Exploring the Rapid Growth of ETFs

And why they may accelerate the community + capital convergence

This week’s Roundtable Roundup is focused on ETFs, their impact on our financial markets and opportunities for growth alongside a new generation of digitally native retail investors.

🧐 First of all, what is an ETF and how does it differ from a traditional mutual fund? (Assist from ChatGPT)

An ETF, or exchange-traded fund, is a type of investment fund that is traded on stock exchanges. ETFs can be bought and sold throughout the trading day, like stocks, prices fluctuate based on market demand and the underlying assets are disclosed daily.

Passive ETFs aim to replicate the performance of a specific market index or benchmark, such as the S&P 500 or the Nasdaq 100.

Actively managed ETFs are managed by a portfolio manager or a team of managers who aim to outperform the market or a particular benchmark by actively selecting securities and adjusting the portfolio's composition based on their investment strategy and market analysis.

Smart Beta ETFs use a rules-based approach to investing rather than passively tracking a market index, and use a variety of factors to select and weight securities, such as value, momentum, quality, and low volatility.

ETFs typically have lower fees and expenses than mutual funds and greater transparency, making them an attractive investment option for many investors.

A mutual fund is a type of investment fund that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Mutual funds are managed by professional fund managers, who make investment decisions on behalf of the fund's investors.

Mutual funds are priced at the end of the trading day, based on the net asset value (NAV) of the fund's underlying assets but are only required to disclose those assets quarterly.

Mutual funds typically have higher fees and expenses than ETFs, due to the active management involved in their operation.

Overall, the main difference between ETFs and mutual funds is their trading mechanism, fee structure and transparency requirements. ETFs are traded on stock exchanges, have lower fees and positions are disclosed daily, while mutual funds are priced at the end of the trading day, have higher fees and positions are disclosed quarterly.

🎉 The first ETF is 30 years old. It launched a revolution in low-cost investing (CNBC)

Thirty years ago, State Street Global Advisors launched the Standard & Poor’s Depositary Receipt (aka SPY 0.00%↑ ) , the first U.S.-based Exchange Traded Fund (ETF), which tracked the S&P 500.

Bob Tull, who was developing new products for Morgan Stanley at the time and was a key figure in the development of ETFs said, “there was tremendous resistance to change. There was a small asset management fee, but the Street hated it because there was no annual shareholder servicing fee. The only thing they could charge was a commission. There was also no minimum amount, so they could have got a $5,000 ticket or a $50 ticket.”

Bob Pisani, CNBC’s longterm correspondent suggested, “it was retail investors, who began buying through discount brokers, that helped the product break out.”

Success did not happen overnight. By 1996, as the Dotcom era started, ETFs as a whole had only $2.4 billion in assets under management. In 1997, there were a measly 19 ETFs in existence. By 2000, there were still only 80 with $65 billion in assets. But by 2005 after the dot-com bust, ETF assets had reached $300 billion, and by 2010 they were up to $991 billion.

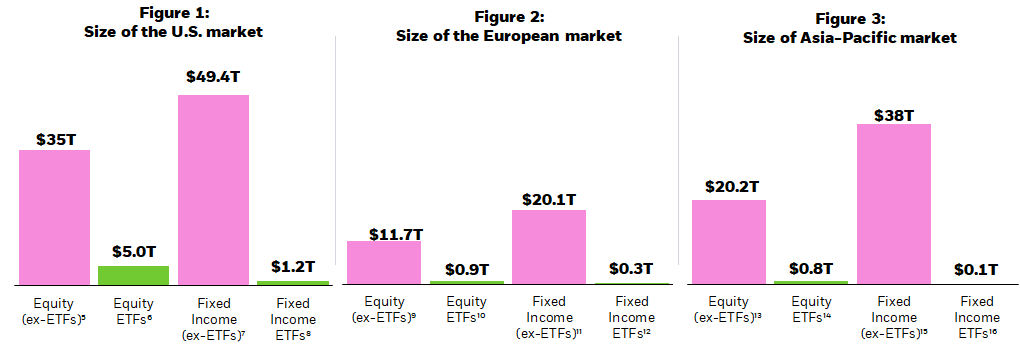

📈 Global ETF Market Facts from Q4 2022 (BlackRock)

In a turbulent year for global markets, investors continued to use ETFs at an increasing rate, with global ETF trading volumes reaching record levels. For example, in the U.S, ETFs represented over 32% of total equity volume traded on average, up from 25% in 2021.

While ETF flows declined year-over-year, ETF trading activity in 2022 was the largest on record, surpassing full-year 2021 levels by the end of Q3.

ETF trading volumes driven by retail investors in 2022 were the most on record. As of Q3, retail investors had already traded over $6.6 trillion in ETFs, over 30% more than what they traded in all of 2021.

Retail investors accounted for 15% of all ETF trading volumes in 2022, but remained a higher percentage in certain segments, like levered and inverse exchange traded products (ETPs), where they represented nearly 34% of all ETP volume.

🌱 Four Trends Driving ETF Growth (BlackRock)

1. ETF investors are active investors.

ETFs are increasingly used in portfolios to seek outcomes that differ from the broad market. As investors recognize that asset allocation tends to be more important than individual security selection, they are likely to step up their use of ETFs as building blocks in asset allocation and as vehicles to deliver factor-based investment strategies that seek to emphasize persistent drivers of returns.

2. Investors everywhere are sensitive to cost, and demand quality.

ETF growth is entwined with investors’ embrace of index investments as foundational strategies. Index investing is predicated partly on the notion, popularized in academia a generation ago, that costs associated with stock-picking can erode long-term returns. It’s an easy concept to understand: the extra small fee that you are paying to a fund manager to pick stocks for you, adds up and will cost you after 5 years, 10 years and 20 years.

3. A transformation in the business model for financial advice

Investors are increasingly paying wealth managers a transparent fee based on assets, instead of an indirect fee via brokerage commissions and retrocessions. In the years ahead, we expect to see new demand for lower-cost index products that will bring more adoption of ETFs into advisory. This backdrop could favor ETFs at the heart of portfolios.

4. An evolution in the way bonds trade favors ETFs for efficient market access.

The bond liquidity that many institutions once took for granted is declining. We believe there is tremendous growth potential in bond ETFs as institutions find it more difficult to access individual bonds. To facilitate large transactions, investors are increasingly likely to use bond ETFs alongside or instead of single securities.

🔦 Spotlight on Gen Z & ETFs (Nasdaq)

Key Facts:

83% of Gen Z investors are “very familiar” or “somewhat familiar” with ETFs compared with 65% of all adult investors.

64% of Gen Z investors expressed interest in ETFs compared to 43% of all adult investors.

56% of Gen Z investors expressed interested in robotics and autonomous technology ETFs compared to 32% of all adult investors.

78% of Gen Z investors prefer online video or podcasts as formats to convey information about ETFs compared to 52% of all adult investors.

Takeaway: The next generation of investors are significantly more engaged with ETFs than the older generations.

🏆 The Big ETF + Retail Investor Opportunity

The explosive growth of ETFs, particularly among younger retail investors, has recently led to more sophisticated marketing, thematic ETFs and the evolution of ETF brands. ETFs have a unique marketing and community building opportunity compared to corporate issuers for two reasons:

ETFs can organize their investment thesis & portfolios around values, belief systems and/or other social factors that extend deep into the emotional psyche of investors, examples include:

SHE 0.00%↑ (SPDR® MSCI USA Gender Diversity ETF) seeks to provide exposure to US companies that lead their sector in demonstrating a commitment towards promoting and supporting gender diversity throughout all levels of the organization.

MAGA 0.00%↑ (Point Bridge America First ETF) tracks an index of US large-cap companies whose employees and political action committees are highly supportive of Republican candidates.

SROI 0.00%↑ (Calamos Antetokounmpo Global Sustainable Equities ETF) provides opportunities worldwide to invest in high-quality companies that contribute to a more sustainable world and improved conditions for humankind. This ETF is backed by 2-time NBA MVP Giannis Antetokounmpo with a portion of the proceeds committed to increasing financial literacy.

DEMZ 0.00%↑ (Democratic Large-Cap Core Fund) is the first investment product that strives to replicate the S&P 500, “without the GOP”.

MEME 0.00%↑ (Roundhill Meme Stock ETF) is designed to offer investors exposure to “meme stocks” by providing investment results that closely track the performance.

VICE 0.00%↑ (AdvisorShares VICE ETF) invests in the products and services that people find pleasure in regardless of economic conditions. VICE seeks long-term growth from select global companies operating in “vice” industries which can include alcohol, tobacco, gaming, food and beverage, restaurant and hospitality, or other vice related business activities.

ETFs often have marketing budgets that grow alongside investor inflows which give the funds the opportunity to create a virtuous consumer cycle. For example, Invesco’s QQQ 0.00%↑ currently has over $172B assets under management with .08% per annum dedicated to marketing the ETF. 2022 QQQ marketing expenses totaled $132M and you might have noticed QQQ TV ads were predominately featured throughout NCAA's March Madness.

As ETFs continue to grow in size and marketing budgets, we anticipate that ETF marketing strategies will continue to emulate the general trends we are seeing with creator and community marketing. Below is a QQQ ad with WNBA legend Candace Parker and her super fans to establish an emotional connection between potential investors and the ETF’s brand.

🔮 Let's take out our crystal ball and imagine a not-so-distant future…

It’s 2025 and Mr. Beast just announced the BEAST ETF in partnership with a leading financial institutional that tracks an index of companies that deeply align with Mr. Beast’s community values.

Since Mr. Beast organically reaches hundreds of millions of potential investors through his content channels, marketing expenses are diverted to one of the community’s many philanthropic initiatives which in turn grows the community with viral content.

Similar to a regular issuer on the NYSE, the BEAST ETF shares are available for purchase on every major digital brokerage allowing Gen Z investors to participate with just a few clicks from their phones.

Mr. Beast decides to partner with Stakeholder Labs and verify investors holding BEAST ETF shares in their brokerage accounts allowing his team to engage a new cohort of community members who are also shareholders.

Mr. Beast is now able to reward ETF holders a 10% discount on Mr. Beast Burgers, Feastibles and apparel as well as exclusive access to the annual BEAST ETF shareholders conference. Mr. Beast also loves to surprise loyal shareholders at their homes on their anniversary of purchasing the shares.

As the BEAST ETF grows, it in turn becomes a large and influential shareholder across a number of public companies, potentially representing his community in shareholder meetings and proxy voting. An investment from the BEAST ETF brings with it a highly engaged community prepared to support the underlying assets however asked.

The BEAST ETF becomes a king maker for public companies seeking loyal and authentic engagement with Gen Z and Gen Z investors are able to get equity exposure to companies the Mr. Beast community might end up spending significant money with.

These are the types of win-win scenarios within our current financial system that Stakeholder Labs technology is designed to unlock and it is our belief that ETFs are poised to accelerate the community + capital convergence.

In summary, ETFs are a relatively new, rapidly growing financial product that are cheaper and more transparent than mutual funds and they particularly popular among Gen Z retail investors. We’re in the early innings of the ETF evolution in terms of combining a values-driven investment thesis and a community driven marketing strategy that provides financial and emotional returns and Stakeholder Labs is thrilled to be supporting pioneers in this space.

Interested in chatting more about ETFs and digital communities? Drop us a line!