Investor Relations in the Digital Age

What IR teams can learn from Dumb Money’s 'Roaring Kitty' about engaging retail shareholders

Thanks to all for your comments, feedback and reshares on last week’s post about Dumb Money. If there is one clear takeaway from the film is that today's global markets are deeply influenced by social media, online communities, and public discourse. But for investor relations professionals accustomed to traditional paradigms, it begs the question, "How do we adapt in this new age?" To answer this question, let's delve into what made Keith Gill, aka 'Roaring Kitty', such an engaging figure during the 'meme stock' surge:

Mastery in Communication: Keith's day job at MassMutual crafting educational content for perspective clients sharpened his ability to resonate with everyday individuals, especially in the digital realm.

Genuine Connection: 'Roaring Kitty', Keith Gill's online persona, was born out of his genuine enthusiasm for stocks. His early, viewer-less YouTube days underscore the importance of authenticity in community-building, whether for one or a million viewers. He also truly believed GameStop was an undervalued stock when he purchased it after conducting thorough due diligence.

Consistent Engagement: Regardless of market turbulence during the initial 2020-2021 run-up, Keith remained an active voice, sharing updates and reactions. Many 'meme stock' enthusiasts turned to him to gauge the market pulse, illustrating the value of direct, proactive engagement.

People-Centric Approach: Keith's passion for educating his followers cultivated mutual respect and loyalty, emphasizing the significance of leaders truly valuing their stakeholders.

In this week's Roundtable Roundup, we explore recent examples of companies taking a page out of the ‘Roaring Kitty’ engagement playbook as well as other news impacting investor relations professionals and our capital markets.

Interactive Investor sends open letter to UK PLC (Interactive Investor)

Interactive Investor’s Initiative: The UK's second-largest investment platform, interactive investor (ii), sent a 'Dear CEO' letter to FTSE 100 chairs and the top 20 investment trusts on its platform by value. ii is set to launch an ‘AGM Experience’ scorecard to gauge how effectively these entities engage with private investors surrounding AGMs (Annual General Meetings).

Focus on Clear Communication: ii emphasizes that shareholder communications should be in 'plain English'. The company believes clearer communication will enhance shareholder engagement and will spotlight entities that need to improve their communication practices.

Research Partnership: The scorecard's methodology is a collaborative effort between ii and financial services consultancy, the lang cat. It has been vetted for relevance and fairness by ShareSoc and the UK Shareholders Association. The scorecard will regularly highlight both good practices and areas for improvement.

AGM Experience Criteria: Companies will be evaluated based on transparency, communication quality, user experience, and going beyond basic requirements. This includes clarity in notifications, meeting details, pre-AGM instructions, engagement with end-investors, and accessibility for in-person and virtual meetings.

US Leaders in Retail Shareholder Communication

Coinbase: COIN 0.00%↑ “Ask Us Anything” on Reddit over the course of three days in their lead up to their direct listing.

Block: SQ 0.00%↑ retail shareholder friendly Investor Presentation

Selina: SLNA 0.00%↑ partnered with IR firm Equity Animal to host a series of interactive Twitter Spaces

Tesla: TSLA 0.00%↑ hosted earnings call and Q&A on Twitter

AMC: AMC 0.00%↑ CEO Adam Aron’s direct communication style with retail shareholders

Netflix: NFLX 0.00%↑ IR YouTube Channel

AMC may launch branded wine, named in honor of 'Ape' retail investors (Morningstar)

AMC's Branded Product Push: AMC is exploring the possibility of selling AMC-branded wine, possibly named 'Chateau Simian' or 'Saint Simian', in tribute to its retail investors who call themselves "apes" or "ape nation". This follows AMC's recent venture into branded products, including a popcorn partnership with Walmart and a plan to launch its branded gourmet candy line.

Popcorn Partnership Success: AMC's branded popcorn, both ready-to-eat and microwave-at-home versions, have seen robust sales at Walmart, with CEO Adam Aron indicating that the popcorn business could potentially generate $100 million annually for AMC. The company is looking to further expand this partnership to other grocery chains.

Financial Maneuvers & Challenges: AMC made a $27.9-million investment in Hycroft Mining Holding Corp last year and attempted to address its significant debt by launching AMC Preferred Equity units. The company recently underwent a 1-for-10 reverse stock split and converted its AMC Preferred Equity units to common stock. Despite raising approximately $325.5 million through its equity offering, CEO Aron has been candid about the company's liquidity concerns.

Stock Performance & Investor Sentiment: AMC's stock has experienced significant volatility, with a decline of 69.6% in the past month. Despite this, it closed up 2.7% at the end of the reported Friday session. Aron has been actively engaging with shareholders on Twitter, noting a mix of positive and negative sentiments from the community. AMC's transformation from a pandemic-hit business to a meme-stock favorite has been dramatic, leveraging the sharp rise in its stock price in early 2021 to raise $917 million.

Reddit Is No Longer the “Weird” Social Media. It’s Also Not Quite Normal (The Ringer)

Reddit Evolution: Once known for controversial topics and "culture war" discussions, Reddit has transitioned from being the "weird" social media to a mainstream platform that plays host to celebrity AMAs, refined search queries, and a plethora of niche subreddits.

GameStop Phenomenon: Reddit users on r/wallstreetbets played a significant role in driving up GameStop's stock price in January 2021, resulting in massive losses for several short sellers and highlighting the platform's power to mobilize and disrupt traditional financial systems.

Platform Changes: As Reddit inches towards a much-anticipated IPO, there's been a noticeable push towards profitability and respectability. This shift includes implementing usage caps, pricing plans for previously free APIs, and moderating controversial subreddits more aggressively, which has sparked protests from the platform's user base.

Challenges of Growth: As with other platforms, Reddit faces the delicate balance of expanding its reach and profitability without compromising the very essence that made it unique. Despite these challenges, it remains a strong community-driven platform, showcasing the potential of collective online action.

Impact of the COVID-19 pandemic on the stock market and investor online word of mouth (Decision Support Systems)

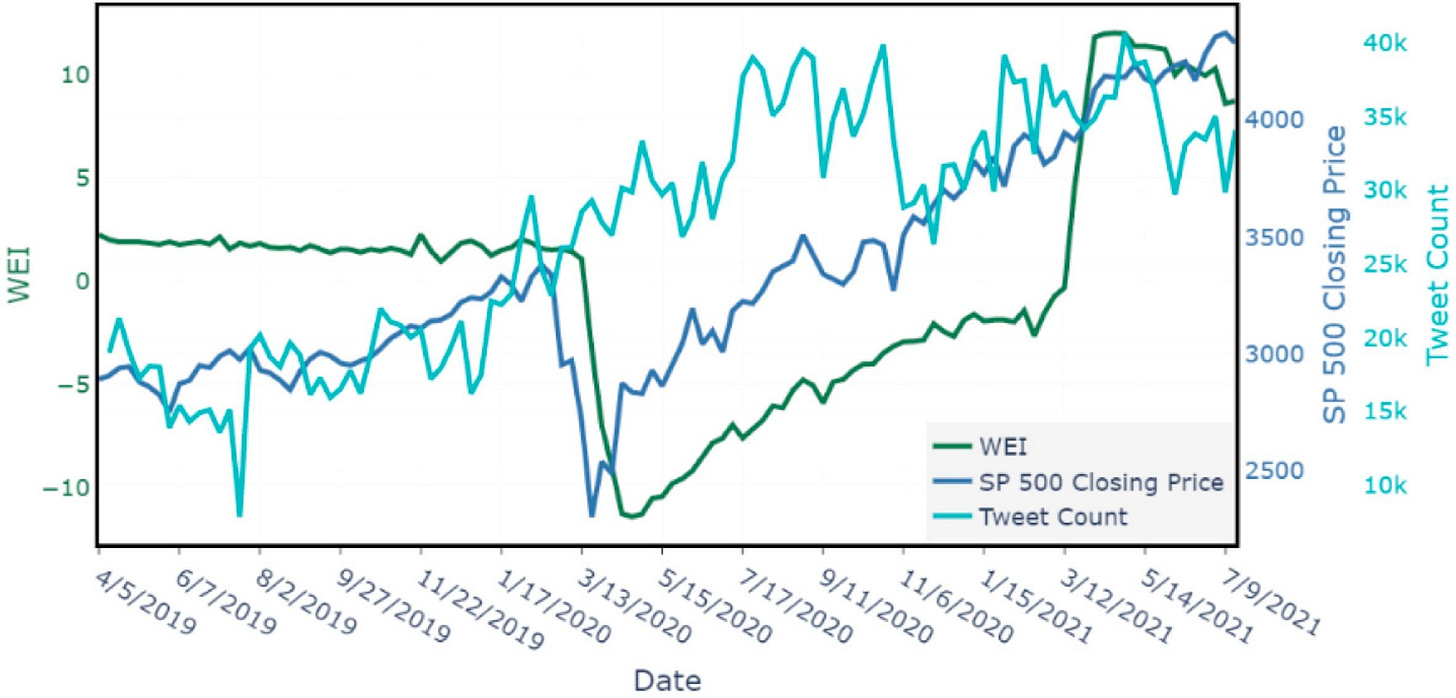

Introduction: This study, conducted by Professors Li, Srinivasan and Lash of the University of Kansas as well as Professor Zhu of Towson University, hones in on the correlation between stock market performance (with a spotlight on the S&P 500 index return) and information derived from social media word of mouth “WoM”. Data from millions of tweets were examined across three distinct phases: pre-COVID, peak-COVID, and recovery.

Key Findings:

Sentiment Analysis during Different Phases: Bullishness and Agreement sentiments displayed reduced predictability for future market returns during both peak-COVID and recovery periods in comparison to pre-COVID times. Furthermore, the peak-COVID period exhibited the highest adjusted R^2 in the day-ahead predictive model, suggesting possible market overreactions.

Latent Topic Analysis: Latent topics, indicative of investors' discussion trends, were extracted and analyzed. The study used an ensemble feature selection method to identify the most predictive topics for each phase. Notably, the topics that predicted stock returns varied considerably between the three periods. Predictive accuracy was notably higher during the peak-COVID phase, whereas during the recovery period, this influence waned.

Contributions and Implications: This research fills a gap in decision support systems literature by offering insights into financial markets during a major crisis. It underscores the importance of versatile prediction models which can adapt to varying market conditions. Practical takeaways for investors and policymakers include the suggestion to:

Reconsider Social Media Sentiment: Disregard social media sentiments like Bullishness and Agreement during periods of significant upheaval.

Adapt Forecasting Models: Regularly update and adjust market forecasting models to respond to evolving situations.

Pay Attention to Emerging Topics: Keep an eye on subjects like vaccinations, lockdown measures, or businesses heavily affected by physical footfall as these might impact short-term market conditions.

Leverage Extrinsic Signals: Utilize external indicators, like topic trends on social media, to fine-tune prediction models.

Limitations and Future Work:

Scope of the Study: The research centered around stock market returns, but future studies could delve into other metrics like volatility or trading volume.

Latent Topic Extraction: Despite rigorous tests, the inherent imprecision of topic extraction methods could limit the study's generalizability.

Causality vs. Predictability: The study primarily sought to understand predictability and not causality. Upcoming research could endeavor to unravel specific causal relationships between social media WoM and stock market trends.

California Governor to Sign Landmark Climate Disclosure Bill (NY Times)

Landmark Climate Disclosure Bill: Gov. Gavin Newsom of California announced his intention to sign a significant climate bill, requiring around 5,000 major companies to publicly disclose both direct and indirect greenhouse gas emissions. This applies to public and private businesses operating in California that earn more than $1 billion annually and the law is poised transform the environment disclosure processes globally.

National & Global Implications: Given California's status as the world's fifth-largest economy, the state's policies often set precedents for the rest of the U.S. and influence global corporations. The legislation seeks to harness financial markets to address climate change by making investors aware of a company's environmental impact, potentially impacting their investment decisions.

Business Concerns & Opposition: The California Chamber of Commerce and other opponents argue that compliance will be expensive and burdensome. They believe this mandate will negatively affect businesses of varying sizes in California and won't directly reduce emissions. Specific industries, like clothing manufacturers, express concerns about the extensive emissions tracking required, from raw material sourcing to final production.

Complementary Legislation & Broader Impact: Alongside this bill, another law will mandate companies with revenues exceeding $500 million to report climate-related risks, although they won't have to specify their emissions. This California legislation is more comprehensive than a proposed rule by the Securities and Exchange Commission and has both received praise from climate advocates and faced opposition from business groups.