Berkshire Hathaway and the new 'meme stocks'

🔬 a closer look at the impact of branding within the financial sector

Amid the recent unprecedented uptick in federal interest rates, the financial sector is observing a resurgence of 'meme stocks'. Household names like Yellow Trucking, WeWork, and Tupperware are navigating notable stock price fluctuations in this complex economic environment. Just last week, WeWork's stock rose sharply from .13 to .30, even as the company's management signaled concerns over potential bankruptcy. This brings to mind the 2021 episodes involving GameStop and AMC, where retail investors significantly influenced stock trajectories. Unlike before, institutional investors and financial analysts are now viewing these retail-driven movements with a discerning eye, appreciating the evolving dynamics and strategy within the retail segment. At the same time, trusted financial brands like Berkshire Hathaway are seeing record-high stock prices as retail investors seek reliability during economic turbulence. Additionally, we note a recent environmental decision in Montana that might greatly influence local ESG reporting.

Retail investors help lift Warren Buffett’s Berkshire Hathaway to new heights (Financial Times)

Warren Buffett and his acumen are ‘in vogue’ again: Trading data and analysis from Goldman Sachs and JPMorgan suggests retail investors have predominantly placed buy orders for Berkshire shares, driving its stock to record highs.

Long-termism = stability: Warren Buffett has noted that Berkshire's significant base of long-term shareholders, many being retail, often limits the stock's trading, emphasizing its unique shareholder composition.

Confidence amidst setbacks: Retail shareholders seemed unswayed by potential challenges like reduced revenues in certain sectors or concerns about PacifiCorp's wildfire-related claims.

Berkshire’s brand equity: Recalling our prior Roundtable Roundup on Stakeholder Labs' visit to the Berkshire Hathaway annual shareholder meeting, Buffett's leadership approach and principles are pivotal in engaging his dedicated retail shareholder base.

Charles Payne: Financial media continues to let retail investors down (Fox Business)

Last week, Charles Payne from Fox Business, ended his show "Making Money" with a critique. He suggested that financial media has often misled retail investors and emphasized the need for transparency.

I think this is a good time in the show to talk about the role… [of financial media] who continue, in many ways, to let retail investors down - retail investors, also known as our viewers. They’ve [the financial media] even gone a step further in the last few years, just totally disrespecting our viewers by calling them dumb, and always, always finding a way to laugh at their expense.

Payne drew attention to the inconsistency in media coverage regarding WeWork. While the company was once valued at over $40B and championed by seasoned private investors, its coverage shifted as its stock price plummeted below $1. Now, the media labels it a 'meme stock', implying it's only for uninformed investors.

Using his own professional experience, Payne cited the transformation of the struggling department store in the early 1990s, Alexander’s, into a successful real estate holdings firm. The stock surged from $8.50 per share pre-bankruptcy to $57 within a year. He underscored the disparity in perception: when institutional investors speculate on a bankruptcy, it's strategy; but when retail investors do the same, it's dismissed as a 'meme stock'.

It's unfortunate that you watch us to learn, for guidance, and the best you can get sometimes out of us is to diss you. To diss you, ironically enough, for buying the crap that was foisted on you by the brilliant folks of Wall St. and...their talking heads that work for them and not for you. I work for you. I want you to do well. I might not always be right...believe me this is a humbling business...but you should never be called dumb money again.

How Hertz became the first meme stock (Young Money Blog by Jack Raines)

The ‘meme stock’ trend can be partially traced back to the 2020 bankruptcy of Hertz, the car rental company that saw a significant rise in its stock price despite its precarious financial situation.

Key points in the Hertz story:

Hertz faced challenges in spring 2020 due to the pandemic's effect on travel.

Despite filing for bankruptcy, its stock price surged 800% due to retail investors, commonly associated with the Robinhood trading platform.

Hertz planned to raise $500M through new shares, but the SEC intervened, and they only raised $29M.

After being delisted, Hertz's reorganization plan in 2021 attracted multiple bidders, and an eventual deal resulted in an ~$8/share payout for existing shareholders, rewarding those who had invested in the bankrupt stock.

The Hertz saga paved the way for other ‘meme stocks,’ where retail investors rally around financially struggling companies to bet on contrarian returns.

Hedge fund billionaire Dan Loeb laments the victory of meme stocks (Fortune)

Retail traders have resumed their activity, driving up stock prices and inflicting significant losses on short sellers. Tupperware Brands Corp., Nikola Corp., and Yellow Corp. are among the companies that witnessed stock price surges, causing short sellers to experience losses amounting to approximately $435 million over two months.

Dan Loeb of Third Point LLC conveyed in a letter to his clients that he's scaling back on betting against individual stocks. He highlighted that fundamental analysis is increasingly overshadowed by Reddit message boards and daily option expiries, leading to significant short squeezes.

The unpredictability brought on by retail traders, especially those from platforms like Reddit's WallStreetBets, poses a heightened risk for short sellers. Dan Loeb's sentiments echo a broader realization among investors that the landscape for short selling has fundamentally changed, with online communities having the power to quickly rally and significantly influence stock prices.

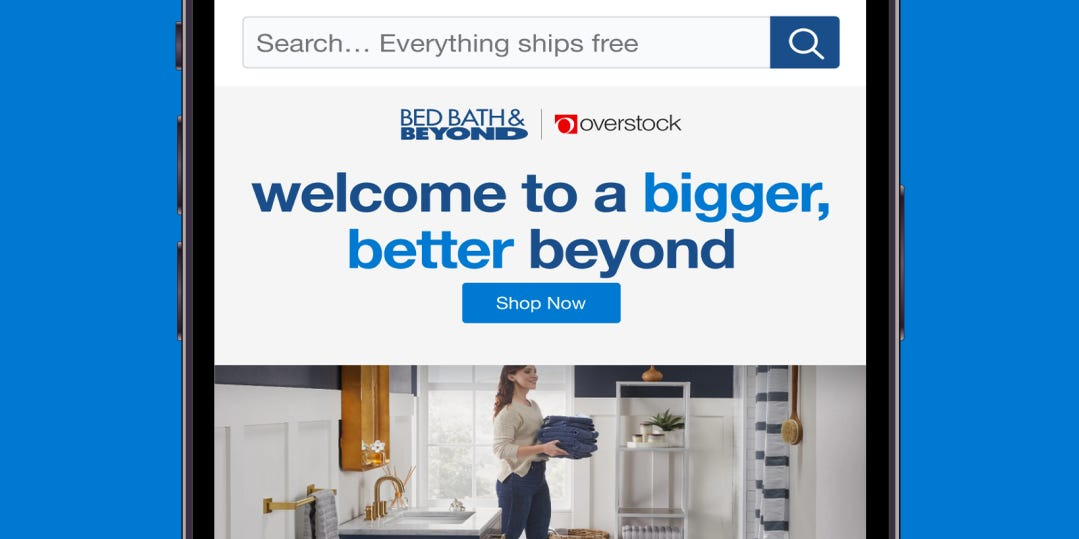

Overstock’s rebrand as Bed Bath & Beyond may go down as the best in marketing history (Fast Company)

Overstock.com purchased the recently closed Bed Bath & Beyond chain (and former ‘meme stock’) for $21.5 million and subsequently rebranded itself, leading to a 65% spike in its share price. This move added approximately $600 million to Overstock's valuation.

Historically, the name "Overstock" hinted at being a liquidator and was associated with surplus inventory, limiting its appeal. Additionally, the company's reputation suffered in 2019 due to its then-CEO's controversial actions and public statements.

The acquisition was driven by Bed Bath & Beyond's strong brand recognition and consumer respect. The brand was familiar and flexible, making it easier for Overstock to retrofit its identity. Along with the brand, Overstock also acquired Bed Bath’s customer database and its loyalty program data.

Brands like Bed Bath & Beyond have historical recognition and consumer loyalty, making them susceptible to becoming 'meme stocks' in today's trading environment. The acquisition and subsequent rebrand aim to leverage the old brand's familiarity to attract and retain consumers and shareholders in a competitive e-commerce landscape.

Judge rules in favor of Montana youths in landmark climate decision (Washington Post)

A Montana state court sided with young activists, ruling that Montana violated their rights to a "clean and healthful environment" by endorsing fossil fuel usage. This case, unique in nature, alleged that a provision in the Montana Environmental Policy Act harmed the environment and the youths by blocking the consideration of climate impacts when evaluating energy projects.

This victory could propel the environmental movement and redefine climate litigation in the U.S., possibly leading to an influx of lawsuits promoting climate action. Given that many youth-led climate lawsuits in the U.S. have been dismissed in the past, this decision might represent a change in the legal climate regarding such cases.

Montana, which heavily relies on coal, has historically never denied permits for fossil fuel projects. The state's defense claimed its contribution to global greenhouse gas emissions was minimal and any legal change would insignificantly affect the climate. However, the state's unexpected defense tactic, not contesting the climate science, hints at a broader acceptance of climate change realities.

Broader Impact on ESG Disclosures: As this case sets a legal precedent, it could prompt publicly traded companies to be more vigilant about their environmental practices and related disclosures. The verdict might encourage other states to reevaluate their environmental policies and how they assess the impacts of commercial projects, potentially requiring more stringent ESG disclosures from companies operating within their jurisdictions.