recently held “glitzy and widely publicized” investor days in lieu of a more intimate shareholder meeting and we anticipate that this is just the beginning of a major shift towards towards community-focused investor engagement strategies. For Goldman Sachs, it was just the second time in 154 years in which they held an investor day and executives served as company showmen and touted their products and accomplishments to a general audience. Public.com attributes the shift towards experiential events as part of rising demand among retail investors for education and diligence with 63% of their users spending more time researching stocks in 2023 than they did at this time last year (CNN).

Investor Days vs. Annual Shareholder Meetings - What’s the Difference? (ChatGPT)

An investor day is an event that is typically held by a company once a year or every few years, where the company's management team provides detailed information on the company's strategy, financial performance, and future plans. Investor days are usually attended by institutional investors, analysts, and other stakeholders, and they provide an opportunity for the company to showcase its strengths, address any concerns, and answer questions from investors.

A shareholder meeting, on the other hand, is a legally required annual meeting that all publicly traded companies must hold to update their shareholders on the company's financial performance, elect directors to the board, and vote on other important matters, such as changes to the company's bylaws or mergers and acquisitions. Shareholder meetings are typically attended by the company's shareholders, and they provide an opportunity for shareholders to ask questions, express concerns, and vote on important decisions affecting the company.

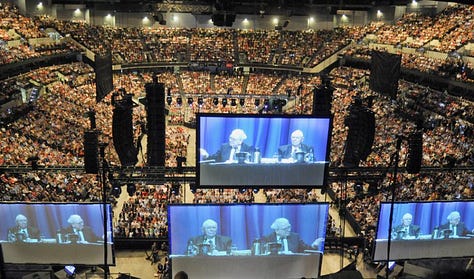

How Berkshire Hathaway's annual meetings exploded to become must-go carnivals for Warren Buffett disciples around the world (Business Insider)

Warren Buffett held the first Berkshire Hathaway annual shareholder meeting in 1973 when he and other shareholders huddled in an employee lunchroom at National Indemnity, an Omaha-based insurance company that Buffett acquired in 1967. To avoid interrupters such as people who wanted to get coffee, they taped a simple sign on the door that said "Meeting in Progress.”

As Buffet’s reputation continued to grow in the 1980s, attendance at the Meetings grew something like Berkshire's stock price: 1,000 in 1989, 1,400 in 1990, 4,100 in 1995, 7,700 in 1997, 13,000 in 2000, 17,000 in 2001, 19,500 in 2004, 35,000 in 2009, and 40,000 in 2015.

The Berkshire Hathaway annual event serves almost as a pilgrimage for throngs of people that feel a deep emotional connection to Buffet and Munger’s leadership, and for many, there is no place in the world they would rather be then in Omaha, Nebraska during the first week in May. In 2018, authors Lawrence Cunningham and Stephanie Cuba published the book “The Warren Buffett Shareholder: Stories from inside the Berkshire Hathaway Annual Meeting” in which 43 veterans of the Berkshire Hathaway Annual Meeting explain why the event has developed into groundbreaking cultural and community affair.

While most publicly traded companies could only dream of having strong enough brand loyalty among shareholders to attract a carnival-like environment, investor days that offer public access and take a consumer-facing approach have the opportunity to serve as an critical intermediate step to growing a company’s shareholder community and culture.

Tesla Shows Why They Are Favorites Among Retail Shareholders

On March 1st, Tesla hosted an investor day at their headquarters in Austin, TX for a in-person and global audience via YouTube and Twitter. The event was certainly more retail focused than a shareholder meeting and there were well over 100K live concurrent viewers listening to thumbing house play as they waited for Elon Musk and Tesla’s executive team to present a multi-year vision for the company.

To translate the overall size of the digital audience watching Tesla’s investor day into Gen Z terms, a similar audience size could be found watching the global esports team FaZe Clan ($FAZE), with millions of digitally connected online fans, play Call of Duty on a Saturday afternoon.

Once Musk did the take stage, he went so far to align Tesla’s broader company mission to humanity’s overall existence that he suggested Tesla’s stock was intended for anyone who is ‘an investor in Earth’. While this statement might have been interpreted with negative sentiment to an analyst or institutional investor, it is important to remember from our previous Roundtable Roundup on ESG that this kind of idealistic language around making the world a better place is exactly why many retail investors support Elon Musk as a business leader and why they have continued to purchase Tesla stock in record volumes this year.

In addition to the large live audience that watched the event, Tesla earned millions of social impressions across platforms and the event effectively gave the company complete dominance of a 24 hour financial news cycle.

Public.com’s Exchange Conference (March 29 - RSVP)

Stock issuers are not the only ones hosting experiential investor events with retail focused brokerages like Public.com also creating new opportunities for engagement.

The all day digital event features a range of speakers from Ark Invest’s Cathy Wood to NYU’s Scott Galloway to The Chainsmokers DJ / General Partner in Mantis VC, Alex Pall.

Katie Perry, Public.com's GM of Investor Relations, recently appeared on Bloomberg Markets to explain how the changes in retail investing is creating new demands and behaviors among brokerages and issuers.