Skybound takes Regulation A+ crowdfunding to new heights

Happy Holidays from Stakeholder Labs! Welcome to the 4th edition of The Roundtable Roundup.

This week we’re highlighting the success of Skybound, the global hit entertainment company behind popular series The Walking Dead and Invincible, that recently launched a recording-breaking Regulation A+ crowdfund campaign and raised over $9.5M from 3600 investors in its first week. In our second edition of The Roundtable Roundup, we featured The Chosen as the immensely popular content series that has benefited from capital and community support courtesy of crowdfunding campaigns. Skybound is now taking that same idea of having fans as shareholders and applying it to over 150+ IP titles across Comics, Film/TV, Audio, Games, VR, and Tabletop.

What is a Regulation A+ Crowdfund?

In April, 2012, President Obama signed the Jumpstart Our Business Startups (JOBS) Act which enables entrepreneurs and small business owners to sell limited amounts of equity in their companies to retail investors via social networks and various internet platforms. Prior to the JOBS Act, any form of crowdfunding for private companies was illegal under United States securities laws which left the venture capital / private equity asset class completely inaccessible to unaccredited investors. Regulation A+ allows companies to raise up to $75M from retail investors in a calendar year while Regulation CF allows companies to raise up to $5M on a registered crowdfunding platform such as WeFunder, Republic or StartEngine.

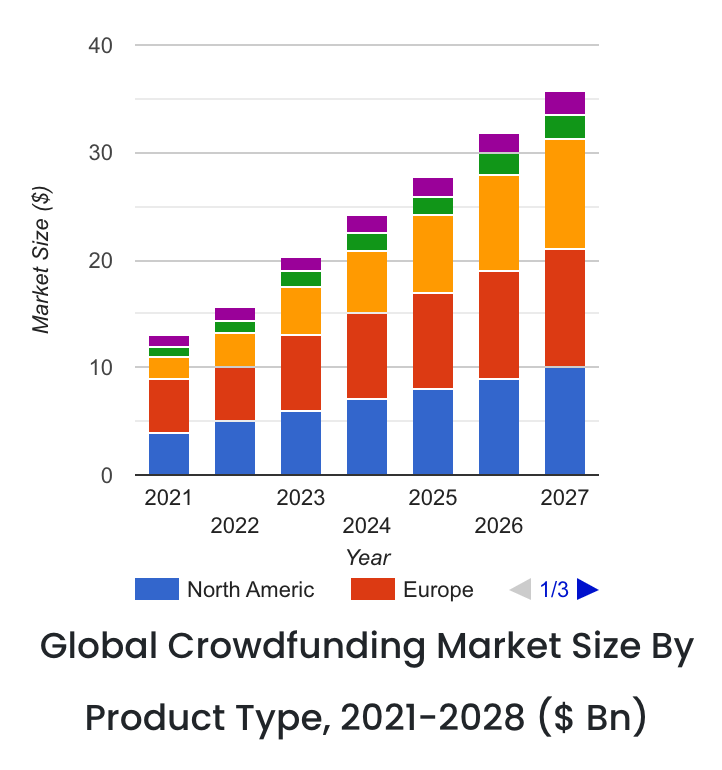

SkyQuest Technology, a consulting firm providing market intelligence, recently published a report suggesting that the global crowdfunding market size had reached $17.51B in 2021 and is expected to reach $42.93B by 2028, a CAGR of 16.40% over the forecast period. This rapid transformation of our private and public markets is starting to have a major impact on how companies are built and what companies succeed.

Stakeholder Labs + Skybound 🤝

Stakeholder Labs is pleased to announce that we’re partnering with Skybound and deploying Roundtable software to support the post-crowdfund experience for retail investors. In January, Skybound will be announcing unique investor rewards based on the number of shares held and offering retail investors ways to interact with the content they have fallen in love with.

“When we launched Skybound in 2010, we quickly became fans of our fans and have been constantly exploring new ways to interact with them through our content distribution,” said Dave Alpert, CEO of Skybound Entertainment on behalf of business partners Jon Goldman and Robert Kirkman. “We’re thrilled to be an early customer and investor in Stakeholder Labs and to use their technology to engage our thousands of new retail investors and offer them meaningful ways to experience our over 150 intellectual properties.”

Introducing Roundtable

Stakeholder Labs is excited to be deploying our technology with organizations like Skybound who are committed to innovating with their retail investor community. The Regulation A+ crowdfund allows Stakeholder Labs to onboard all of Skybound’s retail investors at the conclusion of the crowdfund campaign and integrate that data in Skybound’s Insider Loyalty Program. Our goal with this partnership is to prove that Skybound’s retail investors are more loyal and engaged consumers over the next several years. The Roundtable Roundup will be providing regular updates on the success of this program and key learnings for the investor relations community at large.