Fintech Giants Prepare for New Regulatory Paradigm

How brokerages are innovating to safeguard and expand their revenue streams amidst regulatory uncertainties

The capital markets are at a critical juncture, facing shifts that could deeply impact the strategies of brokerages and major financial institutions. Central to these changes is the issue of data transparency and control. This is highlighted by the forthcoming 'Open Banking' regulations from the Consumer Financial Protection Bureau (CFPB) and the new Securities and Exchange Commission’s (SEC) rules that aim to ensure broker-dealers and investment advisers prioritize investors' interests, especially when leveraging predictive data analytics. As these regulations loom, financial institutions might see their grip on customer data usage and monetization wane, prompting a reevaluation of their business models. In this week's Roundtable Roundup, we delve into these impending regulatory changes, their potential impact on financial entities and retail investors, and how brokerages are innovating to safeguard and expand their revenue streams amidst regulatory uncertainties.

US Consumer Watchdog: Proposed 'Open Banking' Rule Due This Month (Reuters)

Release Date Confirmed: The Consumer Financial Protection Bureau (CFPB) will unveil a regulatory proposal on consumers' control over their banking data later this month, as per the previous timeline.

Director's Statement: Rohit Chopra, the CFPB director, emphasized the need for robust safeguards for American consumers against over-surveillance and potential misuse of their data. He articulated these concerns during his speech at the Brookings Institution in Washington.

Key Features of the "Open Banking" Proposal: The forthcoming "open banking" proposal from the CFPB aims to:

Empower consumers to transition between service providers effortlessly.

Regulate how financial tech service providers gather and handle consumer data.

Extended Supervision Over Non-Banks: The CFPB is exploring its legal capability to supervise non-banking entities that offer payment platforms directly.

CFPB's Authority Over Large Tech Firms: Rohit Chopra mentioned that the CFPB intends to mandate certain prominent tech companies to disclose details regarding their handling of consumers' personal data and private currencies. The agency can exert this authority especially when these tech companies serve as service providers to significant depository institutions.

Fidelity & PNC Lead Akoya's Open Banking Land Grab; CFPB's Chopra Not Amused, Statements Indicate (Fintech Business Weekly)

Akoya's Background and Challenges: Founded in 2018 as a subsidiary of Fidelity, a major US brokerage.

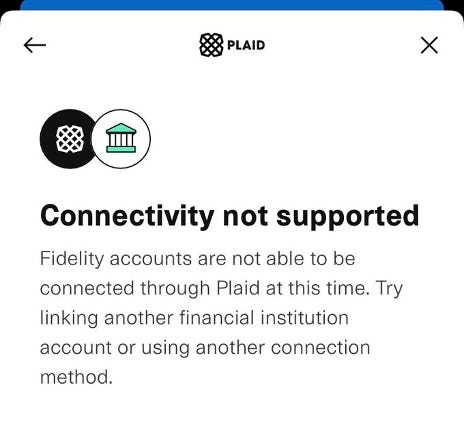

Fidelity opposes "screen scraping" (typically preformed by banking connecting apps) and views Akoya as a means to facilitate secure API-based data sharing and control customer data dissemination.

While major banks such as JPMorgan Chase, Wells Fargo, Bank of America, and PNC took ownership stakes in Akoya in 2020, the platform hasn't gained significant traction among data consumers like Plaid, MX, and Yodlee.

Fidelity's Push for Akoya: Fidelity, overseeing $10.3 trillion in assets under management, has restricted third-parties from accessing its customers' data unless they transitioned to Akoya by October 1. This seems to be an effort to centralize and secure data sharing via Akoya.

PNC's Stance on Akoya: PNC Bank, with around 12 million retail customers, set an initial deadline for third-parties to transition to Akoya by November 1, 2023, but pushed it to June 2024 after receiving feedback. PNC, like Fidelity, aims to have third-parties access customer data through Akoya exclusively.

Issues with Akoya: Industry experts have pointed out concerns with Akoya: charging third-parties for data access, potential prohibition on data enrichment by third-party aggregators, and unproven technological capabilities compared to established open banking players.

CFPB's Position on Open Banking: The CFPB and its Director, Rohit Chopra, emphasize the need for open banking to enhance competition and consumer control. Chopra warns against any singular group monopolizing open banking infrastructure, hinting at Akoya's potential centralization efforts. The CFPB's proposed regulations on this matter are expected soon, with potential implications for Akoya's future operations.

SEC Proposes New Requirements to Address Risks to Investors From Conflicts of Interest Associated With the Use of Predictive Data Analytics by Broker-Dealers and Investment Advisers (SEC)

Introduction of the Proposed Rules: The Securities and Exchange Commission has proposed rules that will mandate broker-dealers and investment advisers to address potential conflicts of interest when using predictive data analytics and related technologies. The rules aim to ensure that firms prioritize investors' interests over their own.

Statement from the SEC Chair: SEC Chair, Gary Gensler, emphasized the transformative nature of predictive data analytics and artificial intelligence in today's financial landscape. He noted that as these models become increasingly adept at personal predictions, there's a potential for conflicts, especially if brokers or advisers prioritize their gains over those of the investors. Gensler believes that the proposed rules will safeguard investors from such conflicts, ensuring that firms fulfill their obligation to prioritize investors' interests irrespective of the technology they deploy.

Emergence and Risks of New Technologies: The adoption of technologies that predict, guide, or direct investment-related behaviors has grown rapidly among broker-dealers and investment advisers. While these technologies can provide advantages like enhanced market access and returns, they can also lead to situations where firms prioritize their benefits over those of investors. Such actions can cause financial harm, and due to the widespread reach and speed of these technologies, the negative impacts can be more pronounced and far-reaching.

Based on current legal standards, the proposed rules will:

Obligate firms to assess if their technology usage creates a conflict of interest that might prioritize the firm's interests over those of the investors.

Compel firms to eliminate or neutralize such conflicts. However, they can use tools tailored to their specific technology that they believe will address these concerns.

Mandate firms to establish written policies and procedures ensuring compliance with these rules.

Require firms to maintain records related to the rules' compliance.

Potential Impact on Payment for Order Flow Market: While the article does not explicitly mention the payment for order flow market, the proposed rules could significantly impact this market. Predictive analytics and similar technologies play a role in determining order flow strategies, and if these rules are adopted, brokers would need to ensure that their use of such technologies does not prioritize their own interests (such as earning rebates) over the best execution and interests of their investors.

Comment Letter on SEC’s Proposed Rule on Conflicts of Interest Associated with the Use of Predictive Data Analytics by Broker-Dealers and Investment Advisers (Professors Alberto Gramitto Ricci and Sautter)

Professors Sergio Alberto Gramitto Ricci and Christina Sautter, who joined us on a previous Roundtable Roundup to discuss their research on ‘wireless investors’, responded to the SEC’s proposal:

Expertise and Perspective: The authors are business law scholars with a deep understanding of retail investors' participation in securities markets. They've advocated for mandatory investing education and have researched technology's role, particularly artificial intelligence, in corporate governance.

Support for Mindful Use of Technology: Alberto Gramitto Ricci and Sautter are in favor of using technology to make securities markets more accessible to the average person, emphasizing its democratic significance. They highlight that the corporate sector's inclusivity is crucial in the context of concentrated ownership and power in equities.

Concerns with the Proposed Rule: They express concerns that the current form of the rule might undermine the benefits of technology, such as transparency, liquidity, and efficiency. They argue that not all technology is harmful to retail investors and that the SEC has previously noted the advantages of properly deployed technology.

Overly Broad Definitions: The definitions of “covered technology” and “investor interaction” in the proposal are considered too encompassing. This broad scope might unintentionally target benign practices, like using spreadsheets for advice, and could potentially inhibit retail investors from utilizing mobile investing platforms and online educational resources.

Recommendations: The authors suggest a more targeted approach, focusing on specific potentially harmful technologies rather than a blanket regulation. They recommend a clear and effective disclosure-based approach consistent with the SEC's tradition. Additionally, they propose strengthening technology-based engagement methods for issuers to better connect with all investors.

Overall, Alberto Gramitto Ricci and Sautter emphasize the importance of including individuals in corporate decision-making and caution against overly restrictive regulations that might deter retail investors.

You Can Now Invest in ‘Shrek’ Music Rights the Same Place You Buy Stocks (Wall St. Journal)

Introduction to a New Investment Option: Starting last Thursday, investing platform Public began allowing its customers to purchase a portion of the rights to the score of the "Shrek" film franchise. Investors will then receive quarterly payouts based on royalty earnings from this music. In 2021 and 2022, the "Shrek" composition rights yielded an annualized dividend of over 8%.

Details on the Royalty Earnings: The catalog, which consists of 768 tracks, earns every time the "Shrek" movies are broadcast or streamed and when the music is used in theme park rides. Notably, the royalties exclude famous tracks like “All Star” by Smash Mouth.

Public's Broader Initiative for Alternative Assets and More Services: This move is part of Public’s strategic progression from equities to crypto to alternative assets, such as fine art and venture capital, in an effort to broaden their services as a platform. Public also offers communications and engagement products to Investor Relations Officers.

Trend in Music Royalties: Investing in music royalties is not a new concept, but the majority of investment has traditionally come from institutional investors like hedge funds. Public is one of the first to offer fractionalized music royalty investing for individual investors. The demand for music royalties has surged with the growth of streaming. In 2022, U.S. recorded-music revenue increased by 6% to $15.9 billion, 84% of which came from streaming.

Financial Considerations and Future Plans: While music royalties can provide steady income, their attractiveness can vary with the broader financial environment. For example, shares of Hipgnosis Songs Fund, which owns rights to songs from artists like Shakira, have declined recently. Income from royalties can also decrease as songs lose popularity. Public, however, sees the "Shrek" catalog as a lucrative option given its history of substantial payouts. The platform intends to add more music-rights securities and other alternative assets for its customers in the future.

Robinhood-owned Say Launches Shareholder Messaging (Axios)

New Messaging Feature: Say Technologies, owned by Robinhood, introduced a feature allowing public companies to send customized messages to retail investors and receive responses. This facilitates direct communication between companies and their shareholders.

Emerging Trend: With a predicted rise in individual investors dominating global investments by 2030, there's a growing need for diverse, virtual, and interactive communication methods. Trading platforms, like Robinhood, Public and WeBull, are creating avenues for companies to connect directly with shareholders.

Business Model: Approximately 50 companies currently pay Say, with the fee determined by their engagement level with verified shareholders. While the platform already offers features like Q&A and proxy voting, this new messaging capability aims to strengthen the direct bond between corporations and their investor base.

Retail Investors' Role: Alexander Lebow, Say Technologies' CEO, believes retail investors are generally more supportive of management. Engaging this group could rally them against activist proposals, offering a strategic advantage to companies.

Comprehensive Platform: Say's integrated platform, which combines voting and messaging, has been effective in encouraging retail voting. This unified approach is deemed by Lebow as the "Holy Grail of retail engagement."

Conclusion

The rapidly shifting terrain of capital markets is seeing pronounced changes, from the proposed 'Open Banking' regulations to the potential impacts of predictive data analytics on investor interests. As these transitions unfold, we observe the strategic responses of financial institutions, from Fidelity and PNC's backing of Akoya to control data sharing to Public’s innovative approach of offering investments in 'Shrek' music rights. Additionally, platforms like Robinhood's Say Technologies are monetizing direct communication between companies and retail investors, highlighting the increasing role and power of these individual shareholders.

In the midst of these evolving dynamics, Stakeholder Labs maintains a steadfast position: shareholders should control their own data and have full transparency on who they share it with. The emergence of varied engagement platforms and software requirements raises a pivotal question for the future—how will Investor Relations Officers navigate and prioritize these myriad tools to reach their own shareholders? We advocate for the strengthening of direct relationships with shareholders through a company’s owned and operated web properties and experiences, leveraging our software Roundtable to enable these direct connections in the background. In this transformative era, it's imperative to ensure that individual investors not only have a voice but that their data and interests are protected and prioritized.