What Does GEO Mean for Financial Communications and Capital Markets?

How LLMs are re-shaping market narratives and what companies can do about it.

Generative engines like ChatGPT, Claude, Perplexity, Grok, and Gemini are now the first stop for investors, analysts, content creators, and the media.

Andreessen Horowitz recently published How Generative Engine Optimization (GEO) Rewrites the Rules of Search, breaking down the impact of consumer-grade AI tools on marketing. Specifically the disruption of SEO. Generative search engines and GTPs are becoming the new way we discover and trust information online.

For public companies, this shift isn’t just about digital visibility, it’s about share price, investor trust, and market influence. Investors are already using generative tools to get synthesized answers to questions like:

“Show me the energy stocks with the most upside.”

“How were Salesforce’s earnings this quarter?”

“Based on the election, which companies should I invest in?”

“Is Rivian losing money?”

“Should I buy Adobe stock?”

What appears in those answers will increasingly come from LLMs, not links. That means investor relations (IR) and corporate comms teams can no longer rely on traditional playbooks - IR site, SEC filings, press releases, and media outreach to manage their narrative. GEO (Generative Engine Optimization) is now a required competency for finance, comms, and capital markets teams.

What’s GEO, and Why Does It Matter?

GEO is the practice of shaping how large language models (LLMs) interpret and summarize your company, product, executive, etc. In contrast to SEO, which focuses on link rankings, GEO determines what investors see and believe when they ask a generative system for financial insights.

This shift upends traditional IR dynamics:

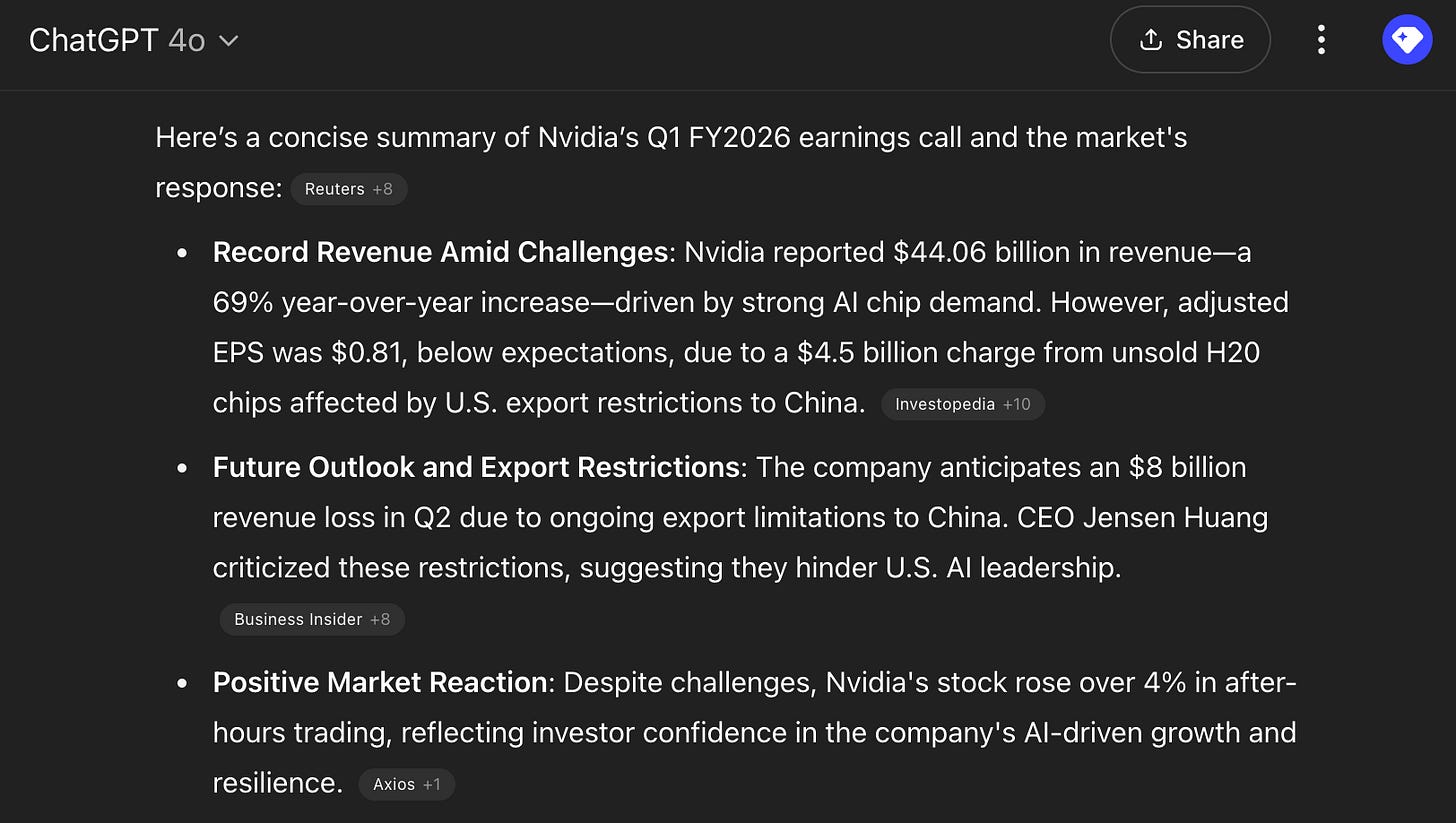

Instead of reading your earnings release, investors may read a chatbot’s summary of it.

Instead of parsing your ESG report, they may ask Claude or FinChat for a one-line answer.

Instead of watching your webcast, they may see your risk factors distilled through an LLM trained on media headlines or outdated filings.

If your official disclosures aren’t structured for discoverability, attribution, and clarity within these systems, they may not appear at all—or worse, be misrepresented by less credible sources.

Why It’s Urgent

Narratives have always moved markets, but GEO changes how and who controls that narrative. Generative platforms are becoming the default way institutional investors, retail traders, analysts, content creators, and journalists gather context. They’re faster than traditional research, and for many users, “good enough” to act on.

This presents both risk and opportunity:

Risk: If inaccurate or incomplete summaries become the first point of contact, it can lead to reputational drag, investor confusion, or volatility in a momentum based market.

Opportunity: Companies that structure and prioritize their communications for generative engines will appear first, clearest, and most accurately—amplifying their intended message.

This isn’t just a comms issue. It’s a capital markets function. The speed and scale at which LLMs distribute financial narratives demands a new layer of IR strategy.

How IR and Corporate Comms Teams Can Adapt

To engage this new interface layer, investor relations and corporate comms teams must reframe their materials not just as disclosures, but as data pipelines for AI systems.

Here’s how to start:

Structure content in Q&A or bullet formats. Generative engines better digest modular, direct inputs.

Use plain, repeatable phrasing for key metrics. Make your earnings and guidance easy to parse and synthesize.

Embed canonical URLs and metadata in your IR content. Help LLMs identify and prioritize your official narrative.

Monitor how your company appears in generative results. Prompt ChatGPT, Claude, or Perplexity with investor-style queries and track hallucinations or inaccuracies.

Prioritize publishing on domains LLMs trust. Syndicating your narrative through credible sources influences what generative models cite.

The rules of visibility have changed. Optimizing for LLMs is now table stakes for investor communications.

What Tools Are Shaping Investor Research?

To succeed at GEO, companies must understand which generative tools investors rely on and how those tools process content. Here’s a quick snapshot of the most influential:

Mass-Market Generative Engines

These platforms are widely used by retail investors, general users, and increasingly institutional researchers. They shape first impressions and often serve as the starting point for investor inquiries.

ChatGPT (OpenAI): Used for earnings breakdowns, strategic summaries, and valuation insights; integrated into Excel and Copilot workflows.

Claude (Anthropic): Excels at parsing long documents like 10-Ks, ESG reports, and transcripts; trusted by analysts for context-heavy queries.

Perplexity.ai: Offers fast, source-cited answers to finance questions; increasingly popular with retail and digitally native investors.

Google Gemini (SGE): Embedded into daily search behavior; casual investors often ask company-related questions here without reaching IR sites.

Grok (xAI / X): Elon Musk–backed generative AI integrated with X (formerly Twitter); used to analyze real-time financial chatter, news, and sentiment. Why it matters: It may synthesize your company's narrative directly from social signals, tweets, and headlines - making social reputation part of generative visibility.

Finance-Specific Research Tools with Generative Layers

These platforms are purpose-built for investors and financial professionals, offering domain-specific interfaces that integrate structured data, transcripts, and AI-enabled discovery.

FinChat: Chat-first financial research tool built for KPI queries, valuation models, earnings synthesis, and quick comparisons.

Koyfin: Combines charting and financial data visualization with natural-language search; widely used by analysts tracking macro and company-level performance.

Quiver Quantitative: Surfaces alternative data like insider trading, congressional activity, and social sentiment; increasingly cited by generative engines.

Quartr: Provides audio, transcripts, and slides from earnings calls; fuels how AI models learn executive tone, phrasing, and disclosure cadence.

Each of these tools plays a role in shaping how your company is discovered, summarized, and judged. In the GEO era, capital markets teams must treat these interfaces like real stakeholders because to many investors, they already are. Each of these platforms is now an invisible gatekeeper between your company and the market’s perception of it.

AI Isn’t Just a Research Layer, It’s Now an Investor Itself

While generative tools are transforming how investors research companies, the next wave is even more consequential: AI systems are starting to allocate capital. Products like Autopilot’s GPT Portfolio are fully AI-managed strategies where large language models help select, evaluate, and rebalance equity positions based on synthesized insights from public information.

This flips the traditional model. Instead of humans using AI for research, AI is now using public narratives to make investment decisions at scale. And that makes GEO a market-moving variable, not just a messaging concern.

Here’s why it matters:

AI portfolios respond to narrative velocity. If your company is frequently summarized in positive or negative terms across LLMs, it could influence position sizing or exclusion.

LLMs can amplify nontraditional signals. AI models might overweight ESG disclosures, executive tone, or social sentiment depending on how content is structured and sourced.

These products scale instantly. Unlike retail investors or analysts, AI portfolios can reallocate based on new summaries or filings the moment they’re indexed.

As more AI-native funds emerge from fintech startups to institutional quant shops your company’s GEO footprint may directly influence whether you’re included, excluded, or over/underweighted. For IR teams, that’s not a future trend. That’s a current exposure.

IR and Corporate Comms in the GEO Era

Investor Relations and Corporate Comms has always been about shaping how the market understands and values your business. GEO doesn’t change that, it just changes the rules of engagement.

Your IR team is now in conversation not only with analysts and shareholders, but also with the AI systems that summarize your company on demand. If your narrative isn’t setup to be encoded into these systems in real-time, you’ve lost control of it.

Stakeholder Labs is helping public companies build for this future by structuring communications that resonate across human and generative stakeholders alike. If you want to know how your company appears in generative systems or how to influence it, we can help.

hello@stakeholderlabs.com

stakeholderlabs.com