🗞 News Roundup - New Frontiers

AI in Earnings Calls, Evolving Investor Trends, and the Quest for Authenticity

As December unfolds, bringing 2023 to a close, we reflect on a year that has been full of significant shifts and challenges in the financial and corporate world. Our latest Roundtable Roundup explores some of the key trends and developments that have helped defined this year.

Key highlights:

Use of AI in finance for deeper analysis

The ongoing enthusiasm of retail investors in the stock market

The cultural significance of the word 'authentic'

The rise of international investors in US leveraged ETFs

The growing influence of retail shareholders in proxy voting

Investors use AI to glean signals behind executives’ soothing words (Financial Times)

AI in Voice Analysis for Investment Insights: Investors are increasingly using AI not only to analyze written transcripts of executives' speeches (Natural Language Processing or NLP) but also to examine audio recordings for signs of executives' true emotions. Tools like Speech Craft Analytics can detect subtle changes in speech, such as hesitation, pitch, and filler words, which might indicate anxiety or tension, offering deeper insights than text alone.

Impact on Investment Strategies: This advanced level of analysis is being integrated into investment strategies. For example, Robeco, managing over $80 billion in algorithmically driven funds, has begun incorporating AI-detected audio signals into its investment processes. This has reportedly improved returns, suggesting a growing trend among investors to utilize such sophisticated techniques.

Challenges and Limitations: Despite its potential, voice analysis in investment comes with challenges. It requires careful consideration to avoid biases (like those based on gender, class, or race) and may not be equally effective for non-native speakers or across different languages. Additionally, there's a risk that companies may start coaching executives to control their voice tones to circumvent such analysis, similar to how they've adapted to text analysis.

Regulatory and Ethical Considerations: The increasing use of AI in voice and text analysis for investment purposes raises questions about ethical and regulatory implications. As AI becomes more embedded in financial analysis, firms must navigate these technologies responsibly, ensuring they don't inadvertently introduce biases or unfair practices into their investment strategies.

Americans would love to see stocks in Santa's bag this year (Yahoo Finance)

Growing Interest in Stock Gifts: According to a Yahoo Finance/Ipsos poll, about 70% of Americans would be happy to receive stocks or other investments as holiday gifts. This trend reflects a shift in gift preferences, with investments being seen as valuable and desirable presents, especially in a year when markets have shown strong performance.

Investments for Future Security and Wealth Building: The poll indicates diverse reasons behind this preference. 61% of respondents want investments to save for the future, 54% view them as a means to build wealth, and 23% aim to use them to beat inflation. This demonstrates a growing awareness of the long-term benefits of investing.

Income Disparity in Investment Preferences: There's a noticeable difference in investment preferences based on income levels. 74% of higher-income households (earning over $100,000) are excited about receiving investments as gifts, compared to 58% of those earning under $50,000. This disparity highlights varying financial priorities and capabilities across different income groups.

Market Performance and Investor Sentiment: The recent rally in major indexes like the Dow Jones, Nasdaq, and S&P 500, with significant year-to-date increases in stocks of major companies like Microsoft, Amazon, and Nvidia, has fueled interest and optimism in stock gifts. However, experts caution that the market's future trajectory is uncertain, with factors like interest rates and political events potentially impacting performance.

What’s Merriam-Webster’s word of the year for 2023? Hint: Be true to yourself (AP News)

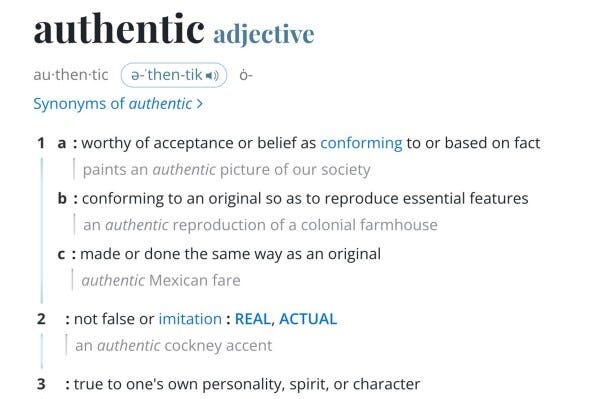

Authentic" is Merriam-Webster's Word of the Year: For 2023, Merriam-Webster has chosen "authentic" as its word of the year. This reflects a broader societal focus on authenticity in various domains, including personal expression, art, and technology. The selection highlights how people increasingly value and question authenticity in an era marked by technological advancements and societal shifts.

Increased Interest in Authenticity: Throughout the year, there was a consistent rise in lookups for "authentic" on Merriam-Webster's website, indicating a heightened interest in understanding and defining what constitutes authenticity. This trend is seen against a backdrop of developments in artificial intelligence, celebrity actions, and social media discourse emphasizing the importance of being genuine and true to oneself.

Authenticity in a Digital and AI-Driven Age: The choice of "authentic" as the word of the year underscores the challenges and discussions around trust and reality in a digital age, where AI, deepfakes, and online personas complicate perceptions of truth and authenticity. It reflects the growing societal concern about distinguishing what is real and genuine in a world increasingly mediated by technology.

Context of Other Popular Words: The selection of "authentic" follows the 2022 word of the year, "gaslighting," and marks Merriam-Webster's 20th anniversary of choosing a top word. Other words that saw unusual traffic in 2023 and were considered for the title include "X," "EGOT," and "Elemental," indicating diverse cultural and technological influences on language and public interest.

Korea’s Retail-Trading Army Is Going All-In on US Leveraged ETFs (Bloomberg)

South Korean Retail Investors Favor US Leveraged ETFs: South Korean retail investors are increasingly investing in leveraged exchange-traded funds (ETFs) listed in the US. They hold significant stakes in ETFs that offer magnified bets on companies like Tesla and sectors like tech and chip stocks. For instance, they own 35% of a Tesla-focused ETF and 28% of a tech-oriented ETF.

High Interest in High-Risk Investments: This trend is driven by a combination of factors, including South Korea's insufficient pension system, high living costs, and a general preference for high-risk investments. Leveraged ETFs, which can amplify returns and losses, are particularly appealing because they promise substantial returns from small initial investments.

Risky Strategies for Financial Gains: Many Korean investors are drawn to leveraged ETFs as a strategy to achieve quicker financial wealth. This approach is seen in the story of Lim DongSeob, who invests heavily in SOXL (Direxion Daily Semiconductors Bull 3x Shares) to spend more time with his family, and James Jeong, who aims to accelerate his path to riches by investing in leveraged bets on the Nasdaq 100 Index.

Volatility and Potential Risks: While leveraged ETFs have provided significant gains, such as SOXL's 140% increase this year, they also come with high risks, as evidenced by SOXL's 86% tumble in 2022 and its current status 70% below its record high. Another popular ETF among Korean investors, the Direxion Daily 20+ Year Treasury Bull 3x Shares (TMF), has seen a 30% slump this year. This underscores the volatility and potential financial risks associated with these high-leverage investment products.

2023 Proxy Season Review (Harvard Law School Forum on Corporate Governance)

Declining Shareholder Support: In the 2023 proxy season, shareholder support for both management and shareholder proposals reached its lowest level in five years. This decline is attributed to lower market valuations and a decrease in support for Environmental, Social, and Governance (ESG) proposals, as companies have become more proactive and transparent in these areas.

Increased Expectations and Decreased Support: There's been an increase in expectations from directors, with a record number failing to attain majority support. Similarly, support for Say-on-Pay proposals has also declined, hitting the lowest average level of support in five years. Meanwhile, the number of shareholder proposals increased, but their support decreased significantly.

Shifts in ESG and Political Spending Proposals: Support for ESG-related proposals has cooled, with the lowest average support in five years. The same trend is observed in corporate political spending proposals, where support has declined markedly.

Rising Retail Investor Participation: Retail share ownership and voting participation have seen a notable increase. Retail investors now hold a higher percentage of shares than in the past five years, and their voting participation has also slightly increased, contrasting with a decline in voting participation by smaller institutional investors.

Hundreds of Stocks Have Fallen Below $1. They’re Still Listed on Nasdaq (Wall Street Journal)

Surge in Sub-$1 Stocks: There has been a significant increase in stocks trading below $1 on U.S. exchanges, rising from fewer than a dozen in early 2021 to 557 as of recently. The majority are listed on the Nasdaq, which requires a minimum share price of $1 to avoid delisting.

Regulatory Challenges and Compliance Strategies: These sub-$1 stocks, often from small, high-risk companies, are straining Nasdaq's listing rules. Nasdaq allows companies with shares below $1 to stay listed for over a year before delisting. This situation has led to a large number of Nasdaq-listed companies (about one in six) not complying with the exchange’s rules.

Reverse Stock Splits as a Remedy: To counter the risk of delisting, many companies are resorting to reverse stock splits, a process where companies consolidate shares to increase the stock price. This practice has surged in 2023, with 255 reverse splits compared to 159 last year.

Investor Concerns and Market Integrity: The increase in sub-$1 stocks, especially on Nasdaq, raises concerns about market integrity and investor protection. There's a heightened risk of catastrophic losses for investors in these stocks, underscoring the need for careful investment consideration in such volatile assets.

As 2023 wraps up, it's been a year full of big changes and new challenges. As this Roundtable Roundup highlights, we've seen everything from AI making big waves in finance, to new trends in investing driven by retail investors and shifts in culture. All these trends show just how technology, market forces, and societal values are all intertwined. As we say goodbye to this eventful year, we're also gearing up for more innovations and opportunities in 2024. Our next Roundtable Roundup will review predictions from across IR and capital markets heading into 2024.