What Retail Investors Are Thinking

PLUS retail's impact on corporate governance, social media IPOs and a new After Earnings episode with Redwire Space CEO Peter Cannito

In this week's edition of the Roundtable Roundup, we examine the surge in participation from younger and female demographics, signaling a shift towards a more inclusive and diverse retail investing landscape. We highlight the renewed interest in meme stocks, Reddit's IPO and Truth Social which shows the continued appeal of speculative investments, driven by social media and community trading platforms. We also summarize a new research paper around zero-commission trading and its effects on corporate governance, emphasizing the need for engaging communication with this expanding rapidly investor base. Robinhood announced a 3% cash back credit card in an effort to become the primary financial institution of their customers, and don’t miss this week’s episode of After Earnings with Redwire Space’s CEO Peter Cannito as he shares the company’s strategic approach towards the Space industry.

What retail investors are thinking (eToro)

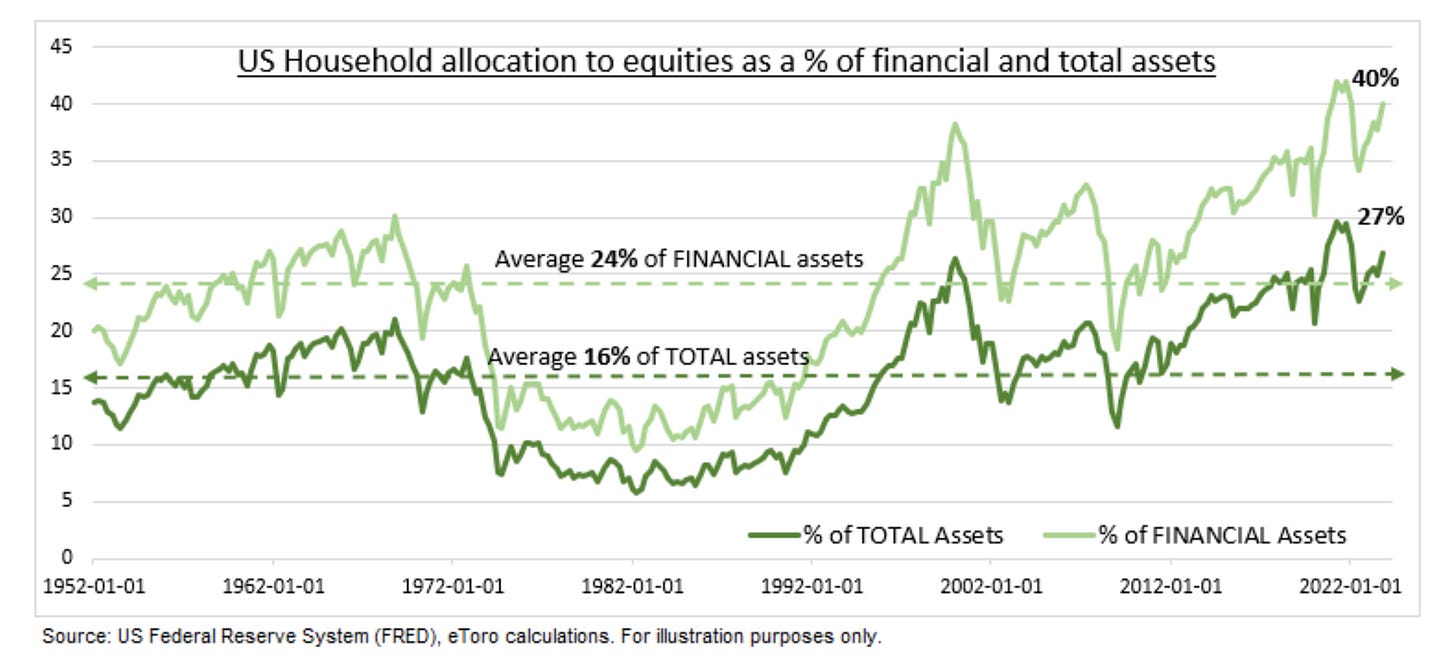

Rapid Growth in Retail Investment: The number of retail investors has increased significantly, led by younger and female investors. They now own nearly one-third of all US stocks, with over a quarter of household assets in shares, nearing a record high.

Shift in Investment Preferences: Retail investors have shown loyalty to big tech, AI, and crypto assets. However, many are planning to rebalance towards cheaper and overseas assets in anticipation of rate cuts, indicating a strategic shift in their investment approach.

Influence of Rate Cuts and Sector Preferences: With rate cuts on the horizon, 53% of investors are planning to rebalance their portfolios, with a focus on equity investments and dividend stocks. The banking and real estate sectors emerge as preferred areas after tech, highlighting a nuanced understanding of market dynamics.

Politics Playing a Role in Investment Decisions: In a significant election year, nearly half of the investors are considering their political views when making investment choices, with geopolitics becoming a top concern. This indicates a blurring of lines between political beliefs and investment strategies.

Retail investors host meme stock party in face of high rates (Bloomberg)

Renewed Retail Investor Enthusiasm: Retail investors have reignited their interest in meme stocks, propelled by optimistic signals from the Federal Reserve, anticipated earnings from GameStop Corp., and high stock valuations. This enthusiasm has led to a significant increase in options volume, particularly in call options, signaling expectations for continued market rallies.

High Activity in Specific Stocks: Shares of Reddit Inc. surged following its successful IPO, and other familiar stocks like GameStop and Bitcoin also saw substantial increases. The 15% rise in GameStop shares and the surge in Bitcoin highlight the continued appeal of meme stocks and cryptocurrencies among day traders.

Institutional Caution vs. Retail Optimism: While the S&P 500 Index has been hitting new highs, institutional traders have shown a modest increase in demand for put options, signaling a growing skepticism about further gains. In contrast, retail traders are doubling down, viewing stretched valuations as an opportunity to go all-in, especially in the shares of companies popular on platforms like Wall Street Bets.

Options Trading as a Speculation Tool: The spike in options trading, especially among retail investors, underscores the speculative nature of the current market dynamics. Retail traders are leveraging options as a low-risk, high-reward strategy, reflecting a broader trend of speculative investment that challenges the Federal Reserve's efforts to temper such activities.

Retail investors and corporate governance: evidence from zero-commission trading (Aggarwal, Choi, Lee)

Zero-Commission Trading's Impact on Retail Investment: The abolition of trading commissions led to a pronounced increase in retail investor participation. Specifically, the study documents a significant "increase in retail ownership," highlighting the shift towards a more democratized stock market access post-2019. Firms already popular among retail investors before the abolition saw "a steady rise in non-institutional ownership in the years immediately after" the introduction of zero-commission trading.

Decreased Shareholder Voting Participation: Accompanying the increase in retail ownership was a notable decrease in shareholder voting participation. The research found a "significant jump in non-voting after the introduction of zero-commission trading," indicating a reduced engagement in corporate governance among the new wave of retail investors, which traditionally had been an area of active participation by institutional investors.

Deterioration in Corporate Governance and ESG Scores: The shift towards greater retail ownership correlated with a deterioration in corporate governance, as evidenced by declining ESG scores. This decline was "concentrated in the governance component," with firms experiencing a drop in their governance scores post-2019. This suggests that the influx of retail investors, who typically exert less pressure on companies regarding governance practices, contributed to a decrease in governance quality.

Adaptation of Corporate Bylaws: Faced with a changing investor base and lower voting participation rates, companies adapted by amending their bylaws, particularly around quorum requirements for shareholder meetings. The study notes an "explosion in the number of firms making their quorum requirements laxer," with a significant number of companies decreasing the percentage of shares required for a quorum post-2019. This move was a direct response to the anticipated challenges in achieving quorum due to the decreased likelihood of retail investor participation in voting.

Trump’s Truth Social is now a public company. Experts warn its multibillion-dollar valuation defies logic (CNN)

Public Debut and Initial Surge: Trump Media & Technology Group started trading under the ticker "DJT," experiencing a remarkable 56% surge at the open to $78, before stabilizing around $70 and then closing at $57.99, marking a 16% increase by the day's end.

Market Valuation Concerns: Despite closing at $57.99, Trump Media was given an "eye-popping valuation of nearly $11 billion" by Wall Street. Experts, including finance professor Jay Ritter, consider this valuation "untethered to reality," suggesting a fair value closer to $2 per share, significantly lower than its closing price.

Comparison to Other Companies: Trump Media's $11 billion valuation starkly contrasts with its financial performance, generating just $3.4 million in revenue with a $49 million loss over nine months. This valuation is notably high when compared to Reddit, which was valued at $6.4 billion despite having 160 times more revenue.

Risks and Future Outlook: The future of Trump Media is heavily tied to Donald Trump himself, facing risks from his legal challenges and the potential impact on the company's reputation and operational stability. The company's success might hinge on the political climate, particularly the 2024 presidential election's outcome, making its stock price volatile and speculative.

Robinhood launches 3% cash back credit card (Axios)

Launch of Robinhood Gold Card: Robinhood introduced the Robinhood Gold Card, offering 3% cash back on all purchases, during its first product keynote event. This move marks the trading firm's entry into the competitive credit card market, aiming to attract more users to its suite of financial services.

Card Benefits and Membership Requirements: The card has no annual fee but requires a Robinhood Gold membership at $5 per month or $50 annually. Benefits include no foreign transaction fees, the ability to create virtual and one-time use cards, and the option to add up to five family members with set spending limits. Robinhood Gold members also receive a 5% APY on uninvested cash and a 3% match on retirement IRA contributions.

Unique Offering and Approval Process: In an effort to entice users, Robinhood is offering a 10k gold version of the card to the first 5,000 users who successfully refer 10 friends. Unlike other companies, Robinhood will independently assess credit card applicants, focusing on a holistic view of credit scores and income, diverging from models where underwriting is outsourced, as seen with the Apple credit card issued by Goldman Sachs.

Strategic Vision for Customer Engagement: CEO Vlad Tenev expressed that the overarching goal is to establish Robinhood as the primary financial institution for its customers, envisioning a future where users custody all assets and conduct all financial transactions through Robinhood. This strategy reflects a significant ambition to deepen customer engagement and broaden the firm's financial ecosystem.

Retail investors are hungry for Reddit options trading, Public CEO says (CNBC)

Strong Market Debut: Reddit's shares had a notable entrance into the public markets, with their value surging 48% from the initial pricing of $34 to close above $50 a share. This significant rise highlights the high level of investor enthusiasm surrounding the social media platform's stock debut.

High Demand Among Young Investors: The investing app Public, known for its popularity among younger investors, witnessed exceptional demand for Reddit shares. Despite the stock only being available for trading for less than half a day, it became "the most bought stock of the day" on the platform, indicating strong interest and anticipation among its user base.

Anticipation for Options Trading: The announcement that Nasdaq plans to list Reddit options for trading is seen as a potential second catalyst for the stock. Options trading, which is notably popular among members of the Reddit investing community r/Wallstreetbets, could drive further activity and interest in Reddit's stock. Public.com's CEO noted a high volume of inquiries from options traders eager to engage with Reddit's stock through both calls and puts.

Speculation on Future Trading Activity: The introduction of options trading for Reddit's stock has led to widespread speculation about the future direction of its trading activity. Investors are keenly interested in whether the trend will lean towards buying calls, betting on the stock's further rise, or puts, speculating on a decline. This uncertainty underscores the stock's potentially volatile trading landscape in the near future.

After Earnings enters Spotify’s Top 15 in the Business category 🎊

Thank you to everyone who has checked out After Earnings! We’re thrilled to see the response so far and we really appreciate the thoughtful feedback we have received.

This Week on After Earnings - Redwire Space: Lunar Dominance, Microgravity Drugs, and Extraterrestrial Life with CEO Peter Cannito

Diverse Revenue Streams and Space Infrastructure: Redwire RDW 0.00%↑ generated nearly a quarter billion dollars in revenue last year by providing essential space infrastructure components, such as solar arrays, avionics, and cameras. Their infrastructure supports a range of missions from the International Space Station to the Artemis Orion mission, demonstrating a broad applicability in both commercial and government sectors.

National Security and Lunar Exploration: The company has seen its national security revenue double, responding to the growing importance of space as a military domain. Redwire plays a significant role in supporting the U.S.'s position in space against adversaries like Russia and China. Additionally, the company is actively involved in projects aimed at establishing a permanent presence on the moon, highlighting the strategic importance of lunar dominance.

Innovation in Microgravity Research: Redwire is pioneering in microgravity drug research and bio-printing technologies in partnership with pharmaceutical giant Eli Lilly. They've developed 'Pillbox,' a facility aboard the ISS for growing highly pure and large crystals for drug development, showcasing the potential of space for advancing pharmaceutical sciences.

Financial Performance and Market Strategy: Despite the lumpiness typical in the space industry's revenue streams, Redwire's strategy of diversifying its product offerings and customer base has led to significant financial growth. The company reported a 52% increase in revenue, with improvements in net income, free cash flow, and adjusted EBITDA. Their approach to balancing proven, revenue-generating products with investment in groundbreaking technologies positions them for sustainable growth.