The Reddit IPO, Disney's Proxy Battle and Retail Investor News

PLUS Celsius Holdings ($CELH) CEO John Fieldly joins this week's After Earnings

In this edition of Roundtable Roundup, we're bringing you a collection of stories from the forefront of business and investor relations. From Reddit's groundbreaking IPO that's catching the eye of its own user base, to George Lucas rallying behind Disney amidst a gripping proxy battle, these narratives are shaping the future of corporate engagement and market dynamics. We also highlight the undeniable power of retail investors in today's market, a trend that's reshaping company and IR strategies. Also, don’t miss this week’s episode of After Earnings with Celsius Holdings CEO John Fieldly who breaks down the energy drink company’s turnaround story and meteoric rise since their last earnings call.

They’re Reddit Die-Hards. Do They Want to Be Shareholders, Too?(WSJ)

Reddit's IPO stands out for offering shares directly to its users, aiming to raise up to $748 million, with a valuation goal of up to $6.4 blillion, a notable decrease from a previous $10 billion valuation.

Kevin Xu, a successful day-trader and former Google employee, is set to invest in Reddit's IPO, motivated by his personal success story linked to the platform.

The article discusses the potential risks for small investors participating in IPOs, highlighting Reddit's unique approach and the concerns about immediate selling by individual investors, which could impact stock stability.

Various Reddit users express mixed feelings about investing in the IPO, showcasing a range of perspectives from enthusiasm and support to skepticism and caution about the platform's future stock performance.

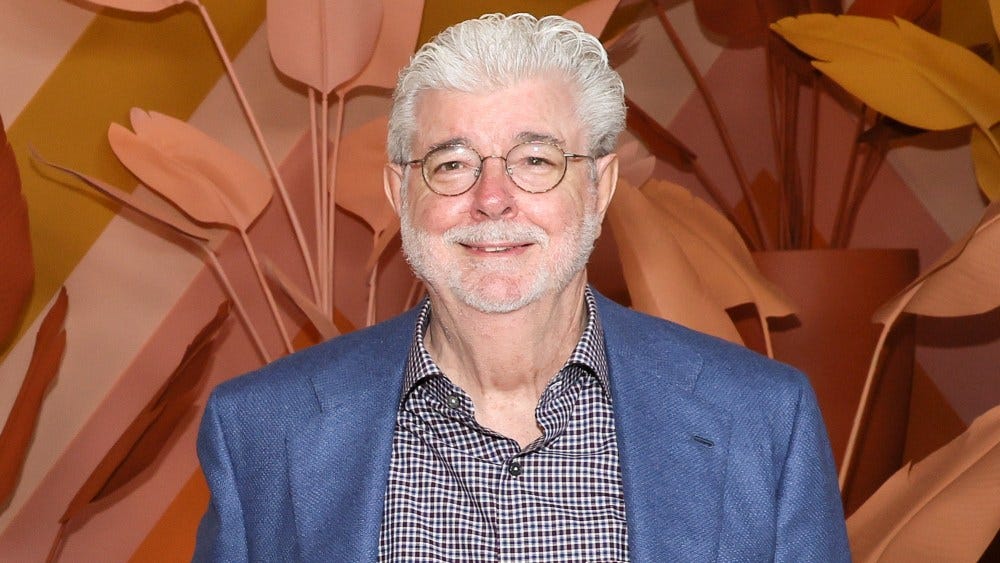

George Lucas Backs Disney Board and CEO Bob Iger Amid Proxy Fight: ‘Creating Magic Is Not for Amateurs’ (Variety)

George Lucas, Disney's largest individual shareholder, supports the current Disney board and CEO Bob Iger, urging shareholders to reject activist investor bids for board seats.

Lucas's support is rooted in his long-term admiration for Disney and confidence in Iger's leadership, especially highlighting Iger's role in acquiring Lucasfilm in 2012.

Disney faces a challenge at its 2024 annual shareholders meeting with rival board candidate slates from Nelson Peltz’s Trian Partners and Blackwells Capital.

Lucas criticizes the lack of media experience in activist investor proposals, emphasizing that creating Disney's magic requires expertise.

Disney and its supporters, including Lucas, argue against the activist investors, emphasizing the current board's depth of talent and strategic direction.

The Power Of The Retail Investor (Forbes Council)

Retail trading peaked in 2023, showing the significant influence of retail investors beyond the meme stock phenomenon, with a notable surge in median net worth and stock market participation.

Technological advancements in fintech, such as fractional shares and mobile brokerages, have lowered investment barriers, increasing direct stock ownership significantly.

Retail investors significantly impact public companies, influencing stock prices through collective actions like boycotts or short selling, driven by social media and investment platforms.

Although private companies are less affected by retail investors due to access limitations and lack of public trading, the growing secondary market and investor sentiment are becoming more influential, especially for those aiming for IPOs.

Investors shun social media advice for independent financial media after meme stock saga (Yahoo! Finance)

A significant portion of retail investors are moving away from social media for investment advice, with 42% using it "significantly less" for investing decisions.

Despite past trends, social media now ranks low in trust for investment information, with investors favoring independent trade and financial media.

Retail investors remain interested in financial advice, showing a shift towards seeking reliable, educational content over social media-driven strategies.

While cautious about AI and cryptocurrency trends, a majority are optimistic about global stock markets, planning to invest in stocks and exchange-traded funds (ETFs).

AMC Retail Shareholders Shows Lack of Long Term Commitment, Says This Wall Street Expert (The Street)

AMC's stock is now primarily held by retail investors, known as "Apes," who continue to support the company despite its stock devaluation.

Analyst Mike Hickey describes AMC's valuation as "exceedingly high" but acknowledges the company's strong Q4 2023 results, maintaining a neutral stock recommendation.

Retail investors' dominance in AMC's ownership structure has led to significant short squeezes, with CEO Adam Aron stating they hold 90% of the float.

Concerns among these investors about potential trading irregularities have been voiced, with AMC appearing on the securities threshold list, indicating possible illicit activities like naked shorting.

The sustained support from retail investors has been crucial for AMC, enabling the company to avoid bankruptcy and strengthen its financial position post-pandemic.

After Earnings with Celsius Holdings ($CELH) CEO John Fieldly

In this week’s episode of After Earnings, we spotlighted Celsius Holdings CELH 0.00%↑ , a brand that's truly heating up the market with its innovative, health-conscious energy drinks. Amidst a rapidly evolving beverage industry, Celsius has carved out a significant niche, captivating health-focused consumers worldwide. CEO John Fieldly’s recent appearance on After Earnings offered a fascinating glimpse into the strategies fueling their explosive growth and market momentum, making it a segment we were particularly excited to feature.

Highlights:

00:00 START

03:11 Celsius’ growth story

06:26 Selecting which sports brands and personalities to partner with

10:56 How Celsius was able to capitalize on the “living fit” trend successfully

13:02 The process of product development

17:00 Growth levers from Pepsi’s $550M investment

23:45 Pricing strategy for entering new markets

26:10 Stepping in as Celsius’ new CEO

33:04 Deepening the relationship with retail investors