How Investor Relations Teams Can Prepare for Activist Pressure

IR teams can reduce risks by nurturing informed, loyal shareholders early.

Leading academic researchers, legal experts, and finance operators recently gathered at Fordham Law School to discuss the implications of broader, more diversified investor participation on corporate governance. The session was part of a new initiative led by Christina Sautter and Sergio Gramitto Ricci, who are co-founders of a newly-launched non-profit called the Center for Retail Investors and Corporate Inclusion (RICI).

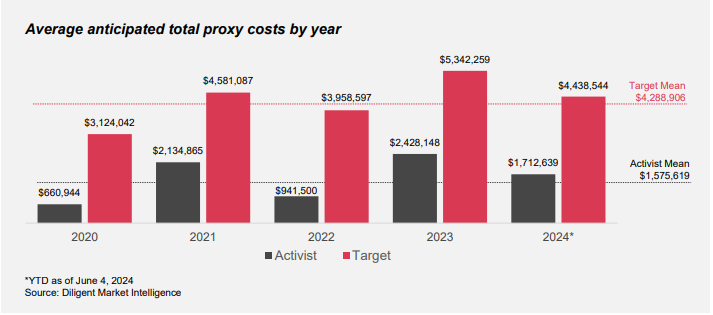

A big topic covered was risk, and specifically the potential risks companies envision when they think of more active investor involvement in things like shareholder meetings, proposals, and voting. Panelists noted that companies are increasingly seeing a risk in not engaging with shareholders from a corporate governance standpoint. Disney, for example, paid tens of millions of dollars as part of its recent proxy fight. More than CEO Bob Iger’s total annual compensation.

Activist campaigns are becoming more common, and CFOs are increasingly looking for ways to minimize the financial and reputational risks that these campaigns pose. Two decades ago there were 20 activist campaigns per year. That figure is now 1,000 per year. In fact, new data from Bain found that 25% of CFOs expect their company to be the target of an activist investor campaign in the next two years.

In these cases, many companies scramble to spend millions of dollars in defense, especially during proxy battles that can disrupt strategic direction, leadership, or even corporate control. However, waiting until an activist campaign is underway is also not ideal. Proactively engaging shareholders before any pressure mounts is a more effective, long-term strategy.

Proactively Preparing for Activist Investor Campaigns

What are activist investor campaigns?

Activist campaigns are initiated by shareholders, typically institutional investors or hedge funds, seeking changes within a company to unlock greater value. These campaigns often focus on altering corporate strategy, leadership, governance, or even capital allocation. They might push for a board seat, advocate for significant restructuring, or demand the sale of certain assets. While these campaigns can sometimes improve governance or performance, they can also derail long-term strategies, leading to costly proxy battles and instability.

For CFOs and investor relations teams, these campaigns represent not only a financial threat but also a reputational and operational one. Companies can spend millions defending themselves, and even if they win the battle, the distraction can damage focus on long-term goals.

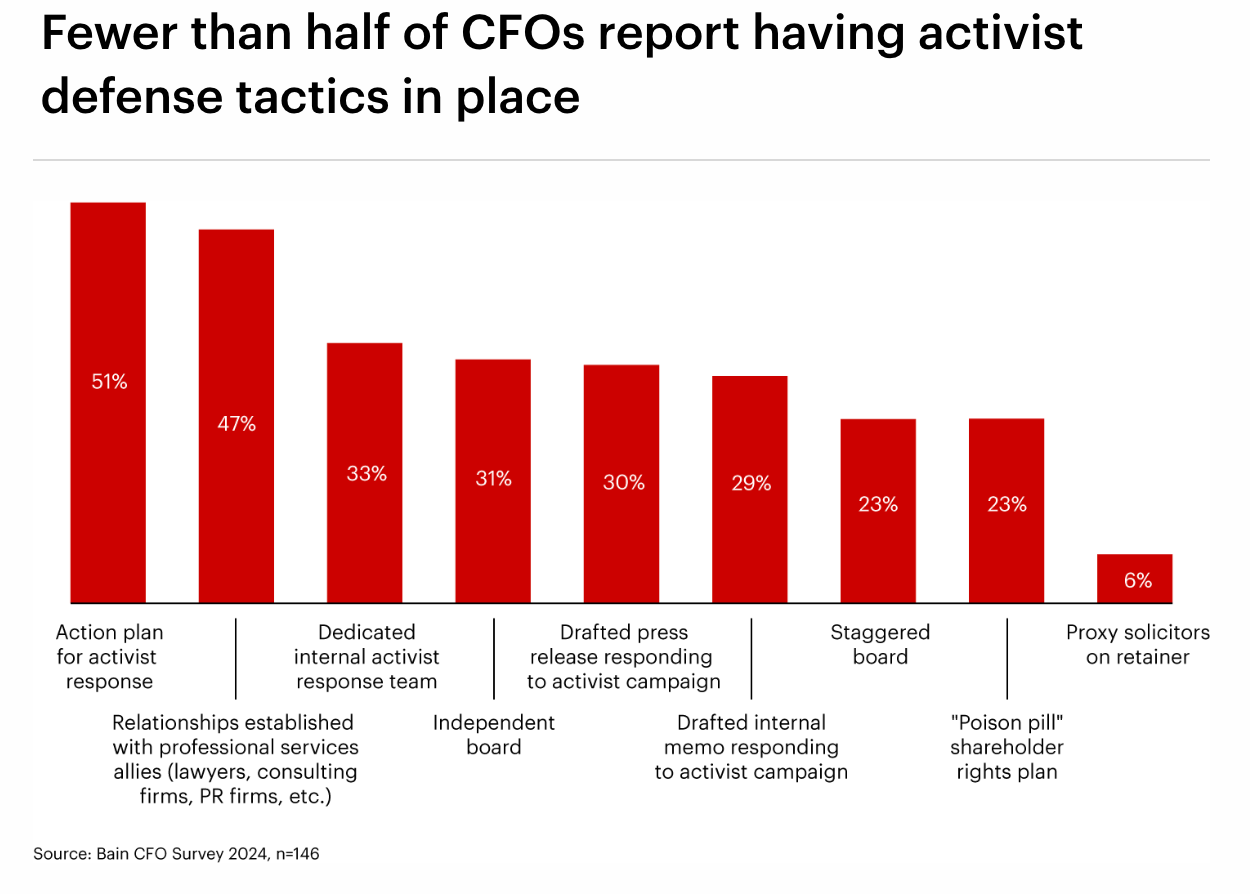

As these campaigns rise in number and aggressiveness, more companies are realizing the importance of proactive defense, primarily through robust shareholder engagement. That said, less than 50% of CFOs surveyed by Bain said they have activist defense tactics in place.

Why should CFOs and IR teams invest in proactive shareholder engagement?

Activist investor plans, of course, involve a lot more than just direct shareholder engagement; however, for companies with strong retail investor bases, this could form a crucial component to the game plan.

Historically, many firms engaged their shareholders only when absolutely necessary—often after the first signs of an activist campaign appeared. However, in the current environment, this is a risky approach. Once an activist campaign is underway, companies may be forced to spend millions of dollars on legal fees, consulting firms, and public relations efforts, not to mention the disruption to business continuity.

By contrast, launching a proactive investor relations strategy helps companies mitigate these risks before they escalate. Engaged and informed shareholders are more likely to support management’s vision when an activist challenge arises. And as University of Pennsylvania law professor Jill Fisch pointed out at the Fordham event, retail investors tend to vote with management.

Regular communication, especially when transparent and detailed, fosters trust and builds a loyal shareholder base. Moreover, a company that has consistently communicated its strategy, financials, and decision-making rationale will have an easier time countering any activist’s narrative. Shareholders will be less likely to be swayed by outside pressures if they already understand and support the company's long-term strategy.

Proactive engagement doesn’t just reduce the likelihood of an activist campaign—it also positions the company more favorably in the event that one arises. Activist investors tend to target companies with weak investor communication, where they can exploit gaps in shareholder understanding or dissatisfaction.

As Bain points out, the best way to fend off activist investors is to “think like them,” and this might involve making changes to how the company is operated and also how those changes (and their benefits) are communicated back to shareholders.

How can companies proactively engage shareholders to mitigate activist campaigns?

Building a successful investor engagement strategy is not a one-time initiative but rather an ongoing effort that begins early and scales over time.

Here’s how CFOs and IR teams can get started.

Start Early – Even Before IPO

Companies can lay the groundwork for effective shareholder engagement well before they go public. For IPO-stage firms, setting the tone with transparency and open communication from the beginning helps attract long-term, engaged investors. At this stage, the goal is to foster relationships with shareholders who align with the company's long-term strategy.

See also: From Private to Public: How Retail Investors Are Reshaping the Investor Relations Lifecycle of Pre-IPO Companies.

Tailor Communication to Key Stakeholders

Investor communication shouldn’t be one-size-fits-all. Instead, segment your shareholders based on their priorities, investment horizons, and influence. Institutional investors, retail investors, and proxy advisors all have different motivations and concerns. Tailored communication ensures that each group feels heard and valued.

Using segmentation to your advantage hinges on having access to the data, thanks to technology there are new tools that make it possible for institutional and retail shareholders to directly authenticate on your IR page via LinkedIn or via brokerage confirmation.

Maintain Consistent, Transparent Reporting

Regular, transparent financial and strategic updates are crucial. Quarterly earnings reports should go beyond the numbers, offering insights into the company’s long-term strategy, risk management, and market positioning. These communications should be as open during tough times as they are during periods of growth.

Some companies have evolved their cadence of communication, sharing monthly newsletters that recap any corporate-related news and press releases, in addition to product news and announcements, personnel updates, and other media coverage.

See also: The Art of an Effective Shareholder Letter: Turning Numbers into Narratives.

Upgrade Your Design to Improve Your Storytelling

Part of ongoing and transparent communications is about the medium and not the message. That’s why companies are investing in simplified, well-designed IR websites and materials that incorporate rich media like videos, and why they are delivering shareholder letters as designed PDFs or microsites. Whether institutional or retail, your investors are accustomed to easy-to-consume digital experiences, and your IR website and materials are no different.

By way of proxy design specifically, Broadridge just released some fresh best practices in their 2025 Proxy Design Handbook, which include:

Creating clean, well-designed materials that simplify the complex

Using visuals as a key component in your storytelling

Focusing on the audience and how they will read and perceive your content

Educate and Align Investor Base

It’s important to invest time in educating shareholders about the company's mission, values, and long-term goals. Engaged, well-informed investors are less likely to be swayed by short-term activist demands that contradict the company's broader objectives. Consider hosting regular investor days, releasing detailed annual reports, and offering open lines of communication to foster a stronger connection between the company and its shareholders.

Monitor Shareholder Sentiment

Regularly assess shareholder sentiment using both qualitative and quantitative tools. This allows you to detect potential dissatisfaction early on and adjust your strategy accordingly. Leveraging surveys, social media monitoring, and feedback from key investors can provide early warning signs that help prevent activist campaigns before they start.

Build a Response Team

Even with the best preparation, activist campaigns can still arise. Having a dedicated response team—comprising legal, financial, public relations, and digital media experts—ready to act is crucial. This team can quickly address activist demands, engage with shareholders, and present a cohesive counter-narrative.

***

No company can completely avoid the risk of an activist investor campaign, but those that invest in a proactive shareholder engagement strategy are far more likely to emerge unscathed. By starting early, communicating consistently, and fostering trust, companies can create a loyal investor base that supports long-term success over reactionary short-term fixes.

Stakeholder Labs specializes in helping companies build and scale proactive shareholder engagement strategies. Contact us to learn how we can help you safeguard your company’s future by cultivating a loyal, informed investor base.