📰 News Roundup - Week of July 17, 2023

Netflix's unique earnings calls, CFPB steps toward open banking, and more

Welcome to another edition of The Roundtable Roundup! This week we delve into the unique way Netflix conducts its earnings calls, discuss the surge of stock sales by billionaires and corporate executives amid the market rally, explore the US Consumer Financial Protection Bureau's efforts to accelerate open banking, and learn about BlackRock's plan to grant voting rights to retail investors in its largest ETF. We also cover the potential risk artificial intelligence poses to financial stability, as warned by SEC Chair Gary Gensler, and Barry Diller's concerns about the prolonged Hollywood strikes.

Let’s dive in!

The story behind Netflix’s unusual earnings calls (Fast Company)

For a decade, Netflix has stood out in the corporate world for conducting their quarterly earnings calls as video interviews. These calls, featuring candid chats and even themed apparel by executives, draw in tens of thousands of viewers each quarter, outstripping typical interest in earnings calls. The example above from Q3 2019 has over 245K views to-date.

The unique format was initiated in 2013 after Netflix faced regulatory warnings for revealing key company information on the CEO's personal Facebook page. The SEC subsequently clarified how companies can use social media for investor communications, allowing Netflix to conduct its first earnings call via YouTube.

Despite some hiccups along the way, Netflix has fine-tuned the video format for their earnings calls, including better equipment, pre-recording for quality control, and even set designs for a more professional look.

Although former CEO Reed Hastings, known for his entertaining antics, stepped down from the role and will no longer be on camera, he has promised to stay involved in the preparation for these unique earnings calls.

Billionaires and corporate execs have dumped $9 billion worth of stock this year amid the market's latest rally (Business Insider)

Billionaires and corporate executives have sold approximately $9 billion worth of stock in H1 2023, capitalizing on the recent market rally. The largest seller was the Walton family, heirs to Walmart and Sam's Club, who sold $4.39 billion in shares.

Key sellers also included Joe Gebbia of AirBnB, who sold off $893 million worth of his company's shares, and Larry Ellison of Oracle who sold $848 million in stock. Notably, this was Ellison's first sale in two years.

Meanwhile, insider buying on Wall Street has dropped to about half of 2022's levels. Many sales have been concentrated in the tech sector, which has seen significant gains due to excitement around artificial intelligence.

Despite potential headwinds to corporate earnings, such as tighter monetary policy, retail investors continue to be bullish. According to Vandatrack, net inflows into US equities are averaging around $1.4 billion a day, close to the all-time record set in March 2022.

Laying the foundation for ‘open banking’ in the United States (Consumer Financial Protection Bureau)

The Consumer Financial Protection Bureau (CFPB) aims to accelerate the adoption of open banking through a new Personal Data Rights rule, which empowers consumers to control their personal financial data. This rule intends to break down obstacles, promote competition, and protect financial privacy. Formal proposals are expected to be solicited in the coming months with finalization set for 2024.

While the CFPB is driving this change, it aims to not micromanage open banking, and seeks fair standards developed by the market to form the backbone of this system. The goal is to create a system where consumers can easily switch providers without being trapped by dominant incumbents and while maintaining control over their data.

To prevent skew towards the interests of major market players, the standard-setting organizations must reflect a balance of interests across consumers, firms of different sizes, and both new entrants and incumbents in the market. The CFPB will closely monitor any attempts to limit consumers' data rights, particularly efforts coordinated by dominant firms.

The CFPB encourages those developing open banking standards to discuss their plans with the agency to ensure the standards appropriately allow consumers to exercise their personal financial data rights, as the CFPB intends to incorporate these standards into its proposed rule.

BlackRock offers a vote to retail investors in its biggest ETF (Financial Times)

BlackRock, the world's largest asset manager with $9.4tn in assets, is planning to allow retail investors in its largest exchange-traded fund (ETF), iShares Core S&P 500 ETF (IVV), to participate in proxy voting in 2024. This is a response to recent criticism that the firm is imposing a "woke agenda" and is a part of an industry-wide effort to involve retail investors in voting on shareholder proposals.

Retail investors will be able to select from seven general policies that dictate how their votes are cast, ranging from voting with management, prioritizing Catholic values, or focusing on environmental, social and governance (ESG) factors. However, investors will not be able to cast specific votes on individual companies.

The move to involve retail investors in proxy voting could help asset managers like BlackRock, State Street, and Vanguard make their claim of providing client-centric services more credible, by decentralizing the decision-making process. It might also help diffuse criticism as shares will no longer be voted as a single bloc.

Other fund managers like Vanguard and State Street are also experimenting with similar initiatives. Vanguard recently concluded a pilot program that provided retail investors with four voting options, while State Street aims to include 82% of all its eligible equity assets in a program that offers seven voting options.

SEC’s Gensler Warns AI Risks Financial Stability (Bloomberg)

US Securities and Exchange Commission (SEC) Chair Gary Gensler has warned that the rapid growth of artificial intelligence (AI) could necessitate an overhaul of regulations to ensure global financial stability. He expressed concerns that AI could promote financial fragility due to herding effects, where individual actors make similar decisions based on the same model or data aggregator.

Companies must be mindful of how their use of AI may implicate securities rules, Gensler said. Misuses, such as financial fraud, manipulating corporate returns, or steering investors toward specific products, will be monitored closely by the SEC.

Gensler cautioned publicly traded companies to avoid misleading investors through their statements and disclosures about AI's risks and opportunities. He also suggested that SEC's investigators could utilize AI more effectively for surveillance, analysis, and enforcement purposes.

More broadly, AI's use in business and society is under intense federal scrutiny. For instance, the Federal Trade Commission has initiated an investigation into OpenAI's ChatGPT bot's impact on consumer data privacy, and the Biden administration has proposed an "AI Bill of Rights" and guidelines for the ethical use of AI by government agencies.

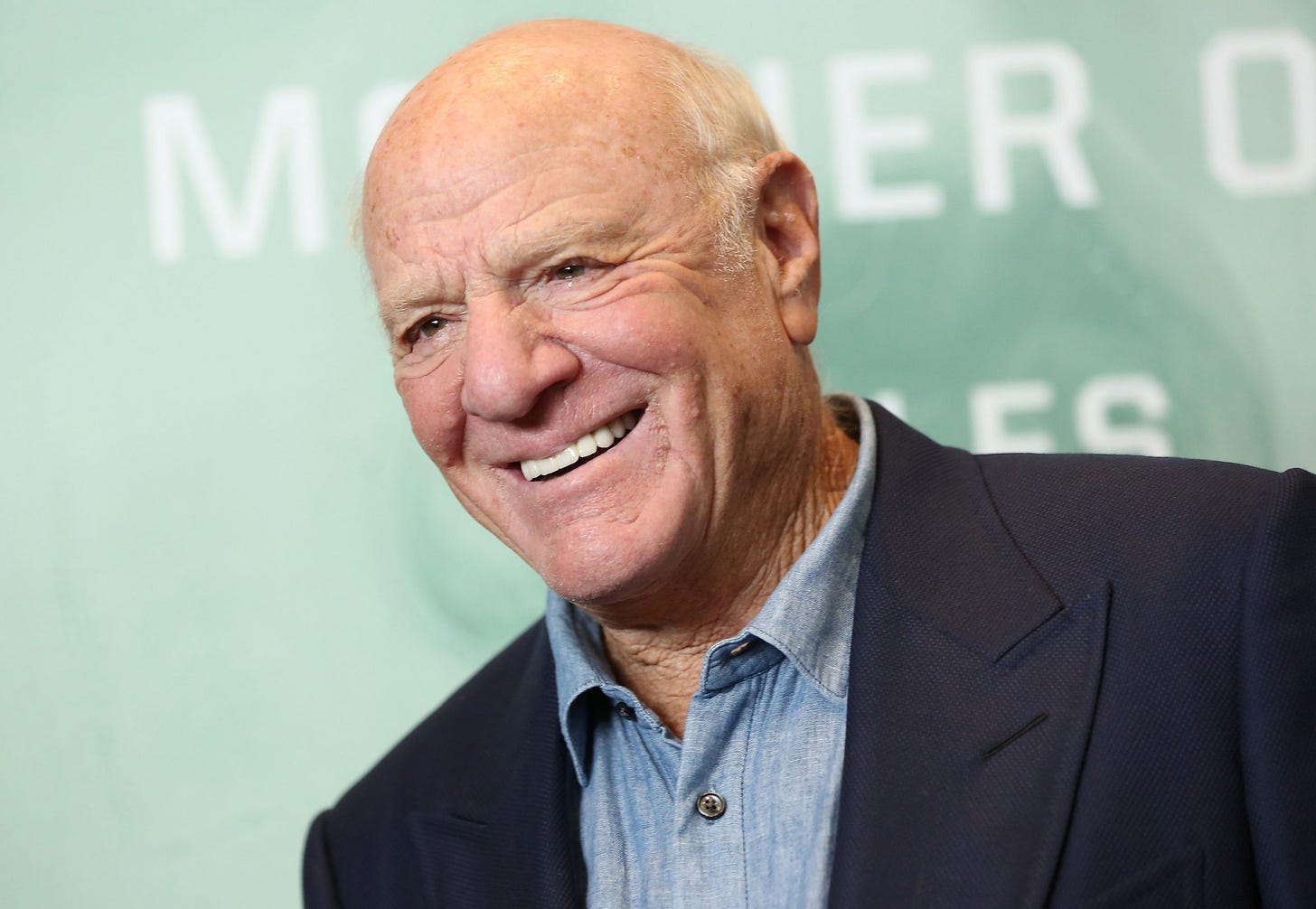

Prolonged Hollywood strikes could lead to ‘an absolute collapse,’ says Barry Diller (CNBC)

IAC and Expedia Chairman Barry Diller warned of "devastating effects" and a potential industry collapse if the ongoing dual strikes of the writers’ and screen actors guilds in Hollywood are not resolved soon. He foresees fewer programs, canceled streaming subscriptions, and a consequent reduction in the entertainment industry's revenue if the strikes persist.

Diller suggested a potential resolution could involve top studio executives and highly paid actors taking a 25% pay cut as a good-faith measure to narrow the pay disparity. He also highlighted "existential issues" such as the rise of artificial intelligence and called for a Sept. 1 settlement deadline.

Contrary to some beliefs, Diller expressed that AI has been "overhyped" in terms of its impact on the entertainment industry, predicting that writers will be assisted, not replaced, and that performing crafts are not in danger due to AI. However, he expressed concerns about the impact of AI on the publishing industry.

Diller anticipates a potential lawsuit with leading AI companies like Google and Microsoft over the use of copyrighted work by publishers. He stressed the importance of a fair business model that respects copyright and suggested that litigation could lead to sensible legislation protecting copyrights.