Channels for Reaching Retail Investors

How Spotify, Coca-Cola, Coinbase and Johnson & Johnson IR teams use owned, earned and paid digital distribution channels

In the ever-evolving landscape of investor relations, the ability to effectively reach and engage retail investors is paramount for Investor Relations Officers. To navigate this complex terrain, it's essential to adopt a strategic framework encompassing owned, earned and paid digital distribution channels. This Roundtable Roundup identifies and explores real-world examples of how leading companies utilize these channels to optimize their investor communications. Owned channels, such as company websites and email lists, offer complete control over content and messaging, ensuring consistent and direct communication with investors. Earned channels, such as organic social media engagement, build credibility and trust through third-party endorsements and organic visibility. Paid channels, including targeted ads and premium experiences, provide opportunities to amplify reach and capture the attention of potential investors in crowded digital spaces. By exploring the synergies and unique benefits of each channel, this roundup offers a guide for IROs aiming to effectively connect with their investor base in today's digital-first world.

Owned Channels

"75% of buy-side say their interest in a company is diminished when the website is poorly designed." - Q4 Inc.

Owned channels, including IR websites, emails and presentations, are the foundation of any investor relations program. They serve as a central repository for quarterly information and legally required disclosures, and also offer a unique opportunity to tell the company's brand story, showcasing its values and vision to educate and engage potential investors. But in today’s fast pace, mobile-first world, website experiences and email correspondence could be the difference between an investor buying or selling a company’s stock. Below are examples of owned channels that are meeting the requirements of today’s modern investor.

SPOT 0.00%↑ released a premium investor relations website and brand experience as a part of the direct listing on NYSE

PVH 0.00%↑ upgraded their corporate / IR website as part of their rebrand from Phillips-Van Heusen Corporation to PVH Corp, owner of clothing brands Calvin Klein and Tommy Hilfiger

Adidas publishes a highly interactive and engaging Annual Report featuring interviews with key leaders, brand information and financial metrics.

Earned Channels

The landscape of retail investing is rapidly evolving, with a demographic shift towards younger, digitally native investors who are increasingly influenced by social media. These modern investors spend significant time on digital platforms, often using them as primary sources of information. This change underscores the critical importance for IR teams to actively engage in these spaces, leveraging the tools provided by social media platforms to effectively communicate and connect. In previous Roundtable Roundups, we've highlighted numerous examples demonstrating the power of social media and self-organized online investor communities. For IR teams and brands, not participating in these channels can result in missed opportunities and potential setbacks in investor relations and brand perception.

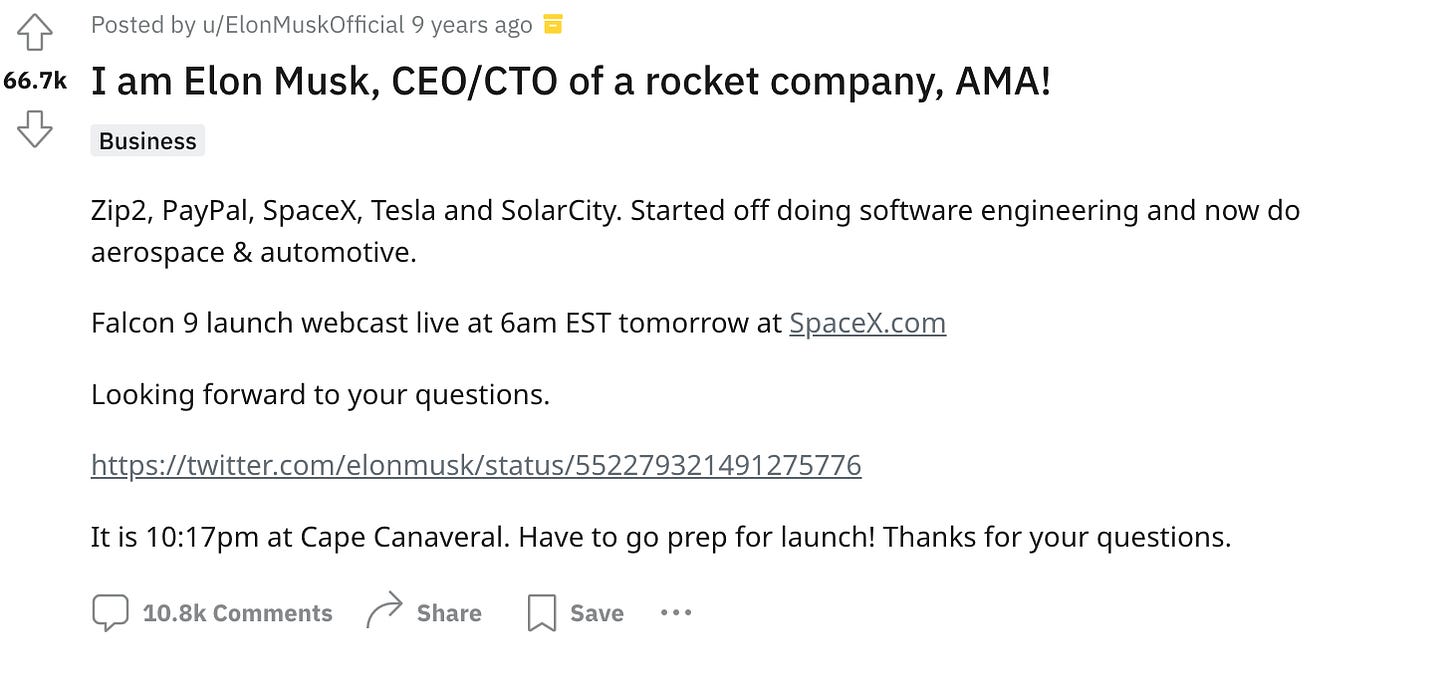

Elon Musk has been a long-time investor in earn channels which has created massive returns in terms of retail investor loyalty and engagement. TSLA 0.00%↑ market cap has 26X since Musk hosted this Reddit AMA in 2015.

F 0.00%↑ Ford CEO Jim Farley joined Elon Musk on an X Space to discuss accelerating EV adoption generating ~400K listens.

COIN 0.00%↑ CEO Brian Armstrong leveraged YouTube for livestream Q&A helping drive nearly 85K subscribers to Coinbase’s YouTube Channel

C 0.00%↑ Citigroup CEO Jane Fraser joined The David Rubenstein Show during the 2023 banking crisis to engage with investors and distribute key company messaging

Paid Channels

Paid media plays an increasingly critical role in the domain of investor relations, moving beyond its traditional use for customer acquisition to now also ensuring that the right messages reach the right investors at the most opportune moments. This strategic approach is visible in traditional digital channels like search advertising, where it's essential to direct potential investors to the appropriate IR pages upon searching specific keywords. Moreover, the strategy extends to promoting key messages across paid social media and newsletter channels. Significantly, brokerages such as WeBull, Robinhood (via acquisition of Say Technologies), and Public.com are capitalizing on their platforms and substantial user bases of individual investors. They offer distribution and engagement tools tailored for IR teams, thus providing an invaluable service in guaranteeing that key messages effectively reach their intended audience. Notable examples include:

SLNA 0.00%↑ Selina Hospitality uses newsletter advertising to generate awareness for their shareholder rewards program

KO 0.00%↑ Coca-Cola uses promoted posts on X to generate more reach for their quarterly earnings reports

JNJ 0.00%↑Johnson & Johnson IR uses Google Adwords to show up at the top of search results

LCID 0.00%↑ Lucid Group uses Say Technologies to solicit questions from retail investors during earnings calls. 13.7K participants asked 3504 questions during the Q4 2021 Earnings Q&A.

WeBull’s Corporate Connect platform has attracted dozens of small cap public companies to reach and engage WeBull’s 35M users.

Conclusion

In this dynamic era of investor relations, our exploration of owned, paid, and earned digital channels in the Roundtable Roundup reveals landscape that is still developing and adapting to a new era. The examples and strategies discussed highlight pioneering approaches and innovative practices, yet they also point to the necessity for ongoing adaptation and enhancement of these channels. IR teams must continue to innovate and adapt, not only to keep pace with the evolving digital landscape but also to fully leverage the opportunities it presents for connecting with an increasingly diverse and tech-savvy investor base. The journey toward mastering these channels is ongoing, emphasizing the need for more sophisticated and effective digital solutions in investor communication.