Are Retail Investors Stabilizing the Stock Market?

Public.com and eToro provide the latest insights on retail investor preferences and behaviors

Recent data published by Public.com and eToro offer unique insights into the mindset of retail investors over the previous quarter. Trends we’re consistently seeing from both brokerages include:

Retail investor interest and engagement is at an all-time high but investors are making more conservative decisions based on the macroeconomic conditions.

Retail investors are continuing to invest in brands they know and love (even during a controversy) while keeping a firm focus on companies and sectors that are poised for long-term growth.

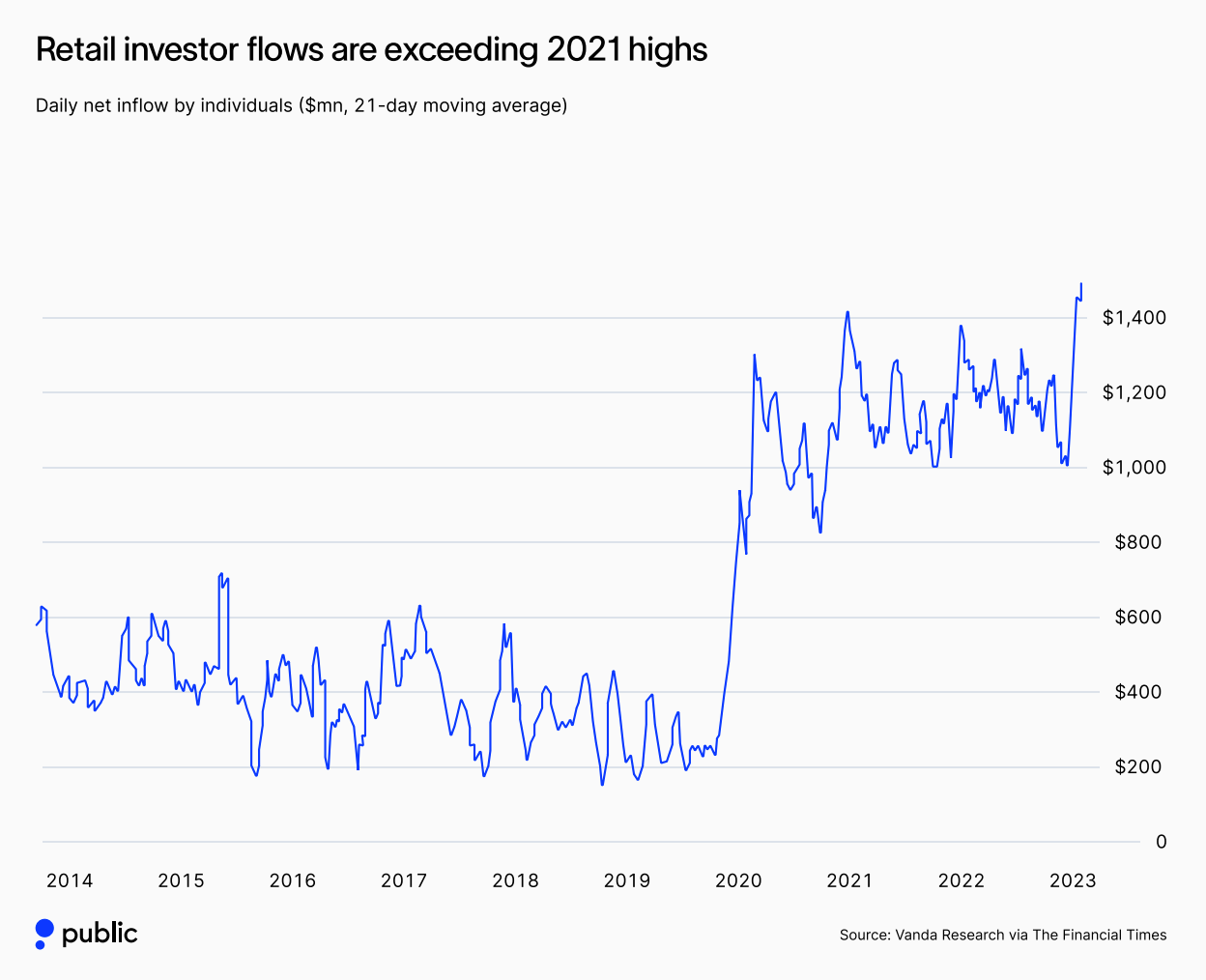

The macroeconomic environment consisting of a rapid increase of Fed interest rates and a sharp decrease in personal savings typically correlates with a bearish stock market but the S&P 500 is up ~24% since Oct ‘22 lows while retail investor inflows are at an all-time high.

Are the tens of millions new retail investors that have entered the market in the last five years influencing traditional cycles and supporting a relatively ‘softer landing’ of the stock market? For this week’s Roundtable Roundup, we explore the latest economic and retail data with this question in mind and analyze how individual investors are actually deepening and diversifying their participation in the markets as they lean into the new macro environment.

The Retail Investor Report - Aug ‘23 (Public.com)

Individual investors are maintaining participation in the public markets — with behaviors that demonstrate increased diversification and new approaches to research and discovery.

Deep Dive w/Venture Daily: Public.com’s Katie Perry joined Venture Daily to dive deeper on their latest research and the new investor behaviors adopting along with changes in the market.

Retail Inflows Reach ATH: According to Public and Vanda Research, retail investor inflows are exceeding pandemic levels despite the rapid increase in interest rates and decline in personal savings rates.

Diversified Sectors & Strategies Focused on the Future: Public’s research suggests that today’s inflows don’t necessarily correlate to blind optimism in the market, but rather, a more focused and conservative approach to the changing economic environment.

70.3% of the respondents were neutral or pessimistic about the economy

Thematic dividend investing and investing in assets that benefited from higher interests rates were leading drivers of portfolio adjustments.

Retail Investors Continue to Show-up for Brands They Love:

Barbie’s record-setting box office debut drove retail investors to increase investment inflows into MAT 0.00%↑ by 6.6X QoQ

AB InBev retail investors appeared to be significantly less concerned about the Dylan Mulvaney controversy relative to their institutional counterparts. As BUD 0.00%↑ total market cap dropped by over $27B, retail investors in AB InBev increased by 1.5X.

Retail Investor Beat ‘Q2 (eToro)

Retail investors were early back into the stocks rebound from the October ‘22 low but are now being contrarian again, and turning more cautious, with just one in ten (11%) believing we have entered a new bull market.

While sentiment has dropped, many retail investors are still backing global markets by a factor of 3-to-1.

Over the last three months, 31% increased the amount of money they regularly contribute to their portfolio while just 12% scaled back their contributions.

The picture is similar over the next three months, with 31% planning to up contributions while only 11% say they will reduce them.

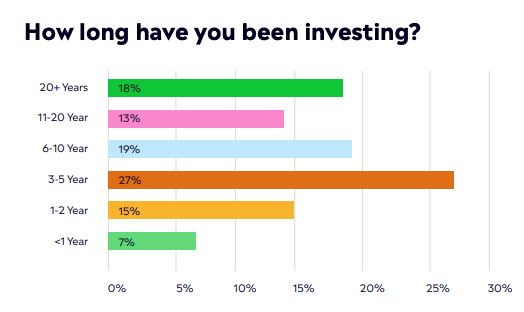

The retail investor community continues to grow, through the thick and thin of markets.

23% of retail investors are new to markets in just the past two years, and they are taking it seriously.

Only 12% do it for fun, whilst they are much more likely to be looking to build long term financial security (47%), supplement their income (36%), and build a retirement fund (35%).

The average retail investor today is 33 years old - this is significantly younger than the median population age that is nearer 40.

Macro Overview:

For the nearly 40% of retail investors that have entered the market in the last 5 years, this is the first time they’ve made investment decisions that wasn’t in a near-zero interest rate environment. The insights from Public.com and eToro on retail investor behaviors are being made against this a new macro economic backdrop.

Rapid Rise in Interest Rates: The Effective Federal Funds Rate is at 5.33%, compared to 2.33% last year and .08% two years ago. This is higher than the long term average of 4.60%. The Effective Federal Funds Rate is the rate set by the FOMC (Federal Open Market Committee) for banks to borrow funds from each other. The Federal Funds Rate is extremely important because it can act as the benchmark to set other rates. Historically, the Federal Funds Rate reached as high as 22.36% in 1981 during the recession.

Rapid Decline in Savings: US Personal Saving Rate (Percent of Disposable Personal Income) is at 3.50%, compared to 3.50% last year, 9.90% two years ago and 18.70% three years ago. This is lower than the long term average of 8.80%.

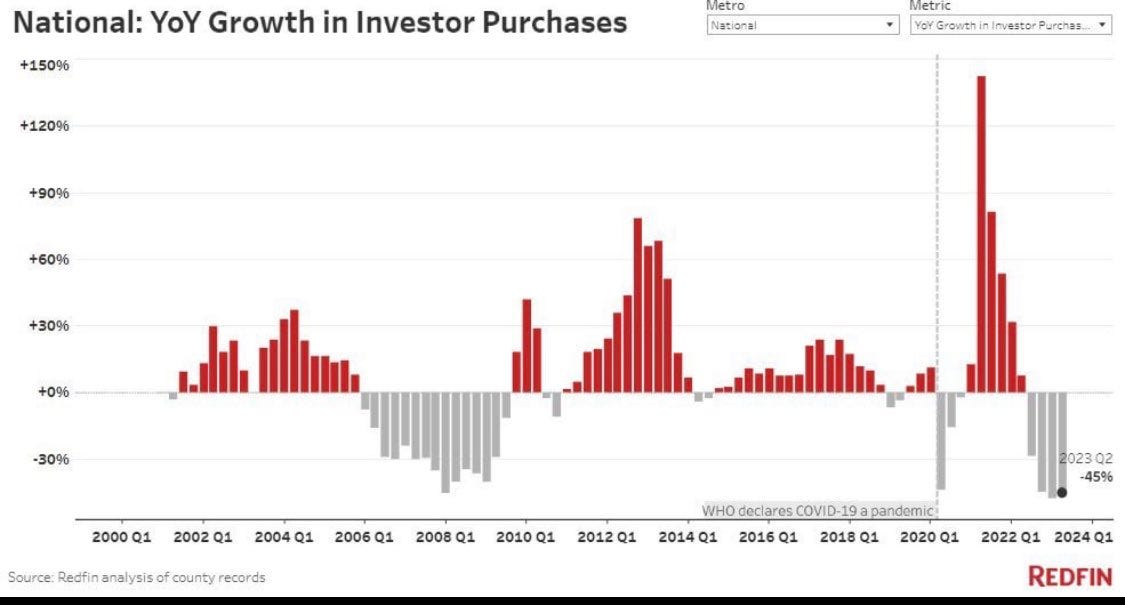

Rapid Decline in Real Estate Transactions: Investor home purchases fell 45% from a year earlier in the second quarter, outpacing the 31% drop in overall home sales. This is the biggest decline since 2008 with the exception of the quarter before, when they dropped 48%. The decline comes as this year’s relatively cool housing and rental markets makes investing in homes less attractive than it was during the pandemic-driven homebuying frenzy of 2021 and early 2022. In terms of market share, investors bought 15.6% of homes that were sold in the U.S. during the second quarter, down from 19.7% a year earlier and a record high of 20.4% in the beginning of 2022.

S&P 500 Approaching ATHs: In light of the recent data, the stock market's continued buoyancy has had a “good news is bad news” effect on The Fed’s approach towards raising interest rates but currently the markets predict there is a 93% chance of there being no interest rate hike at the next FOMC meeting on Sept 20th.

Is Good News Finally Good News Again? (NY Times)

Shift in Perception: The earlier sentiment of "good news is bad news" in economic circles, linked with concerns that strong economic data might fuel inflation, is changing. As inflation starts to moderate, positive economic developments, especially with the robust labor market, are now seen as proof of the American economy's resilience rather than signs of overheating.

Signs of Balance: Even as growth rates remain positive, the economy is moving towards a balanced state. The past discrepancies between demand and supply, especially during the reopening from the pandemic, are now leveling out. The economy hasn't stagnated but is normalizing. Economic resilience isn't necessarily inflationary as was once perceived.

Caution with Growth: While there's optimism, rapid and sustained wage growth could still be concerning, as it could hinder the Federal Reserve's efforts to fully manage inflation. The balance between economic strength and potential inflation is fragile, and overly aggressive rate increases by the Fed to counter inflation might lead to economic slowdown.

Supply Side Optimism: A notable factor for the renewed optimism among economists is the evident improvement in the supply side of the economy. With supply chains almost back to normal and the labor force expanding, there's hope that the economy can achieve growth without instigating inflation.

Goldman Sachs cuts US recession odds to 15% as economic optimism grows (CNN)

Recession Forecast Lowered: Goldman Sachs has reduced its estimate of a US recession in the next year to 15%, down from previous predictions of 20% and a significant decline from the 35% projection in March. This change reflects the bank's renewed confidence in the US economy, bolstered by promising economic indicators related to inflation and the jobs market.

Monetary Policy & Rates: Jan Hatzius, Goldman’s chief US economist, disputes the idea that monetary policy will steer the economy toward a recession. Goldman Sachs anticipates the effects of monetary policy tightening to diminish, vanishing entirely by early 2024. Furthermore, the bank believes the Federal Reserve might be "done" with raising interest rates as other economic factors stabilize.

Resilient Economic Growth: Despite other forecasters predicting higher chances of recession, Goldman Sachs remains "substantially more optimistic." While growth is expected to cool in the fourth quarter due to factors like resumed student loan payments and increased mortgage rates, Goldman Sachs predicts a short-lived slowdown, citing solid job growth and rising real wages.

Consumer Strength & Jobs Market: The August jobs report indicated steady hiring, even though it’s slowed since the early post-pandemic recovery days. The slight increase in the unemployment rate isn't a concern for Goldman Sachs, as it's attributed to more people entering the job market. Continued growth in real disposable income and wages outpacing prices suggests consumers will keep driving the economy's growth.

Conclusion:

As the final quarter of 2023 unfurls, the financial landscape presents a conundrum: an interplay of historical rate hikes, dwindling savings, a dip in real estate transactions, and a stock market that is defying these underlying signals. Yet, amidst these challenges, the resilience and evolving strategies of retail investors stand out prominently. The new generation of retail investors are showcasing a diversified approach, underlined by long-term financial planning and brand allegiance. Moreover, the shifting perceptions in economic data interpretation signify a budding optimism that transcends the traditional fear of inflation. The consensus? While challenges persist, adaptability, strategic foresight, and economic resilience are emerging as the defining narratives of 2023's financial climate. As always, The Roundtable Roundup will continue to keep you updated on new reports, evolving narratives and their implications for the retail investment landscape. Stay tuned and invest wisely!