Earnings Season Innovation: Digital, Social, and Direct

How Public Companies Are Turning Financial Data into Stories That Resonate

Earnings reports are evolving, and the smartest companies are turning numbers into meaningful engagement. From Duolingo’s AI-powered earnings video to Spotify’s beautifully-designed infographic, companies are finding innovative ways to connect with investors and stand out.

Here are the key trends shaping earnings season, with examples from brands like Cava, e.l.f. Beauty, Blade and Udemy—plus, actionable takeaways you can start applying to your strategy next quarter.

Social Platforms Are Reaching More Investors Than Ever

Companies are sharing their earnings updates on platforms like LinkedIn and X, engaging far larger audiences than traditional earnings calls ever could. These quick, shareable posts make it easy for retail and institutional investors alike to stay informed. Instead of a few hundred people tuning into a live call, tens of thousands are seeing these updates, making them an essential part of any IR strategy.

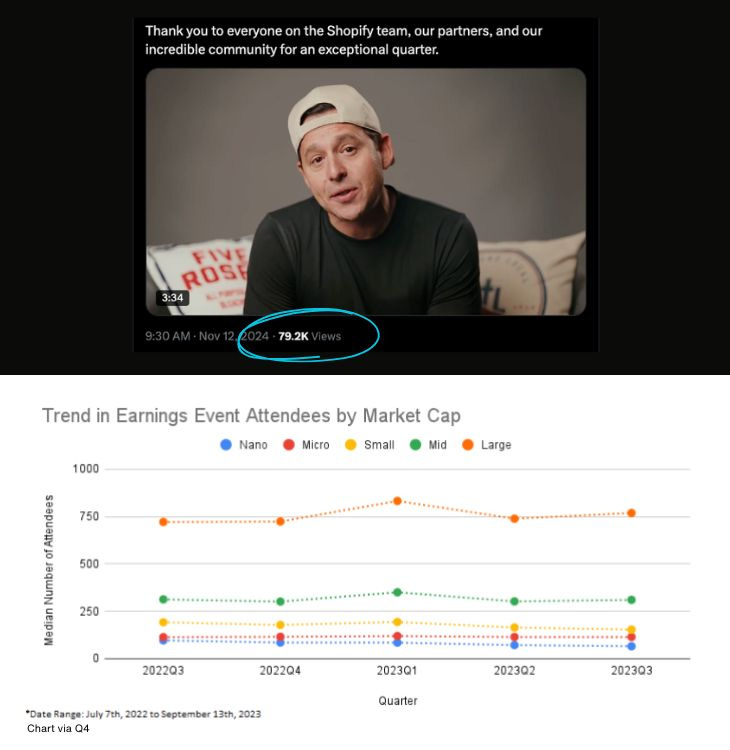

Shopify: Scaling Reach via Executive Handles

In this example, Shopify President Harley Finkelstein shares his breakdown of earnings to his sizable following on X. Within 3 hours, the video amassed 40K views. For comparison, the average earnings call attendance for a large cap is about 750.

Pandora: Video Q&A with CEO

Via Pandora on LinkedIn

Direct Shareholder Q&A Builds Deeper Connections

Engaging directly with shareholder questions is becoming a go-to strategy for fostering transparency and trust. Platforms like Say Technologies and Stakeholder Labs allow companies to collect and answer questions during earnings calls, making the process interactive and inclusive.

Blade: Investor Q&A

Blade Air Mobility is one of many companies that are incorporating shareholder Q&As into their earnings calls.

But this approach isn’t limited to text-based formats—companies like Affirm are taking it further. Following their earnings call, Affirm COO and CFO Michael Linford appeared on the After Earnings podcast to address shareholder questions in detail, offering thoughtful insights and a deeper dive than the call allowed. These formats provide valuable opportunities to connect with investors in meaningful ways.

Affirm: Podcast Q&A

Visuals Are Making Financial Data Easier to Digest

There’s a time and place for scrolling through dense financial reports. But sometimes, investors want to view a digestible summary that makes the numbers easier to navigate. That’s why companies are turning to visuals—like infographics, charts, and videos—to tell a clear story. Not only do these visuals make the information easier to understand, but they’re also more likely to be shared, helping companies reach a wider audience organically.

Spotify: Earnings Infographic

elf Beauty: LinkedIn Video Summary

Via elf Beauty on LinkedIn

Cava: LinkedIn Summary and Infographic

Creativity Is Winning Attention During Earnings Calls

Some companies are taking bold steps to stand out. Duolingo’s decision to have its AI assistant present part of their earnings call is a great example. It was fun, it highlighted their technology, and it left a lasting impression—especially after a strong quarter. These creative approaches break the mold and keep investors engaged.

One caveat: Context matters. Duolingo had a strong financial performance and the perfect feature to make their earnings call work. Creative ideas should be deployed strategically and in the right context, so not as to detract from the content of your report.

Duolingo: AI Assistant Cameo

Leaders Are Showing Their Human Side

Investors want to connect with the people behind the business. That’s why leaders like Robinhood CEO Vlad Tenev are adopting more personal approaches, like selfie-style updates. These casual, direct messages make leaders feel more relatable, building trust and transparency in a way that resonates with modern investors.

Robinhood: Vlad Tenev’s Earnings Recap

Via Robinhood on X

The extent your executives show their human side will vary by industry, company, and executive. For example, companies with eccentric founders may find ways to use their executive personalities as an advantage, as is the case with Palantir’s Alex Karp. Always animated, Karp made headlines by dropping an extremely quotable line during their last earnings call.

Palantir: Candid Commentary

IROs Are Stepping Into the Spotlight

IROs are moving beyond the background and becoming more visible. Whether they’re recording video updates or sharing insights on social media, IROs are helping tell their company’s story in a more personal and impactful way. This shift shows just how important storytelling has become in IR.

Moderna: IR Insights Series with Lavina Talukdar, SVP of Investor Relations

Via Moderna on LinkedIn

Podcasts Are Adding Depth to the Earnings Story

More executives are embracing podcasts as a way to go deeper into their earnings results. Unlike a short call or a press release, podcasts offer a chance to break down complex strategies, share personal insights, and connect with investors on a more human level. The Zoetis CFO’s recent appearance on After Earnings, the show we co-produce with Morning Brew, is a great example of how this format can reach new audiences.

Zoetis: Long-Form Earnings Conversation

These trends highlight how companies are modernizing their approach to investor communications, making their stories more engaging, accessible, and impactful.

Next Steps: Checklist for IROs

1. Harness Design and Marketing Teams for Impact

Provide internal teams with style guides and references to craft compelling visuals for IR communications. Clearly outline metrics to highlight and intended channels for distribution.

Here’s a simple brief template to use:

Audience: [Describe who you are speaking to; this may include sub-audiences]

Overarching messaging goal: [Describe what you want audience to walk away knowing or understanding]

Key points: [Key metrics, data points, and other facts]

X

X

X

Channels: [Indicate where content will be distributed, e.g. LinkedIn or X]

Visual references: [Include example layouts for directional guidance]

2. Plan Podcast Partnerships Early

Identify potential podcast opportunities well ahead of earnings. Building relationships with producers ensures timely scheduling, aligning releases with your communication strategy. Remember that unlike typical media relations efforts, podcasts are often scheduled weeks, if not months, in advance.

3. Measure ROI of Digital IR Efforts

Analyze engagement metrics for various formats to identify what resonates most with your audience. For instance, compare the reach of LinkedIn carousels to summary posts to justify design resource allocation. Understand how many impressions video assets are generating relative to earnings call streams so you can use the data to make the case for additional creative support.

See also: A Framework for Expanding IR Metrics

4. Design Layered Communications Plans

Segment post-earnings content by role—CEO for strategic highlights, CFO for financial depth, and IRO for direct engagement. This layered approach amplifies messaging while catering to varied investor preferences.

5. Consider How Tech Can Automate and Amplify Efforts

Explore tools that can streamline labor-intensive IR tasks. For example, Stakeholder Labs can help companies to transform earnings transcripts into discoverable FAQs. These FAQs can then be added to IR websites, ensuring information is timely and relevant for investors using Gen AI tools. Leveraging such technology allows small teams to maximize efficiency while maintaining high-quality communications.

Stakeholder Labs specializes in helping companies build and scale proactive shareholder engagement strategies. Contact us to learn how we can help you safeguard your company’s future by cultivating a loyal, informed investor base.