Modernizing Earnings Season: A New Approach to Authentic Investor Engagement

Exploring how social media and IR websites are shaping the future with NYSE TV

Matt Joanou, CEO and co-founder of Stakeholder Labs, joined NYSE TV with Trinity Chavez to talk about the latest trends in investor relations. The conversation spotlights the impact of digital technology and social media on earnings season and offers insights into how companies are using these tools to foster more authentic interactions with investors.

You can watch the full video and read the transcript below.

[Trinity Chavez]: Earnings usually consist of similar routines: a company reports figures like earnings per share and revenue before said company’s executives team host an earnings call to go over those figures and then provide guidance. One company, Stakeholder Labs, is looking to change the game when it comes to earnings season.

Stakeholder Labs helps public companies modernize investor marketing and financial communications through digital and data enabled technology. How have you seen CEOs and CFOs effectively leverage social media and other direct-to-investor formats to build authentic executive brands?

[Matt Joanou]: We've really had a front row seat to the transformation in the investor relations and communications world. We had a number of great examples this last earnings season. You had Daniel Ek from Spotify walking next to a lake in Sweden after his earnings call. We also saw Harley [Finkelstein], President of Shopify, doing a breakdown on Twitter. And then Vlad [Tenev] from Robinhood did his own version on LinkedIn, as well. We're seeing a lot more authenticity in how they're reaching those shareholders and trying to translate it to something that's very palatable [...] that's both geared towards retail and institutional investors, as well.

They're using that direct-to-investor format, and then beyond that, we're also seeing investment in the owned and operated properties. You're seeing a lot of these companies transform their investor relations website into more of an investor portal, and they're standing up social channels where they can reach investors and they can engage with them where they are, whether that be Twitter, Reddit, Instagram, etc.

I want to talk more about direct communication with investors, with platforms like your After Earnings show. How do you ensure that financial results and corporate messages resonate directly with your target audience?

[Matt]: We launched a show earlier this year with Morning Brew called After Earnings, which allows public company CEOs and CFOs to speak directly to their investors in a [podcast] format that is something that people are used to. It really gives them a chance to sit down, put a face to the ticker, if you will, and tell their story.

Some of that conversation is reviewing what happened on their earnings call. But it's also about sharing general updates, giving a feel for the company, talking about the executive’s journey, and giving them that opportunity to speak. The hosts are content creators in the finance world who are really able to speak to Millennial and Gen Z audiences in particular.

What are some of the key benefits and challenges of this kind of approach?

[Matt]: The interviews translate what they're reporting on in their earnings call into a new format, to a new channel. Not only do they have the long-form video, but [companies and executives] are able to share cutdowns where they have 15 or 30-second clips that are translating specific messages, and they're able to push that out through social media.

We're also seeing a lot of companies utilize email, so they might be sending out things like early shareholder emails. Disney sent out a great one last quarter, and within those emails, they're including these interviews, they're including company updates, and translating this all into something that is very digestible for the modern investor.

Behind all of this, you also have the analytics and attribution. Companies are getting a lot smarter and understanding what content their investors are engaging with, what's resonating, and they're also able to divide that into outwards so they understand that certain content might be geared towards younger investors, certain content might be geared towards older investors, and ultimately, that's what our software is helping these companies do is translate this into a world where digital really leads the way in investor marketing.

So, it’s not only about communicating directly with investors; it’s also about listening and understanding these audiences so IR teams can make more informed decisions in the next earnings call, or another significant moment for their investors.

How important is it for IR websites to evolve alongside corporate brands? And what sort of role does rich media and shareholder authentication technology play in enhancing this sort of alignment?

[Matt]: It’s critical. IR websites are probably the most important digital piece of real estate that a public company has today, and research has shown that it's the number one source of truth for institutional analysts. We're seeing more and more retail investors look for ways to upgrade their investor relations websites, and ultimately, with all of this, they're turning into more of a portal.

Companies want to have a lot more engagement with shareholders, and they want to know who their shareholders are. Verifiability is critical, both on the institutional side and on the retail side. When someone visits their site, IROs want to know who’s engaging and with what content so that they can make more informed decisions.

This is something that has happened in the digital marketing world with consumer marketing over the last 10 to 20 years, but it's really taking hold in investor relations today, and we're seeing a number of public companies embrace a more modern approach to investor relations in general.

Let's talk about how you go about improving digital analytics. In what ways has Stakeholder Labs improved the tracking of investor behavior from initial interest to becoming an engaged shareholder, and how can companies leverage these insights to refine their investor relations strategies?

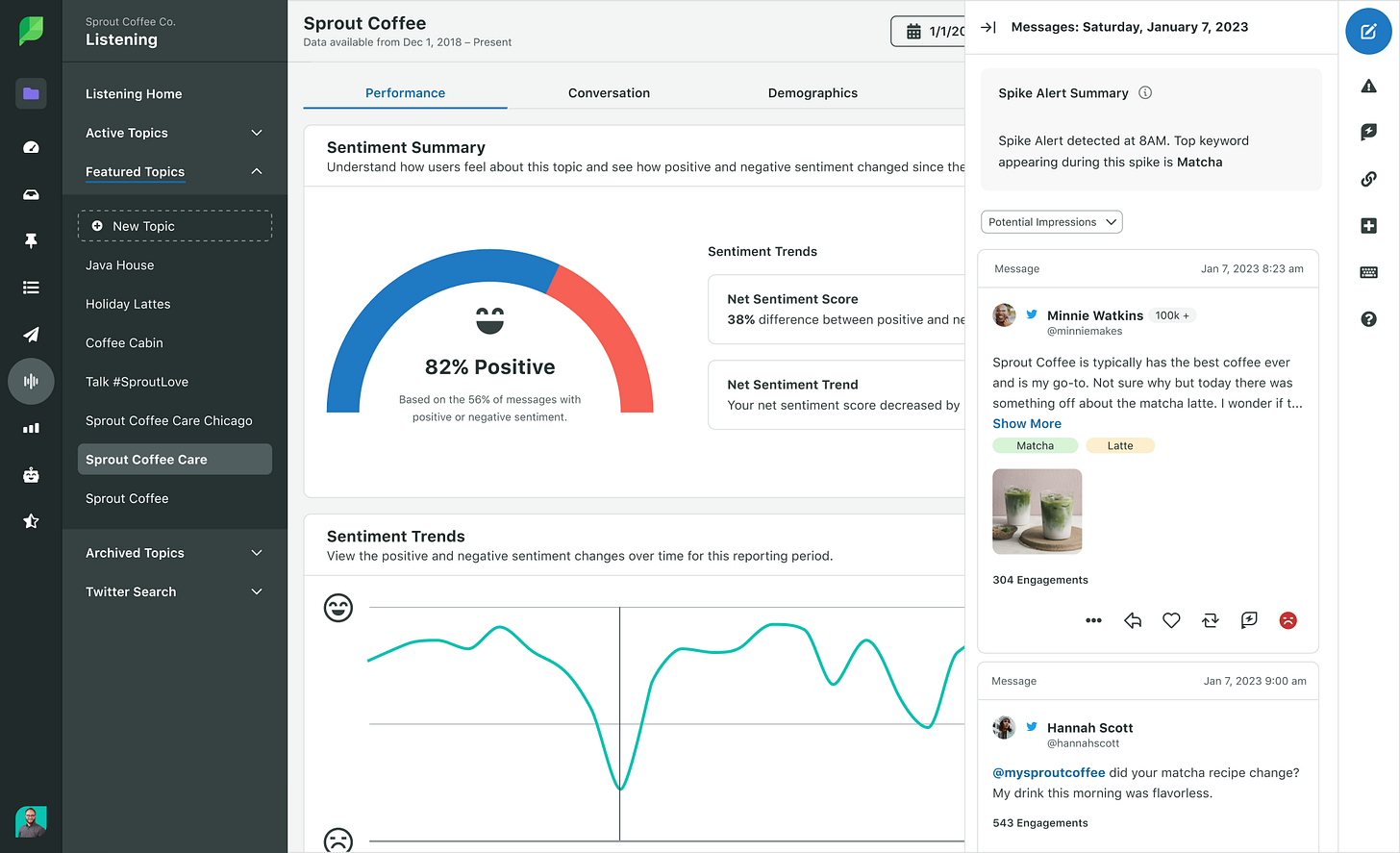

[Matt:] I mentioned that a lot of these companies are leaning into their own and operated properties, and those are great funnels for attribution and analytics. They're also starting to go “off platform.” So they're looking at social listening using platforms like Sprout Social. Ultimately, they're looking at how the company and/or stock is being discussed in different forms, whether that be places like Twitter, Reddit, Stocktwits, etc. What is the sentiment around their ticker? What's the sentiment around their executives, and how are they using that to inform how they're communicating and what they're able to do to affect that sentiment long term?

There’s a growing trend towards integrating digital tools into investor relations. With companies embracing these modern strategies, the industry is poised for a shift towards more transparent and engaging financial communication. This evolution will shape the future of how companies connect with their investors.

Stakeholder Labs builds tools for modern organizations that want to up level their shareholder analytics and engagement to support long-term growth. Contact us to learn more.